Crypto Today: China shortens excitement over cryptocurrencies

Here's what you need to know on Monday

Markets:

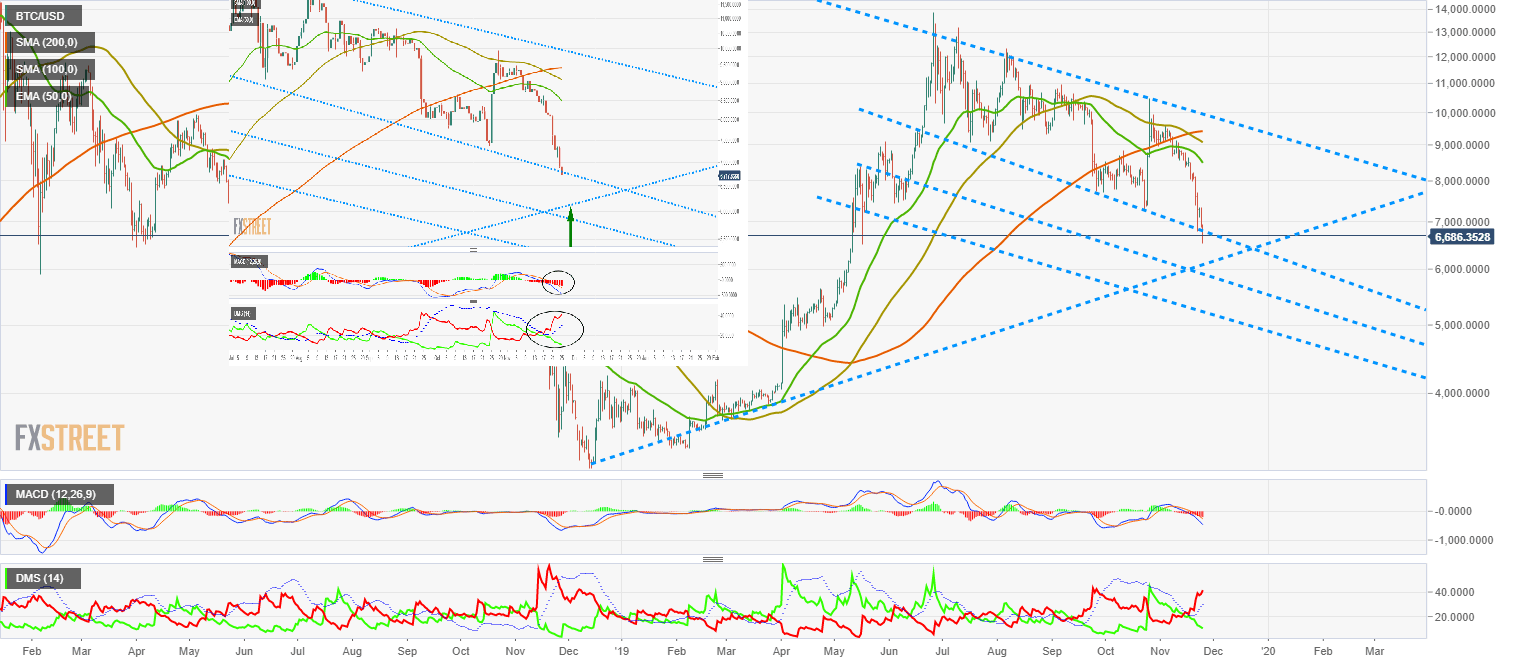

BTC/USD continues in panic mode and it dropped another 7.5% in the European morning. It is currently trading at $6,670 but damage at the end of the day could be critical.

ETH/USD is washed away by the selling storm and loses 9.9% in the day to $134, a price level not seen since the 2018 big downtrend escape maneuver.

XRP/USD currently trades at $0.21 and loses 8.44% in the European morning. The current level has visited last December 2017.

The day's winners are STOREUM (+302.5%), FUSION (+82.14%) and MATIC (+2.33%). The losers of the day are BitMax Token (-20.4%), HYPERCASH (-18.05%) and MAKER (-17.8%).

Chart of the day:

Regulation:

- China continues its campaign against cryptocurrencies not backed by the central bank. Local media point to this campaign as an attempt to curb the speculative fever aroused by President Xi Jinping's statements in favor of the development of blockchain technology.

- Loretta Mester, President of the Cleveland Federal Reserve, says she does not see the need to work for a digital dollar at this time, even though she believes it is necessary to monitor the activity of other central banks.

- The Chinese government suspended the activity of the cryptocurrencies exchange platform BISS, based in Beijing. Authorities alleged violations of capital control regulations.

Industry:

- Grayscale Investment will launch an investment fund composed of a basket of the market's leading cryptocurrencies. The composition of the fund will be Bitcoin (80%), Ethereum (9%), XRP (9%), Bitcoin Cash (2.5%) and finally Litecoin (1.7%).

- The Venezuelan government announces that Petro will be backed by more than 30 million barrels of oil. This amount of oil is part of the strategic reserves of the South American country.

- A cryptocurrency whale moved in the last hours 44K Bitcoins, $310 million-dollar worth, for the modest amount of 32 cents of Dollar.

Quote of the day:

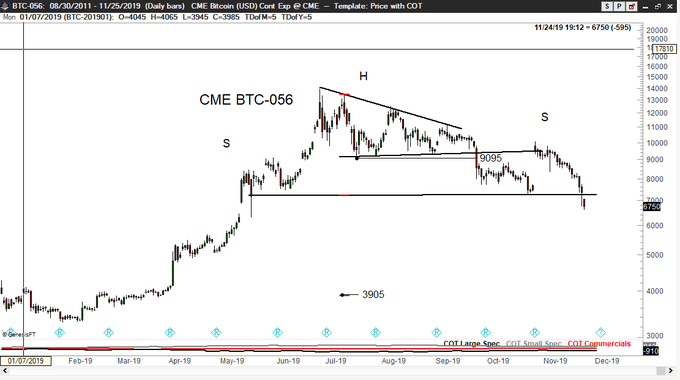

Peter Brandt @PeterLBrandt

"I actually do not think this is a valid H&S top, but one never really knows until history is written. $BTC"

Author

Tomas Salles

FXStreet

Tomàs Sallés was born in Barcelona in 1972, he is a certified technical analyst after having completing specialized courses in Spain and Switzerland.