Crypto Today: US Senator tells Fed to buy BTC, DOGE demand hit $12B, NVIDIA bets drive AKT

- The global cryptocurrency market capitalization hit a new all-time high of $3.1 trillion, gaining $90 billion on November 19.

- Dogecoin ranked third in market interest on Tuesday, with $12.1 billion in volume, surpassing Ripple (XRP) and Solana combined.

- Crypto liquidations reached $275.7 million, as bulls took the biggest hit with long contracts worth $109.8 million liquidated.

Altcoin market updates: DOGE flashes breakout signals, AKT at unicorn Status, BONK, PNUT leading memecoin rave

- Dogecoin's price gained 4% within the daily timeframe to reclaim the $0.40 territory.

With selling pressure in decline, on-chain signals suggest DOGE bulls could set sights on a breakout to $0.50.

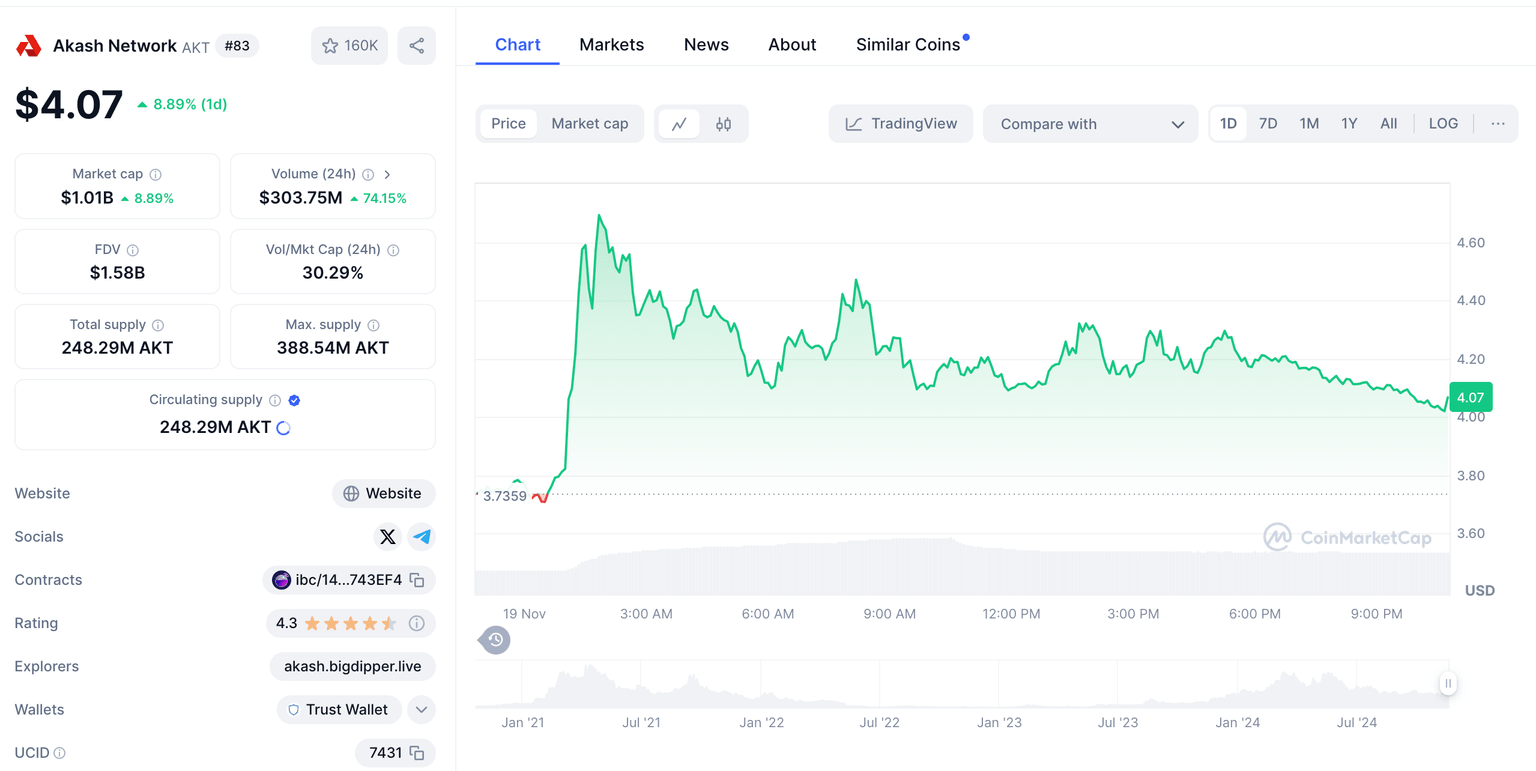

- With 7.5% in gains, Akash Network (AKT) emerged as one of the top performers, breaking past $4 on Tuesday.

Akash Network (AKT) price action | November 19, 2024

This marks a major milestone for AKT, as its market capitalization has now crossed $1 billion.

Why Akash network (AKT) price is going up today

Market reports suggest the AKT token rally could be attributed to growing speculative demand ahead of NVIDIA’s earnings call slated for November 20.

Notably, the crypto AI and big data sectors attracted a significant demand surge when NVIDIA outperformed revenue estimates during each of its last four earnings calls dating back to October 2023.

Hence, AKT’s 7.5% surge could advance toward the next psychological resistance at $5, as strategic traders seek to front-run potential gains if NVIDIA exceeds market expectations for its fifth consecutive quarter on Wednesday.

- In the Solana memecoin sub-sector, BONK and newly launched PNUT dominated the charts, scoring 8% and 5% daily timeframe gains, respectively.

