Cryptocurrencies Price Prediction: Bitcoin, Elrond and Algorand – European Wrap 28 October

Bitcoin Weekly Forecast: Why a $28,000 BTC makes more sense now?

Bitcoin price is reacting well to the bullish developments that have been taking place over the last month or so. A recent breakout could be the start of a prolonged move up when looked at via the lens of Bitcoin’s historical performance in Q4s stretching over the last decade.

Elrond Price Prediction: EGLD projects a 15% crash after an explosive run

Elrond price has hit a dead end after the recent rally locked horns with a four-month resistance level. Lack of buying pressure coupled with the exhaustion of buyers could be key in triggering a pullback for EGLD.

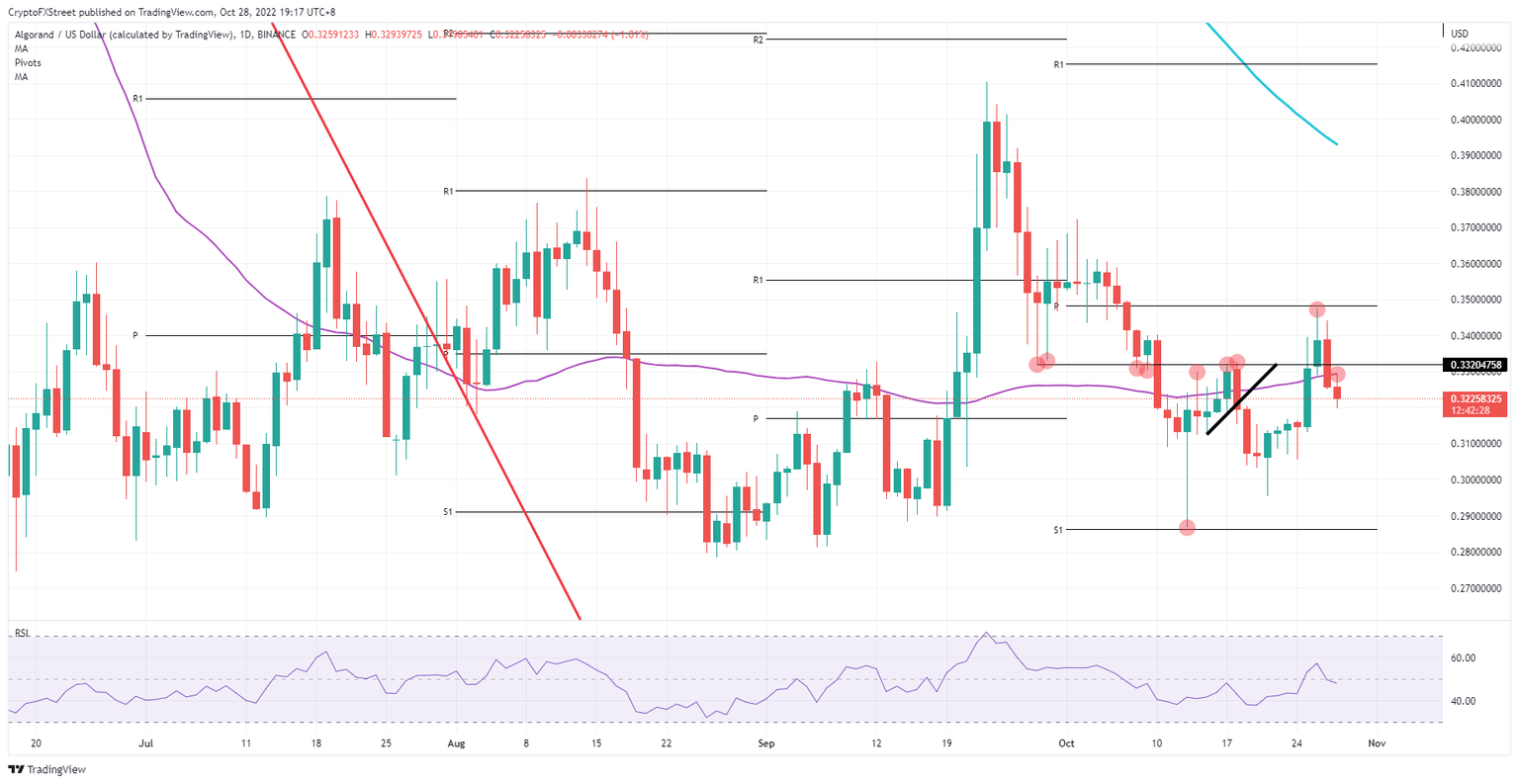

The domino effect makes Algorand price tumble, and there is nothing bulls can do about it

Algorand (ALGO) price action is taking a beating of almost 5% in just one and a half trading days. Luckily for the cryptocurrencies, it was up 7% before, which still means it is likely to make a marginal profit for the week, making it not a lost cause. But traders must be aware that something has snapped as the rally has been broken with no real support to bounce off nearby.

Author

FXStreet Team

FXStreet