Cosmos Technical Analysis: ATOM rallied to $9.0 despite broad-based altcoin declines

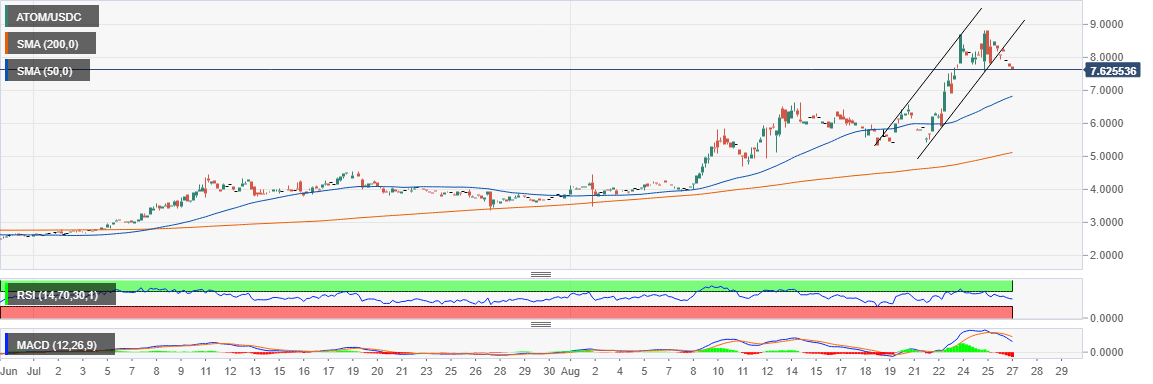

- Cosmos hits a wall within a whisker of $9.00, giving way to ongoing losses eying $7.0.

- ATOM/USD bulls hunt for support above $7.0 in a bid to contain the accrued gains in August.

While other altcoins followed in Bitcoin (BTC)’s slump this week, Cosmos was among the altcoins that recorded massive gains. The digital asset pushed for higher levels, stepping above $8.0. A weekly high traded at $8.82 put a temporary pose to the bullish action.

Meanwhile, ATOM has adjusted lower to trade at $7.71 after tentative support at $8.0 failed to hold. The reversal is still underway and appears to be gaining momentum. This increasing bearish grip is illustrated by the RSI as it dives towards the midline from highs above 70.

The MACD also cements the growing influence of the sellers over the price. A retreat eyeing the midline is underway. In addition, the bearish divergence from the MACD signals that selling pressure is bound to rise in the coming sessions.

Glancing lower, support is envisioned at $7.0, the 50 SMA in the 4-hour range and $6.0. In the event of extended losses, ATOM would seek refuge at the 200 SMA ($5.15) and $3.40.

ATOM/USD 4-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren