CRV price extends losses as Curve tokens flood exchanges, whales shed holdings

- CRV price is approaching the $0.40 level, where $85 million worth of Curve tokens were sold in over-the-counter deals.

- Curve founder, Michael Egorov, sold nearly a quarter of the token’s circulating supply with “handshake agreement” lockups.

- Curve DAO tokens are rapidly flooding centralized exchanges and supply held by top addresses has declined throughout August.

Curve DAO’s CRV token’s price is declining rapidly, following the recent developments in the protocol. On July 31, a DeFi exploit wiped out $62 million in funds, triggering an implosion in the ecosystem. The incident left Michael Egorov, Curve’s founder, with a risk of $100 million liquidation on his CRV positions. Read more about the incident here.

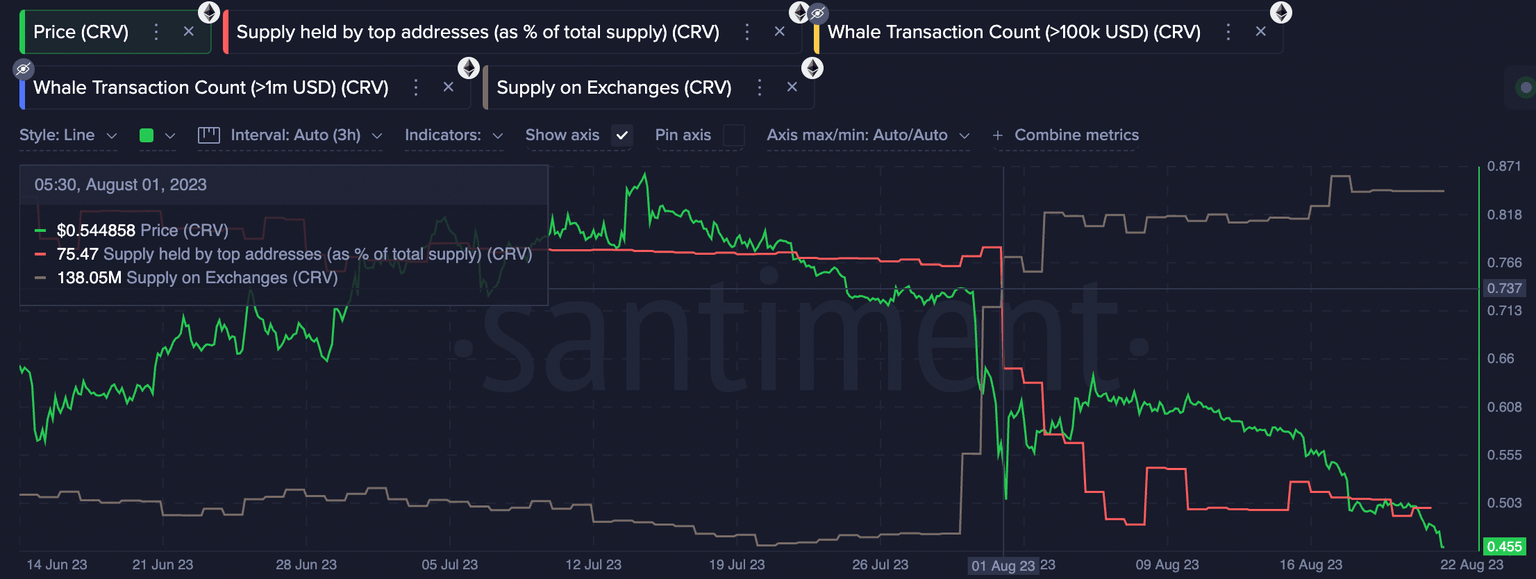

Curve (CRV) token’s supply on exchanges has consistently climbed, and top holders of the tokens have shed their supply, starting August 2023. These two metrics are key to determining the direction in which an asset’s price is headed.

Also read: Shibarium “almost ready” to reopen after initial network-related woes

Curve price decline supported by bearish on-chain metrics

CRV price suffered a decline from $0.65 on July 31 to $0.46 at the time of writing. The DeFi token has consistently suffered increasing selling pressure, with CRV flooding centralized crypto exchanges.

Based on data from crypto intelligence tracker Santiment, CRV supply on exchanges climbed from 138.05 million to 148.46 million on Tuesday. A considerable increase in the volume of CRV tokens hitting exchange wallets was accompanied by top addresses dropping their holdings of the DeFi tokens.

According to Santiment, supply of CRV held by the top 1% addresses, decreased from 75.47% (as a percentage of the total supply) to 71.75%.

CRV supply held by top addresses (as % of the total CRV supply) (red), supply on exchanges (grey) on Santiment

The bearish on-chain metrics support the thesis of further declines in CRV price.

The $0.40 price level is key to CRV, since this is the level at which nearly a quarter of the token’s circulating supply was sold by founder Michael Egorov to crypto firms and influencers through “handshake agreements” to keep the tokens locked.

There remains a possibility that these tokens enter circulation or hit exchange wallets, according to crypto analyst Hsaka.

Despite Michs exhaustive efforts, Curve continues to slowly bleed.

— Hsaka (@HsakaTrades) August 22, 2023

Rapidly approaching $0.4

where 210m coins ($85m)

~1/4th the circulating supply

were sold OTC

with "handshake agreement" lockups.

A few sophisticated actors have already moved their coins to CEXs pic.twitter.com/Q3qPDA9IJ7

Hsaka argues that some sophisticated entities have moved their CRV holdings to centralized exchanges, explaining the significance of Curve price drop to $0.40.

Andrei Grachev of DWF Labs clarified why the global market maker moved 2 million CRV tokens to Binance. Grachev asked the community to expect further CRV inflow from the entity, not with the intent of selling, but for other purposes. This development supports a recovery thesis for CRV price in the long term.

Sent 2m $CRV on Binance, and, will probably send more. Not for liquidation purposes (it would be dumb to sell it now), but for trading needs.

— Andrei Grachev (@ag_dwf) August 22, 2023

When we’ve done our plan, we will withdraw $CRV back to onchain

Cheers and enjoy rollercoaster pic.twitter.com/Kdds4DQrP6

At the time of writing, CRV price is $0.46 on Binance. It remains to be seen whether the price drops to the $0.40 level, where Curve is likely to experience heightened selling pressure and volatility.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.