Crypto liquidations hit $1.8B in a day: Final flush or more to come?

Overleveraged crypto traders were liquidated out of nearly $2 billion in one of the year’s largest market flush-outs on Monday, in what some analysts blame on technical factors rather than weakening market fundamentals.

More than 370,000 traders have been liquidated to the tune of $1.8 billion over the past 24 hours, according to data from CoinGlass.

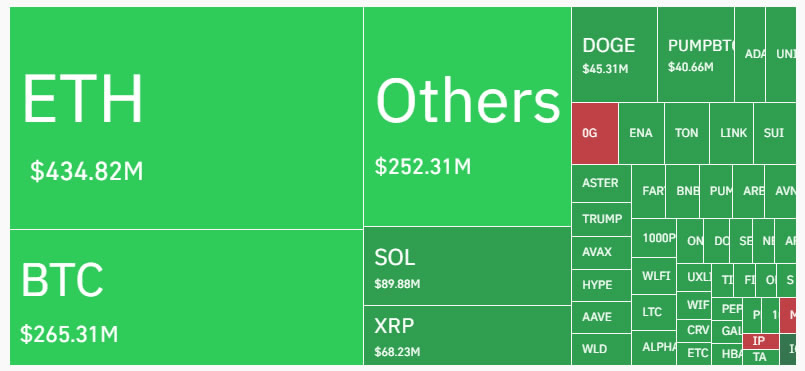

The majority of those positions had bet on Ether and Bitcoin, while altcoins also got hammered across the board.

The liquidations came as crypto market capitalization tanked by more than $150 billion, falling to a two-week low of $3.95 trillion as Bitcoin (BTC $112,990) fell below $112,000 on Coinbase and Ether (ETH $4,206) fell below $4,150, its most significant pullback since mid-August.

The dust appears to have settled now, with major assets finding temporary support, but there could be more pain to come if previous September corrections are anything to go by.

Long ETH and BTC positions saw the lion’s share of liquidations. Source: CoinGlass

Crypto traders overleveraged: Same story, nothing new

Real Vision founder Raoul Pal said the same thing happens all the time, adding “the crypto market is focused on a big breakout, gets levered long ahead of it, it fails at first attempt, so everyone gets liquidated... only then does the actual breakout occur, leaving everyone sidelined.”

CoinGlass reported that it was the largest long liquidation event of the year. There have been similar liquidation events in late February, early April, and early August, when spot markets shed hundreds of billions over a very short period.

Largest long position wipeout of 2025. Source: CoinGlass

Others blame altcoin leverage

Researcher “Bull Theory” blamed the big flush on an “excessive imbalance” of altcoin leverage compared to Bitcoin. The liquidations for Ether topped $500 million, more than double those for long Bitcoin positions.

When altcoin leverage gets this extreme, the market doesn’t ignore it. One sharp move down triggers cascading liquidations. That’s how you flush out weak hands and reset the board.

Nassar Achkar, chief strategy officer at the CoinW exchange, said that the flushout “may present a near-term adjustment rather than a shift in the long-term structural bull run, as the path of future easing remains supportive for risk-on assets like Bitcoin.”

Potential dip back to support zone

Meanwhile, IG market analyst Tony Sycamore told Cointelegraph that Bitcoin hasn’t been correlated with tech stocks or gold recently, but this could be “largely due to technical factors and it needs more time to correct its stellar gains to the August $125k high over the past 12 months and to continue to work off overbought readings.”

Technically, a dip back into the $105/100k support zone, which includes the 200-day moving average at $103,700, makes sense. It would flush out a few of the weaker hands and Johnny come lately types - and I think set up a nice buying opportunity for a run up into year-end.

Bitcoin had only corrected by around 13% in early September since its peak in mid-August. The current drop from the all-time high stands at 9.5% despite this week’s rout, which is shallow compared to previous bull market year pullbacks.

BTC fell in 8 of the past 13 months of September but still remains up around 4% so far this month. It has historically performed much better in “Uptober.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.