Cryptocurrencies price prediction: Bitcoin, Ethereum & Litecoin – European Wrap – 14 January

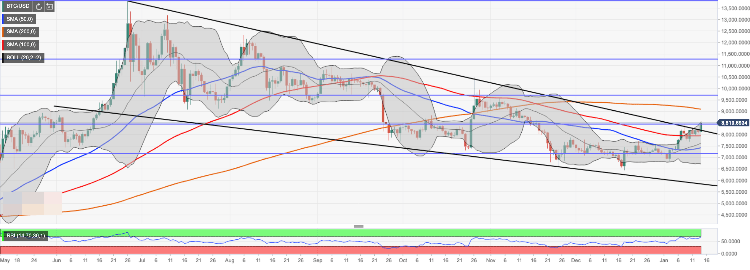

Bitcoin Price Analysis: BTC breaks above the downward wedge formation

BTC/USD is changing hands at $8,500, having gained over 4.5% on a day-to-day basis and over 5% since the beginning of Tuesday. The first digital currency has been moving within a strong bullish trend during early Asian hours amid strong demand on Bitcoin options launched on CME.

Litecoin Price Analysis: LTC/USD gains over 10% in just a few hours, stops short of $55.00

Litecoin, the 7th largest digital coin with the current market value of $3.4 billion, gained over 7% in the recent 24 hours amid global recovery on the cryptocurrency market led by such coins as Bitcoin SV (+26%) and Dash (+23%). Notably, Bitcoin has lagged behind with only 5% of gains. LTC/USD retreated to the seventh position giving way to Bitcoin SV. At the time of writing, LTC/USD is changing hands at $53.8, off the intraday high registered at $54.78.

Ethereum Price Analysis: ETH/USD recovery stops at $150, where to next?

Ethereum is trading 4% higher on the day following widespread recovery movements across the board. The stubborn selling activity at $148 was smashed this time, allowing Ether to jump above $150.

However, the trend became unstainable, forcing the bulls to take a step back to the market value at $149.19. The former resistance at $148 is currently working as the immediate support. The technical picture remains positively intact with the RSI staying within the overbought territory.

Author

FXStreet Team

FXStreet

-637145913612954267.png&w=1536&q=95)