Crypto.com price struggles to break out, despite kickstarting 2022 Monaco Grand Prix

- Crypto.com's partnership with Aston Martin at the 2022 Monaco Grand Prix failed to trigger a bullish sentiment among investors.

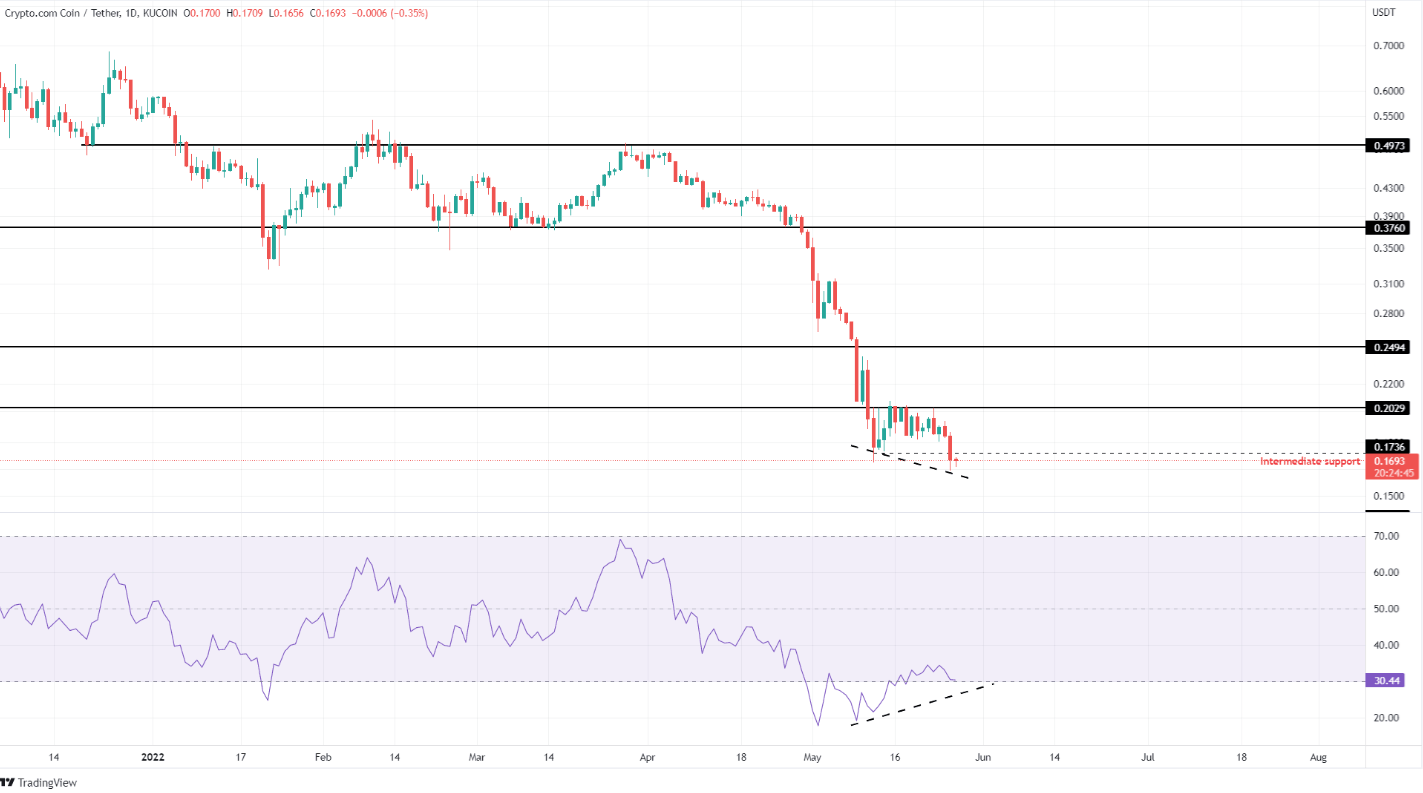

- Analysts identify bullish divergence in the CRO price chart, and set a target of $0.20.

- The 2022 Monaco Grand Prix was kicked off on May 27 and ends on May 29, 2022.

The 2022 Monaco Grand Prix, where Crypto.com partnered with Aston Martin, started on May 27 and ends this weekend. Crypto.com's CRO price is struggling to recover from the recent slump in price.

Crypto.com price fails to rally despite kickoff of 2022 Monaco Grand Prix

Earlier this year, Crypto.com signed a multi-year partnership deal with Aston Martin. The 2022 Monaco Grand Prix was kicked off on May 27, 2022. Events were lined up over the weekend, and the prominent automobile race ends on May 29, 2022.

On-track action is about to kick off in Monaco.

— Aston Martin Aramco Cognizant F1 Team (@AstonMartinF1) May 27, 2022

Don’t miss a moment of the #MonacoGP weekend.#F1 | @cryptocom

Through the course of the two days, Crypto.com's Cronos token, CRO, has failed to recover from its slump. The colossal crash of Terraform Lab's UST and LUNA, the sister tokens, led to massive volatility in the crypto ecosystem. Investors pulled capital out of the crypto market, and capital rotation led to a slump in several altcoin and token prices.

Cronos price is 81.9% away from its all-time high of $0.965. Despite recent partnerships and the rising adoption of CRO, the token has struggled to recover from the bloodbath.

On the closing day of the 2022 Monaco Grand Prix, CRO price posted 2.3% gains overnight.

Analysts spot bullish divergence in Cronos

Analysts at FXStreet recently evaluated the Cronos price chart and predicted a recovery in CRO. After spotting a bullish divergence in Crypto.com, analysts noted that CRO had set lower lows. Despite the price trend, RSI has made higher lows, and the token could target a breakout to the immediate barrier at $0.20. Analysts believe Crypto.com is on track to make a u-turn.

CRO-USDT chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.