Cryptocurrencies Price Prediction: Bitcoin & Ethereum – European Wrap 20 March

Is the US Federal Reserve’s bailout of international banks a bullish signal for Bitcoin?

The US Federal Reserve has announced a coordinated effort with five other central banks to boost US Dollar liquidity. The Fed’s reaction to a series of banking collapses in the US and Europe is to enhance the frequency of 7-day maturity operations of international swap lines from weekly to daily.

Swap lines are agreements between central banks to exchange currencies and shore up liquidity during times of crisis. Experts believe this is a bullish sign for Bitcoin and cryptocurrencies as an economic crisis similar to 2008 is brewing on the horizon.

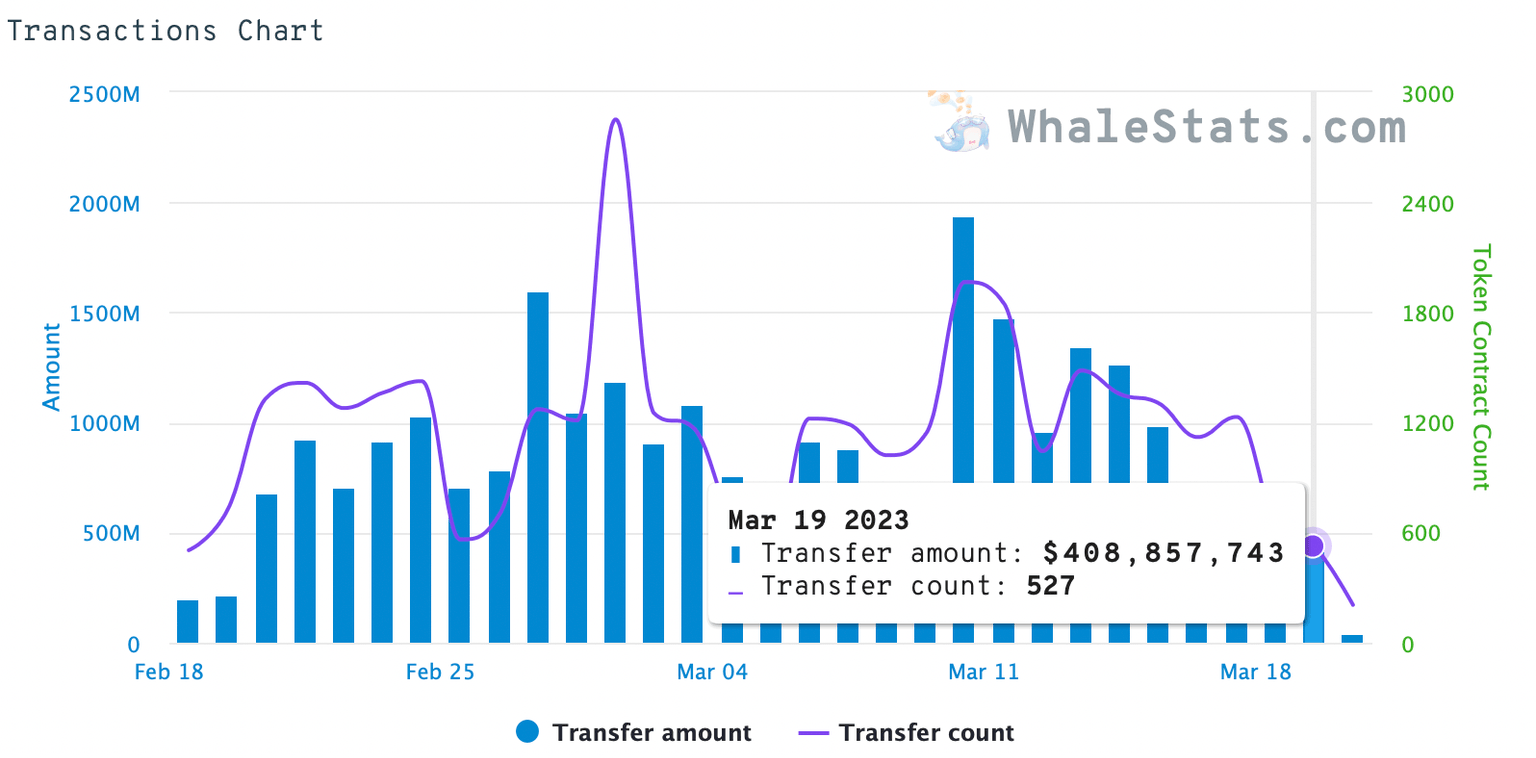

What Ethereum whales are doing ahead of Arbitrum's ARB token airdrop

Arbitrum Decentralized Exchange’s (DEX) trade volume increased by 32% to $4.34 billion. The DEX’s trade volume hit a new two-week high, surpassing BNBChain and second only to Ethereum.

Large wallet investors in the crypto ecosystem increased their activity close to ARB token airdrop scheduled for March 23. Experts predict a massive liquidity injection in crypto from ARB’s airdrop.

Week ahead: March Mayhem continues with Fed, but cryptos emerge victorious

The United States Federal Reserve is scheduled to announce its interest rate decision on March 22 at 18:00 GMT. The decision is to help curb inflation which currently sits at 6%.

Due to the banking crisis, the central bank has stepped in to prevent a further run on the banks. This decision has put the Fed in a mighty tough position. As a result, market participants are speculating on two outcomes.

Author

FXStreet Team

FXStreet