Chart of the day: Bitcoin bears mount $1.6B leverage to prevent $95K breakout

Bitcoin price bounced 4% to hit a new all-time high of $93,816 on Tuesday after NASDAQ launched options trading for BlackRock’s iShares Bitcoin ETF (IBIT).

However, derivatives market data shows bear traders remain resilient and are actively increasing leverage on short positions.

This move could potentially prevent BTC's price from advancing above the $95,000 milestone.

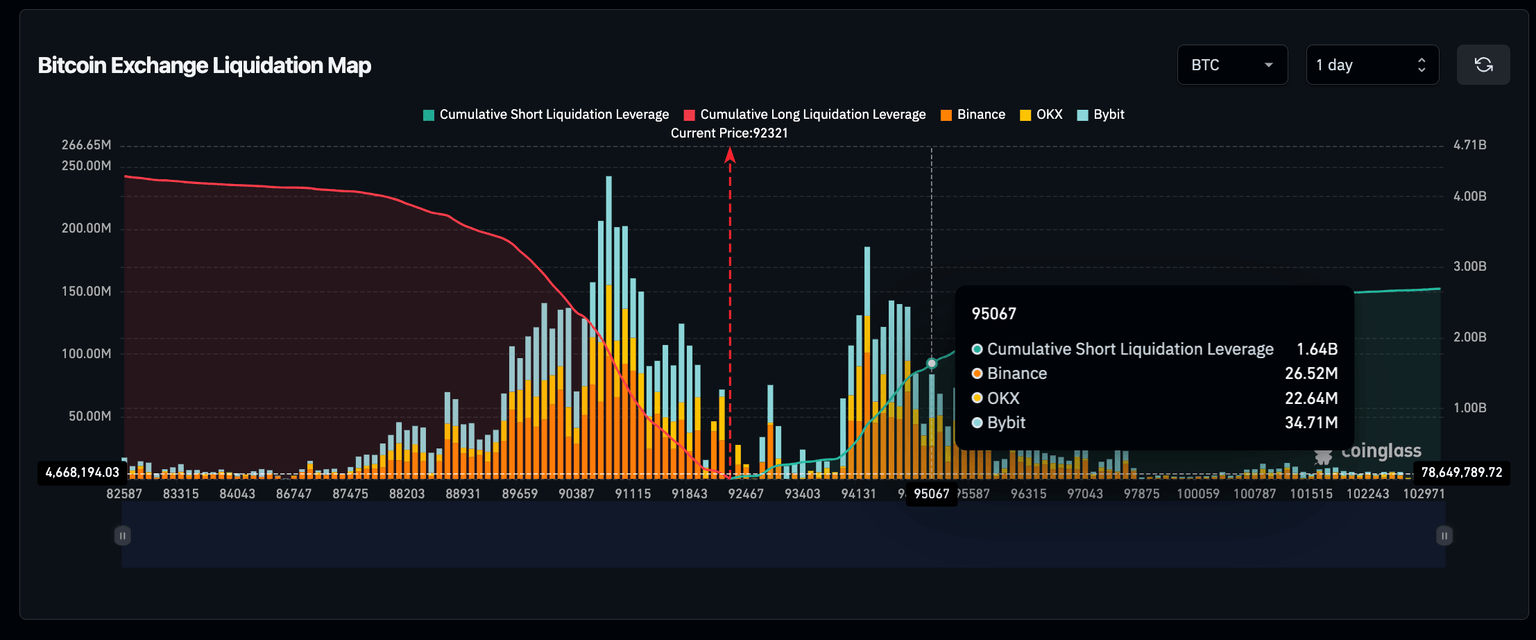

The Coinglass chart below depicts the volume of leverage deployed within the +/- 20% boundaries of Bitcoin’s current prices.

Bitcoin aggregate exchange liquidation map | November 19, 2024

At first glance, bulls appear dominant, with over $4.2 billion in leveraged long positions deployed against $2.7 billion worth of active BTC short contracts.

However, a closer look at the chart shows that bears have concentrated $1.64 billion in leverage around the $95,000 resistance level, accounting for over 65% of total active short contracts.

Meanwhile, bulls have only mounted $1.1 billion in support at the critical $90,000 level.

This shows bears have considerably higher stakes around the current prices and are likely to deploy more aggressive loss-avoidance measures in the near term.

Hence, without additional market demand catalysts to support the tailwinds from NASDAQ listing BlackRock’s IBIT ETF, Bitcoin’s $95,000 breakout could be impeded again.

Crypto news updates:

- U.S. Republican Senator, Cynthia Lummis, has proposed including Bitcoin in the national strategic reserve.

In a recent Bloomberg interview, Lummis suggested that the U.S. The Fed liquidates some of its gold reserves to purchase BTC to hedge against economic risk and mitigate mounting public debt.

“We already have financial assets in the form of gold certificates to convert to Bitcoin,”

- U.S. Republican Senator Cynthia Lummis.

Cynthia Lummis, a U.S. Senator from Wyoming, is a key figure in cryptocurrency regulation, as she currently serves on the Senate Banking, Housing, and Urban Affairs Committee.

Additionally, she co-leads significant legislative efforts related to crypto, such as the Responsible Financial Innovation Act, in partnership with Senator Kirsten Gillibrand.

This act aims to establish a comprehensive framework for digital assets, promoting innovation while ensuring transparency and consumer protection.

- Coinbase has announced its decision to delist WBTC on December 19, just two months after launching its native 1:1 wrapped bitcoin token, cBTC.

- Bitfinex Securities, in collaboration with NexBridge, has launched USTBL, the first regulated tokenized U.S. Treasury bills under El Salvador’s digital asset framework.

The Bitfinex offering, running from November 19 to November 29, seeks to raise at least $30 million, providing investors exposure to U.S. dollar-denominated short-term Treasury bills with an expected 5% annual yield to maturity.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.