Cryptocurrencies Price Prediction: Binance, Bitcoin & Crypto – European Wrap 8 April

Binance to delist BADGER, BAL, 12 more tokens on April 16

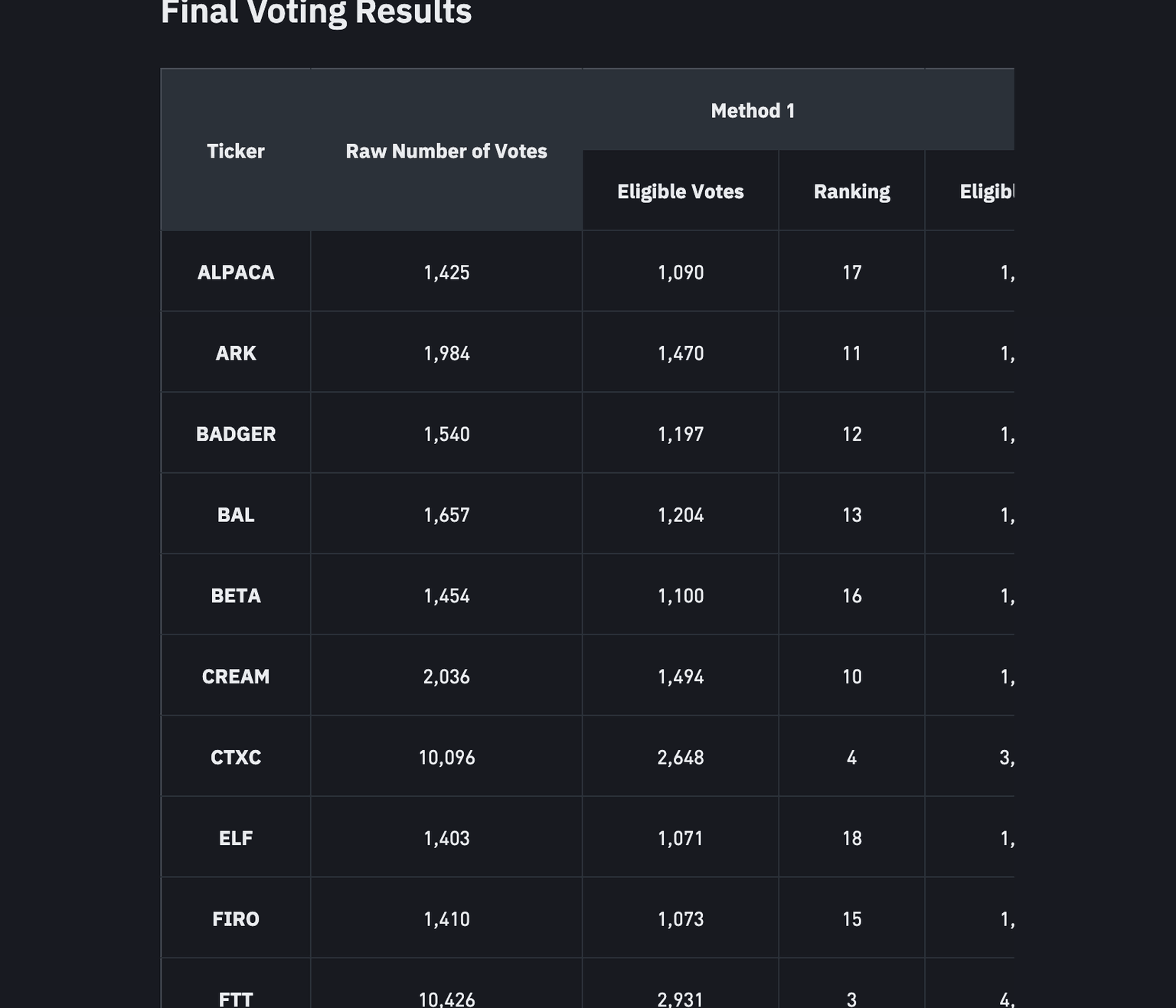

Binance, the largest cryptocurrency exchange by daily traded volume, is preparing to delist 14 tokens from the platform following the release of the “first batch of vote to delist results.” According an announcement made on Tuesday, the tokens to face the axe include BADGER, Balancer (BAL), Beta Finance (BETA), Cream Finance (CREAM), Cortex (CTXC), Aaelf (ELF), FIRO, Kava Lend (HARD), NULS, Prosper (PROS), SNT (SNT), TROY, UniLend (UFT) and VIDT DAO (VIDT).

Bitcoin Price Forecast: MicroStrategy’s SEC form 8-K filing hints at possible Bitcoin sales to meet financial obligations

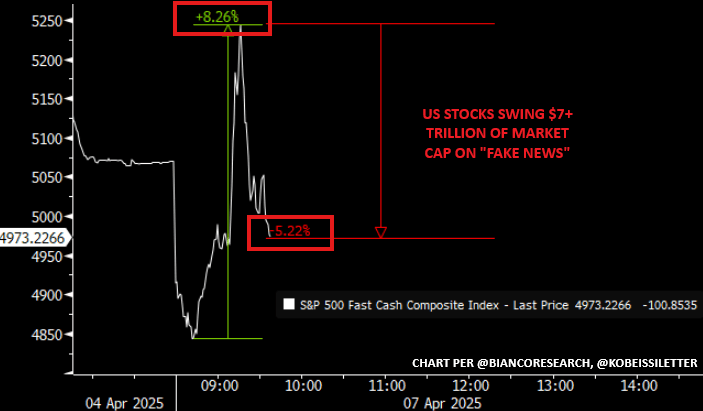

Bitcoin (BTC) price stabilizes around $79,000 at the time of writing on Tuesday after reaching a new year-to-date low of $74,508 the previous day. MicroStrategy’s SEC Form 8-K filing on Monday highlights an unrealized loss of $5.91 billion in BTC holding during the first quarter, hinting at possible sales to meet financial obligations. Moreover, the ‘fake news’ regarding a pause in the US tariff policy brought volatility spikes in risky assets like Bitcoin. Looking down on the technical outlook, it suggests a ‘dead cat bounce’ scenario with a recovery towards $85,000 and dumping to $76,606.

Top 3 gainers Fartcoin, Hyperliquid and Telcoin: Asian session sparks tariff relief rally in meme coins and DeFi

The cryptocurrency market is experiencing a tariff relief rally, with altcoins like Fartcoin, Hyperliquid (HYPE) and Telcoin (TEL) bouncing back with double-digit gains. Fartcoin has jumped 28% in the past 24 hours, reaching $0.5801. Meanwhile, HYPE climbed 18% to $11.93, and TEL surged 22%, hitting $11.93 at the time of writing on Tuesday.

Author

FXStreet Team

FXStreet