Crypto Today: Bitcoin loses slightly, Ethereum and XRP dip as Ripple Swell event goes live on Tuesday

-

Bitcoin holds steady above $65,500 on Tuesday, erasing less than 1% to its value.

- Ethereum and XRP prices recede slightly on the day, traders anticipate key announcements in the Ripple Swell event.

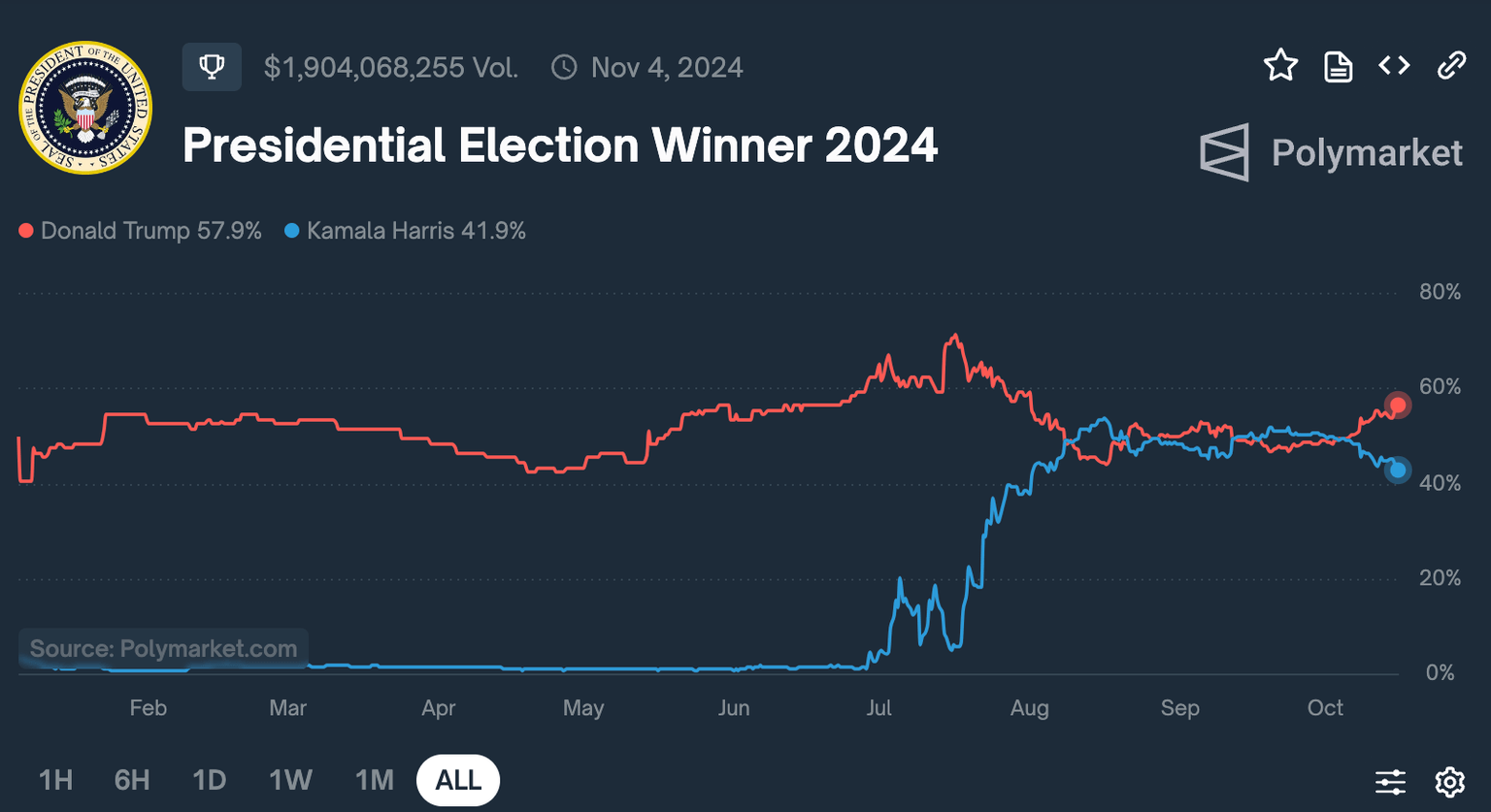

- Pro-Bitcoin US Presidential candidate Donald Trump’s odds of winning November elections shoot up on Polymarket.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $65,777, down less than 1% on the day. Larry Fink, the CEO of asset management giant BlackRock, said that Bitcoin is an asset class in itself. The executive talks about institutions allocating capital to BTC, saying it reminds him of the early days of the mortgage market. Now at $11 trillion in market cap, Fink doesn’t think the outcome of the US Presidential election will make a difference to BTC.

Here's full Larry Fink quote on bitcoin/digital assets from the Q3 earnings call, he says bitcoin asset class in itself, they talking with institutions worldwide about allocation, dig assets remind him of the early days of the mortgage market (now $11T) and POTUS won't make dif pic.twitter.com/McvpW7cCnB

— Eric Balchunas (@EricBalchunas) October 14, 2024

- Ethereum trades at $2,558, holding steady above key support at $2,500.

- XRP trades at $0.5357, even as Ripple’s annual flagship event Swell 2024 goes live in Miami on Tuesday.

Chart of the day: Storj (STORJ)

Storj, the token of a decentralized cloud storage platform, could extend gains by another 7% and test the lower boundary of the Fair Value Gap (FVG) between $0.6835 and $0.5921 as resistance. The token broke out of its downward trend on September 16 and is making steady gains ever since.

The Relative Strength Index (RSI) is 79.87, above the overbought level at 70. This typically generates a sell signal, however, the other momentum indicator, the Moving Average Convergence Divergence (MACD), flashes green histogram bars above the neutral line. There is likely an underlying positive momentum in STORJ’s price trend.

STORJ/USDT daily chart

