Cryptocurrencies Price Prediction: Bitcoin, Ethereum, & Bitcoin Cash – Asian Wrap 08 Jul

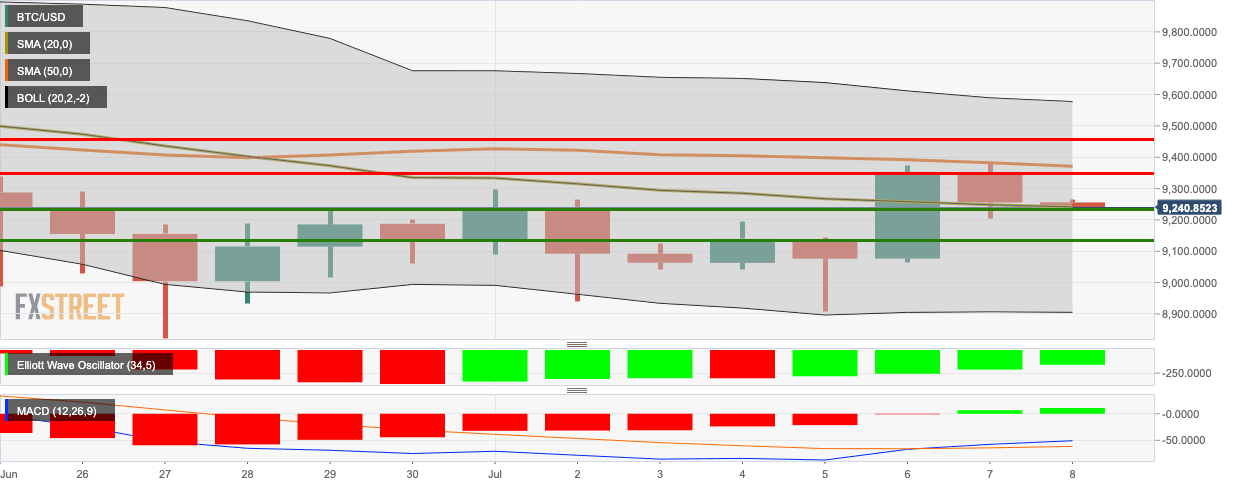

Bitcoin Price Analysis: BTC/USD bears currently look to conquer support at SMA 20 curve

BTC/USD dropped from $9,255.80 to $9,255.15 as the bears remained in control for the second straight day. Currently, the price is sitting on top of the SMA 20 curve. The Elliott Oscillator has had four consecutive green sessions, while the MACD shows that market momentum is presently bullish.

