Cryptocurrencies Price Prediction: Bitcoin, ChainLink & Avalanche – European Wrap 8 December

Bitcoin analyst calls early bull market as BTC price targets $50,000 in December

El Salvador launched a Freedom Visa and citizenship program where users deposit $1 million in Bitcoin or USDTether (USDT). The country made Bitcoin legal tender in 2021 and since then has drawn the interest of crypto market participants through BTC adoption.

Catalysts driving Bitcoin price alongside the El Salvador citizenship program include the anticipation surrounding Spot Bitcoin ETF approvals, and the institutional adoption of Bitcoin. Bitcoin price is trading sideways close to the $43,500 level on Friday after BTC yielded 15.25% gains for holders this week.

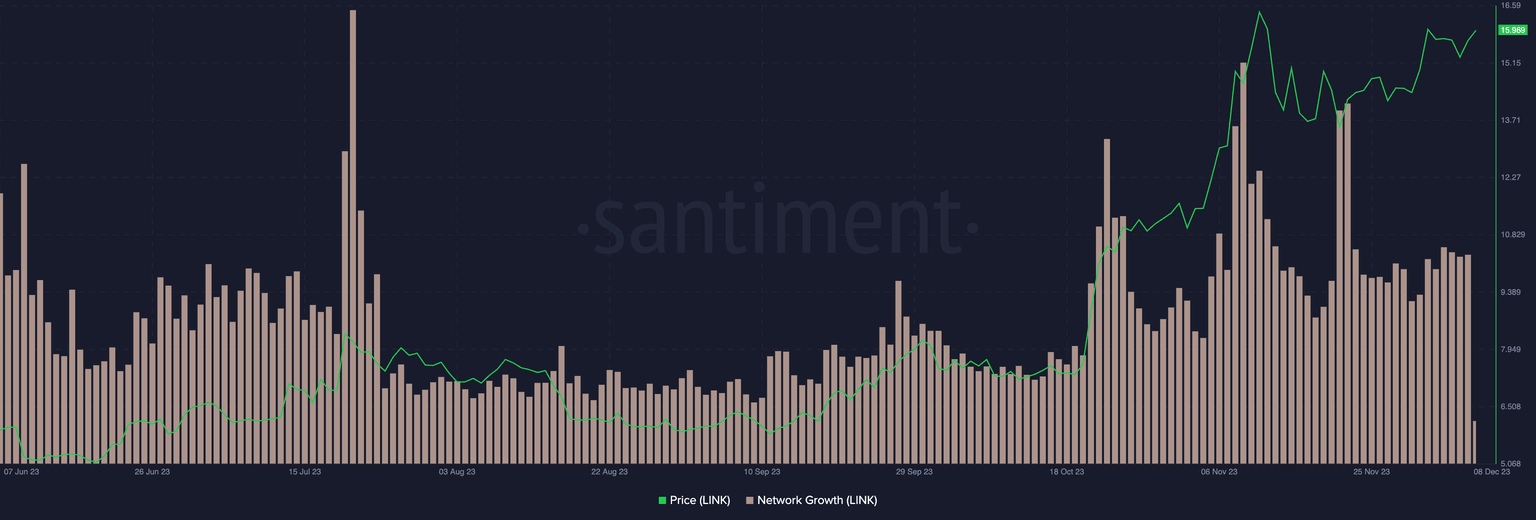

ChainLink price could succumb to profit taking by whales

LINK price is likely on the brink of a correction driven by increasing profit taking by large wallet addresses in its network. The launch of v0.2 of LINK staking acted as a catalyst for ChainLink, driving price gains in the altcoin, however, now that many large-wallet holders are sitting on unrealized profits there is a risk they may cash in, driving price back down.

According to a ChainLink tweet on X, posted on December 11, ChainLink’s v0.2 community staking pool has officially filled with over 40.87 million LINK tokens staked – both by users migrating from v0.1 and new participants.

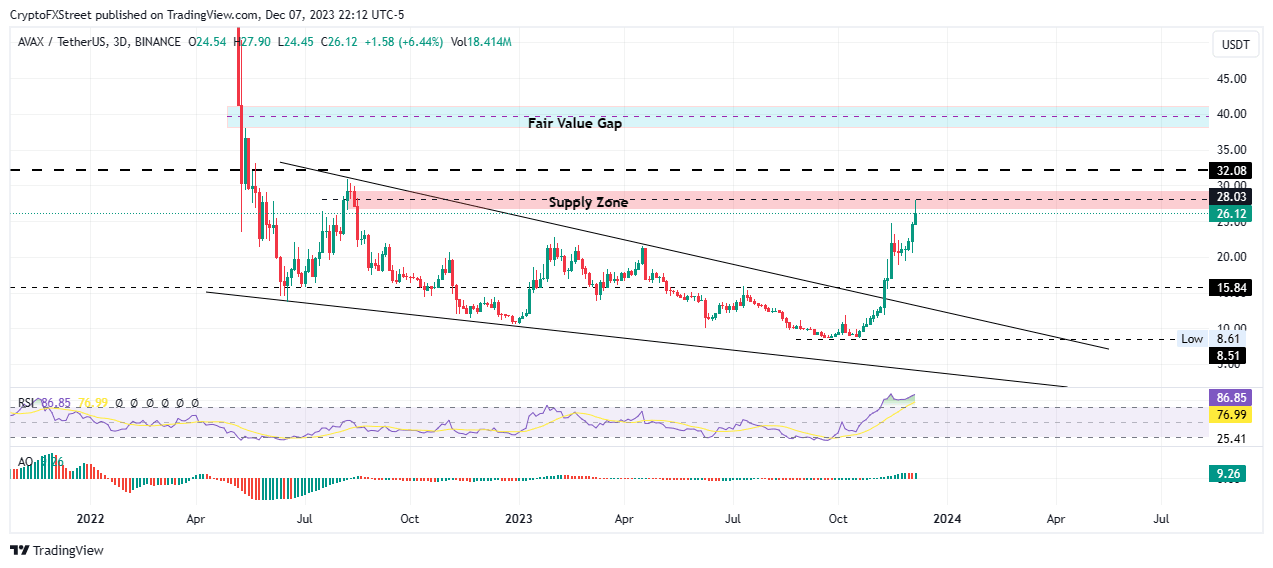

Avalanche Price Prediction: AVAX could rally 40% if it overcomes this barrier

Avalanche (AVAX) price is trading with a bullish bias after activating a bullish technical formation, with prospects for more gains depending on how the bulls play their hand going forward.

Avalanche (AVAX) price is up 236% since the market turned bullish, but the uptrend could be running out of steam as the altcoin faces a supply barrier extending from $26.56 to $29.34. As of 3:30 a.m. GMT time, it is trading for $26.12 with prospects for more gains amid rising momentum.

Author

FXStreet Team

FXStreet