Cryptocurrencies Price Prediction: Bitcoin, Bonk & XRP – European Wrap 6 February

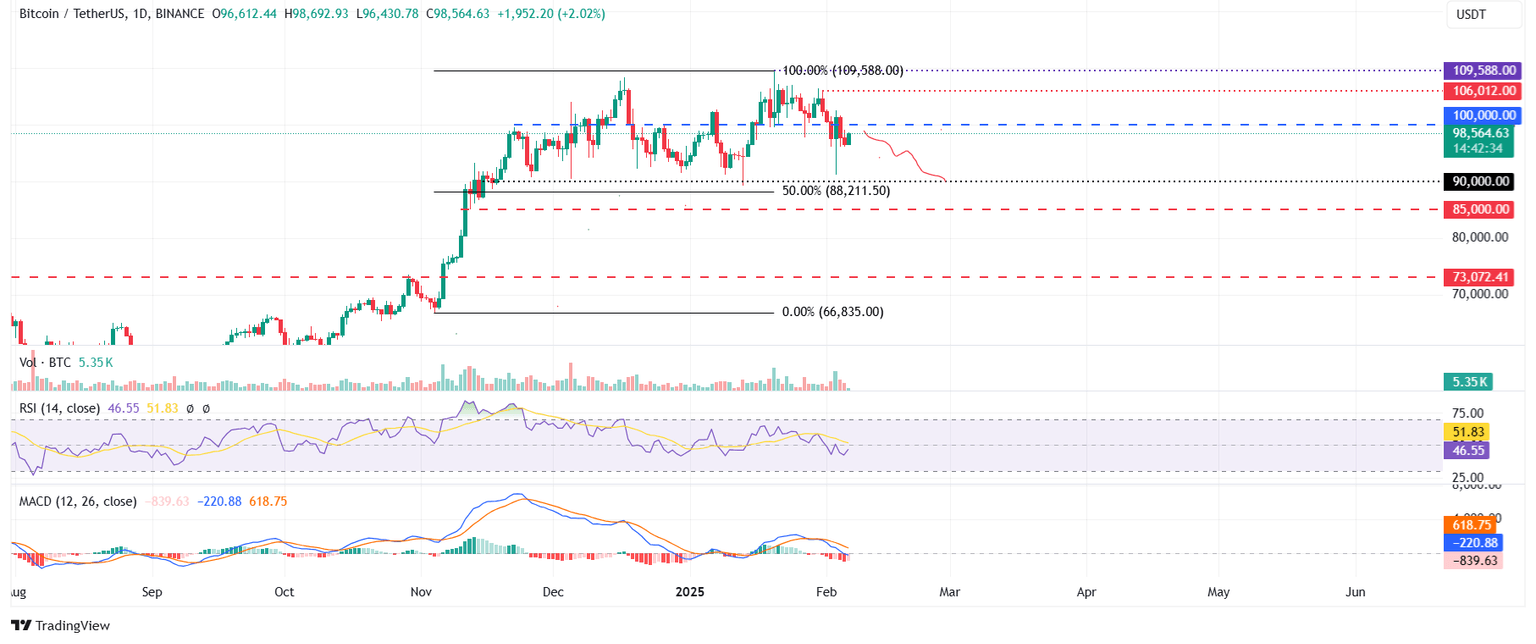

Bitcoin Price Forecast: BTC recovers above $98,000 as Eric Trump encourages WLFI to add BTC

Bitcoin (BTC) price recovers slightly, trading above $98,000 at the time of writing on Thursday after losing nearly 5% in the last two days. Eric Trump encouraged the addition of BTC to their family-backed crypto platform World Liberty Financial (WLFI) portfolio, which may be supporting Bitcoin’s recovery. Moreover, Santiment’s data shows that Bitcoin whales have been stacking up more BTC during the recent correction while retail traders are getting liquidated, hinting at recovery ahead.

Bitcoin price recovers, trading above $98,000 during the early European session on Thursday. This recovery was fueled after Eric Trump, son of US President Donald Trump, posted on his social media X encourages to add BTC to their family-backed crypto platform World Liberty Financial portfolio.

