Cryptocurrencies Price Prediction: Bitcoin, Dogecoin and TRON – European Wrap 11 November [Video]

![Cryptocurrencies Price Prediction: Bitcoin, Dogecoin and TRON – European Wrap 11 November [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/financiera-comercial-grafico_XtraLarge.jpg)

Bitcoin Weekly Forecast: BTC at the mercy of FTX, Binance and TRON

Bitcoin price reveals that its quick recovery rally is coming to an end as it faces a critical hurdle. This development has pushed BTC to slide lower and could result in a consolidative structure over the next few days.

Why traders should apply healthy risk management while trading DOGE

Ethereum Classic price appears to be going against the grain of widespread market sentiment that it is primed for a significant correction by rising 6.5% in the last 24 hours. The bullish trend began on June 18 but took a breather on July 29. As reported last week, miners moving from Ethereum to Ethereum Classic ahead of the former’s transition from the proof-of-work (PoW) to a proof-of-stake (PoS) consensus, aka ‘the merge’ were the primary drivers of the rally.

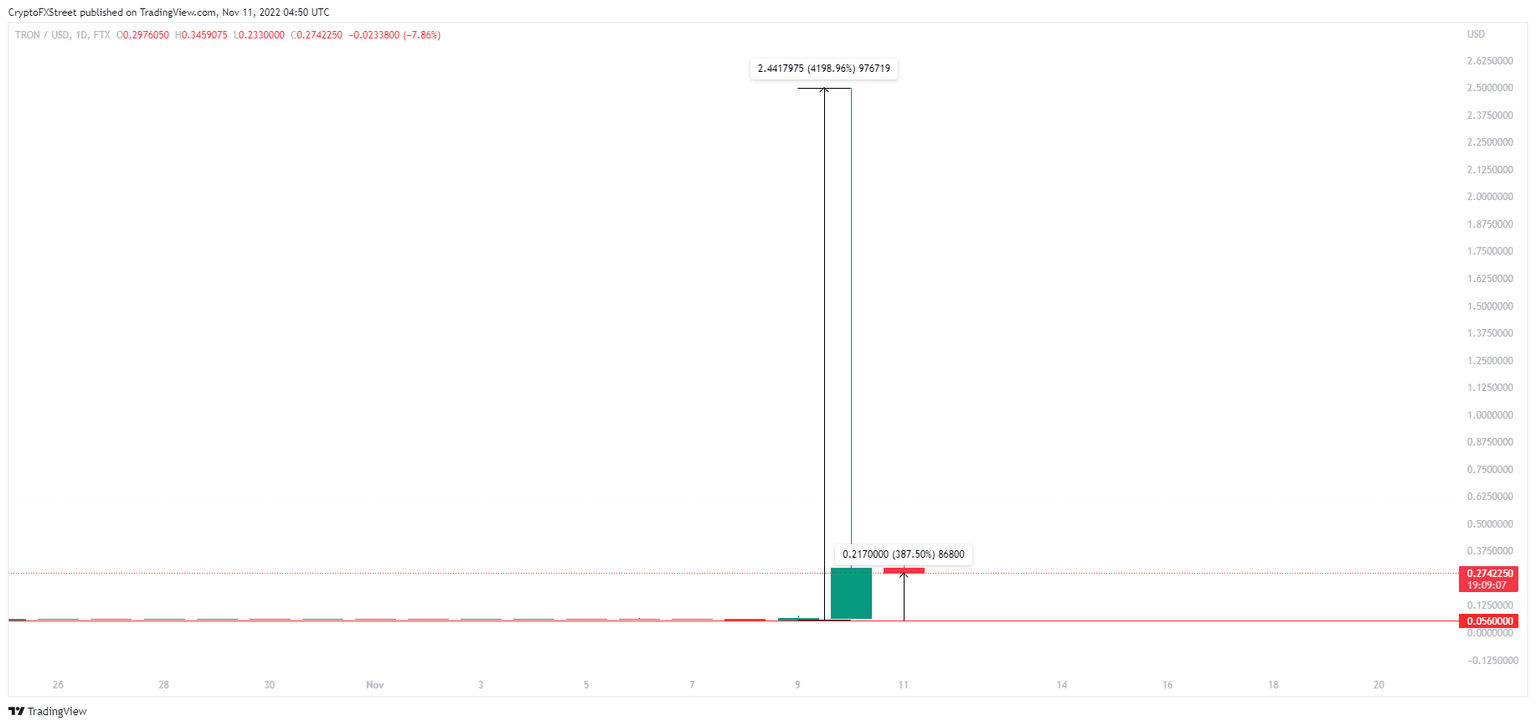

Justin Sun has been an avid supporter of Sam Bankman-Fried (SBF) and his FTX empire even after its collapse this week. The fall of FTX and its sister company, Alameda, led to the exchange halting its withdrawals. However, Sun's support is now being interestingly rewarded by FTX, even allowing users to withdraw their assets, but at a cost.

Author

FXStreet Team

FXStreet