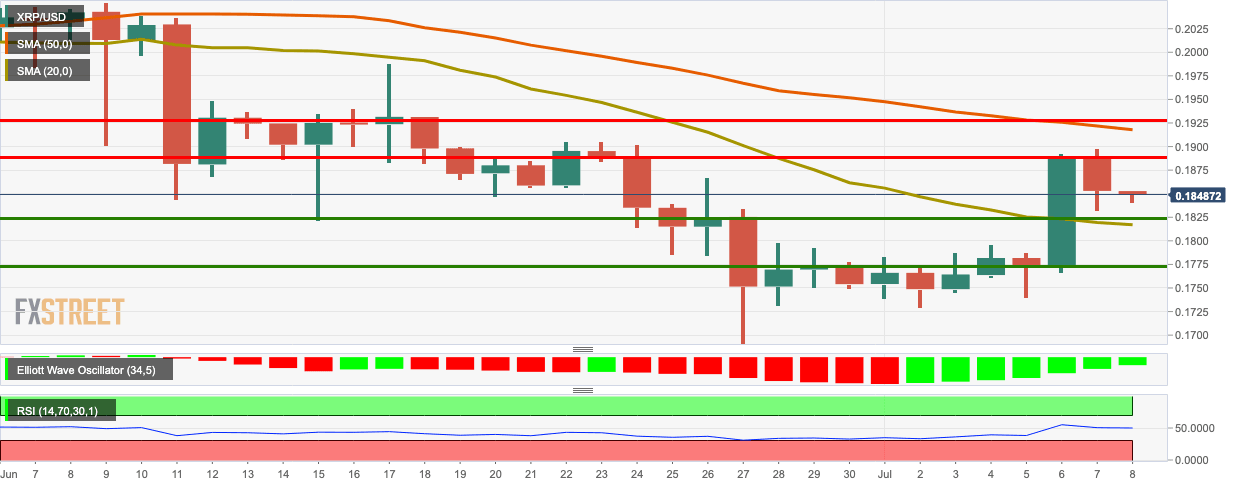

Ripple Technical Analysis: XRP/USD bears take price below $0.185

XRP/USD bears remained in control for the second straight day as the price fell from $0.1852 to $0.1848. Despite the bearish price action, the Elliott Oscillator has had seven consecutive green sessions, showing that the overall market sentiment is still bullish.

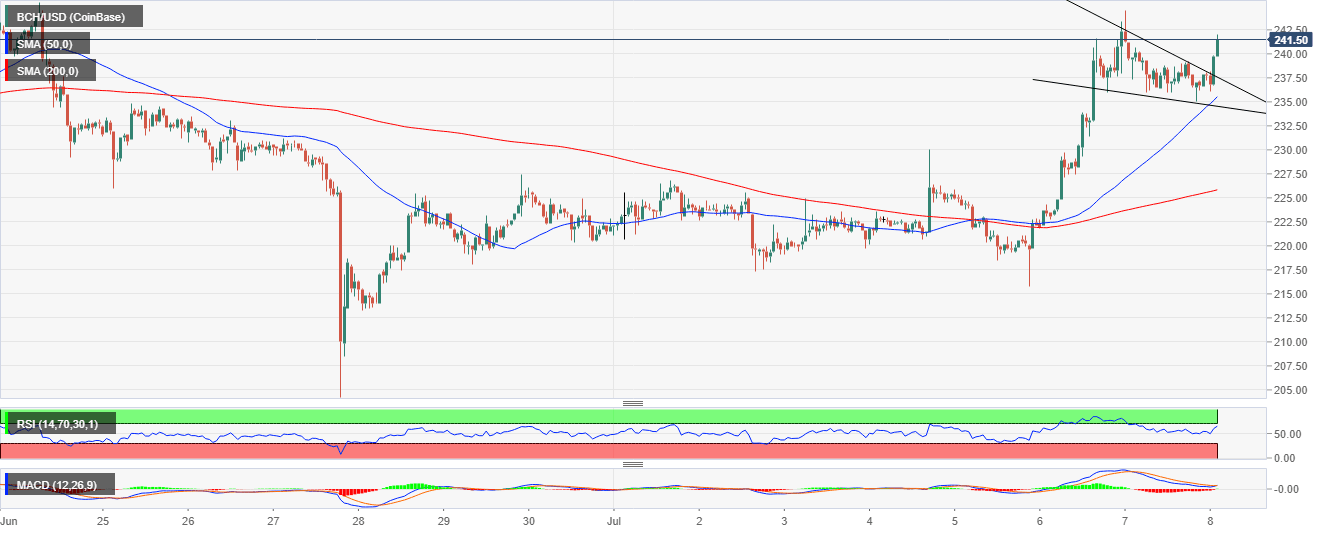

Bitcoin Cash Price Analysis: BCH/USD explodes 2% higher in minutes

The cryptocurrency market is dominantly in the green mid-through the week’s trading. Bitcoin Cash has not been left behind following a 2% steady rise on the day in a matter of minutes. Some of the best-performing cryptocurrencies include Ripple (XRP) up 4.62%, EOS up 1.89% and IOTA (IOT) up 1.93%.

Author

FXStreet Team

FXStreet