Bonk Price Forecast: 2.02 trillion BONK coins will be burn

Bonk price recovers slightly, trading around $0.000018 at the time of writing on Thursday after falling over 5% so far this week. Bonk announced on its social media platform X that it will burn 2.02 trillion tokens to celebrate the BONKdragon event and the 2025 Lunar New Year. Coinglass data shows that the BONK long-to-short ratio reached the highest level in over a month, indicating more traders are betting on Bonk’s price to rise.

Bonk announced on its social media platform X on Thursday that it will burn 2.02 trillion tokens to celebrate the BONKdragon event and the 2025 Lunar New Year. The token burn is expected to positively impact its value by reducing supply and increasing its scarcity.

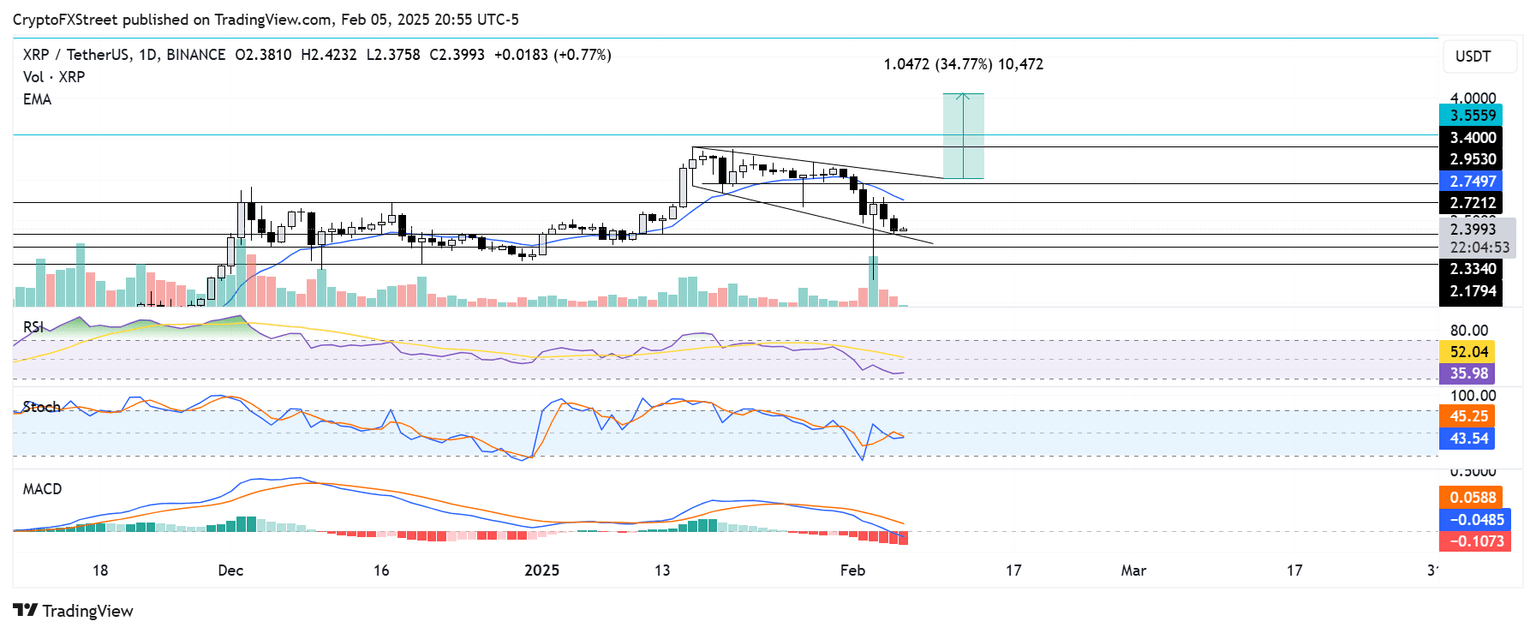

Can XRP bounce back? SEC actions may favor Ripple in ongoing appeal

XRP is down 3% in the early hours of Thursday as crypto community members anticipate that the Securities and Exchange Commission's (SEC) appeal of the ruling in its case with Ripple will likely not stand following latest developments under the new administration.

Crypto Crypto community members are speculating that the Ripple vs SEC case is potentially over, considering the latest developments in the agency. In a restructuring under acting Chair Mark Uyeda, the SEC is reducing its Crypto and Cyber Unit, which consists of over 50 lawyers and staff members, according to a New York Times report.

Author

FXStreet Team

FXStreet