A daily candlestick close under the 200-day Exponential Moving Average (EMA) at $0.4496 could invalidate the bullish thesis. STORJ could slip to support at $0.4114, the 50-day EMA.

Market updates

- Nansen and MetaStreet released a pivotal report identifying crypto verticals that harbor high-yield opportunities like Artificial Intelligence (AI) Compute DePIN and NodeFi, early on Tuesday. The report highlights that the DePIN sector is a high-growth alternative to traditional DeFi yields for crypto investors.

- NodeFi, a crypto sector where licenses are provided to token-based rewards protocols, has emerged as a key source of high yield for crypto investors, per the report.

- At Ripple Swell, the firm announced its exchange partners for the Ripple USD (RLUSD) stablecoin.

Today at #RippleSwell, we’re proud to announce our Ripple USD exchange partners.

— Ripple (@Ripple) October 15, 2024

Upon regulatory approval, $RLUSD will be globally available for institutions and users from @UpholdInc, @BitStamp, @Bitso, @Moonpay, @Indereserve, @CoinMENA, and @Bullish. https://t.co/iZ7L1MHpn3

Industry updates

- Blockstream closes $210 million convertible note financing round to further its goal of driving Bitcoin adoption in global finance. The funds will be used for Layer 2 development and expanding mining capabilities ahead of the next cycle.

Blockstream has closed a $210M convertible note financing round led by @FulgurVentures, driving our mission to bring Bitcoin into global finance.

— Blockstream (@Blockstream) October 15, 2024

This capital accelerates layer-2 development, expands mining ahead of the next Bitcoin cycle, and grows one of the world’s largest… pic.twitter.com/gi1ov0LCYU

- Asset management giant BlackRock holds 1.46% of Bitcoin supply, 369,640 BTC, as of Tuesday, October 14.

- Stellar (XLM) holds steady above $0.0932 as the firm announces a partnership with web-based blockchain data analytics platform Dune.

- Polymarket shows former US President Donald Trump’s odds of winning the November 2024 elections shot up to 57.9%.

Polymarket on US Presidential Election Winner 2024

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.