Crypto sentiment recovers to levels when Bitcoin last traded over $100K

Crypto market sentiment is beginning to show signs of improvement, as Bitcoin holds above $90,000, with the attitude toward the market now stronger than it was earlier this month when Bitcoin was trading above $100,000.

The Crypto Fear & Greed Index, which measures overall crypto sentiment, posted an “Extreme Fear” reading of 25 on Friday, up three points from the previous day and nearly 10 points higher than on Nov. 13, which was the last time Bitcoin traded above $100,000 before falling below six figures.

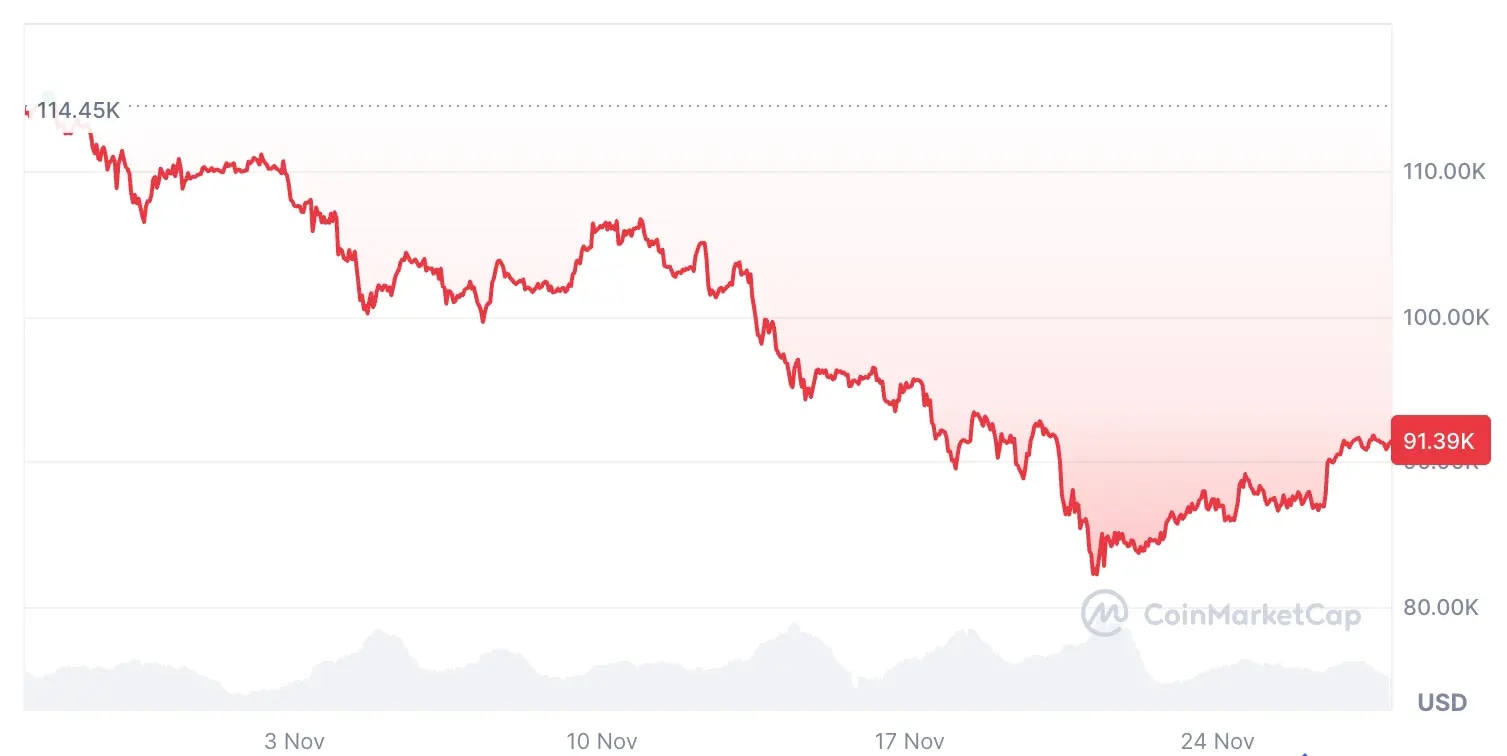

Bitcoin is trading at $91,032 at the time of publication, according to CoinMarketCap, with crypto analysts debating how soon Bitcoin could reclaim $100,000.

Crypto sentiment sees recent volatility

Crypto analyst Ted said in an X post on Thursday, if Bitcoin reclaims $93,000 or $94,000, “I think $100,000 BTC could happen first before any downside.”

Meanwhile, crypto sentiment platform Santiment said in a report on Wednesday that the recent rise in bearish sentiment across social media has historically signaled positive momentum for the crypto market.

Bitcoin is down 18.94% over the past 30 days. Source: CoinMarketCap

“Most major turnarounds occur when retail’s hope is mainly lost,” Santiment said. “Markets have historically moved in the opposite direction of the crowd’s expectations.”

Even some prominent, typically bullish, crypto executives are beginning to temper their outlook in the current market. On Thursday, BitMine chair Tom Lee appeared to ease his bullish forecast that Bitcoin would reach $250,000 by year-end, which he has promoted for most of the year.

Instead, Lee said he remains confident Bitcoin could reclaim $100,000, and it could “maybe” set a new all-time high above its current peak of $125,100.

Will December be different this time around?

Crypto trader Jelle said that “after a bunch of slow-bleed corrections, I think almost everyone was caught off guard by the sell-off.”

The market is now entering December, a month that has historically been relatively mild for Bitcoin.

Since 2013, the month of December has posted an average return of 4.75%, according to CoinGlass.

However, with October and November, traditionally among Bitcoin’s strongest months, failing to meet expectations this year, some market participants are now questioning whether December will also break from historical trends.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.