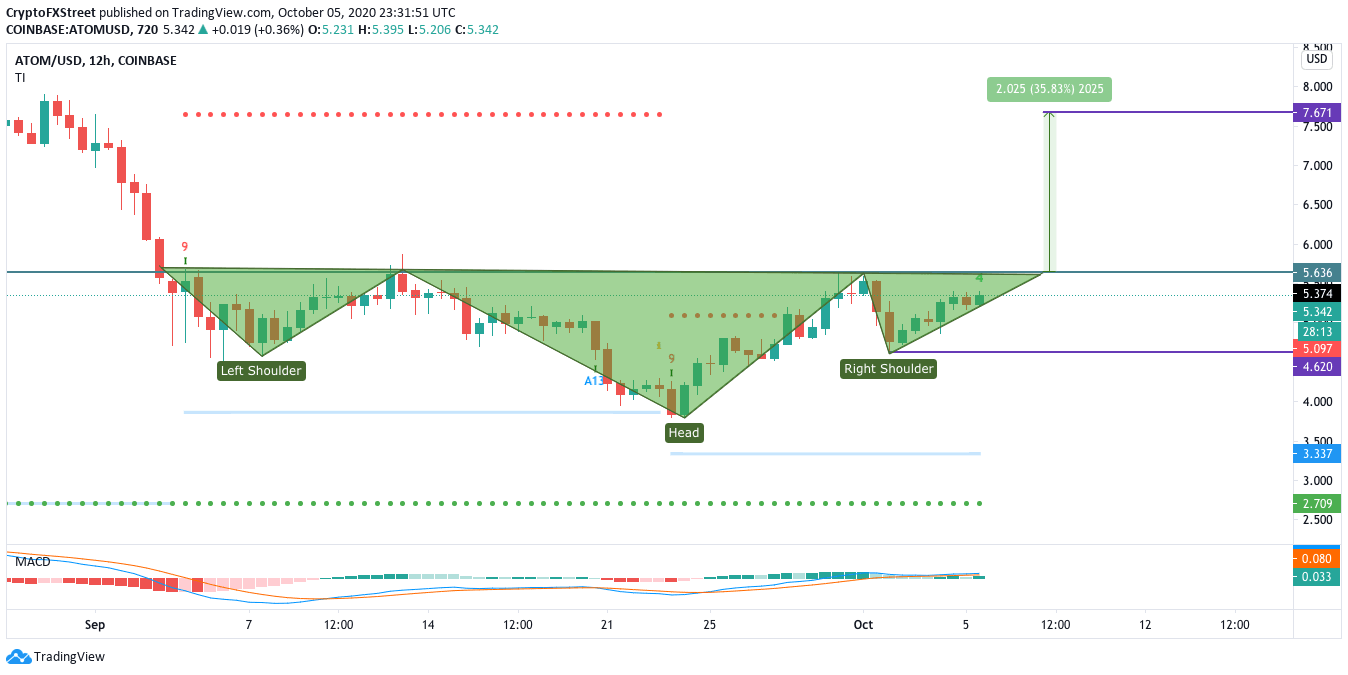

Cosmos Price Prediction: ATOM sits on the verge of a 35% upswing

- A bullish breakout from the inverse head-and-shoulders pattern can potentially push the price to $7.50.

- The bullish outlook could be invalidated if ATOM drops below the right shoulder at $4.65.

ATOM appears to be developing an inverse head and shoulder pattern on its 12hr chart. The neckline seems to be at $5.6. If the buyers gain enough momentum to break above this level, it could precede an upswing to $7.50, as dictated by the TD sequential indicator. The MACD shows sustained bullish momentum and further validates this potential bullish breakout.

ATOM/USD 12-hour chart

The inverse head and shoulder is an interesting pattern. It gets formed when the asset's price action falls to a trough, which, in this case, is at $4.74, and then rises back to the neckline ($5.60). Following that, the price drops below the $4.74 bottom to create the second trough, aka the “head.” After that, the price recovers to the neckline and falls again to a final trough, which isn’t as deep as the second trough.

On the flip side, if ATOM/USD closes below the right shoulder at $4.65, it will invalidate the bullish outlook.

What is Cosmos?

Managed by the Interchain Foundation, Cosmos aims to become an “internet of blockchains,” to solve the interoperability problems in the current blockchain ecosystem. Cosmos’s follows the hub-and-zone architecture wherein several independent blockchains (zones) are connected to a central blockchain (hub).

The core consensus algorithm powering up the Cosmos protocol is “Tendermint,” a variation of the traditional Practical Byzantine Fault Tolerance (PBFT) algorithm. Tendermint can handle transaction volume at the rate of 10,000 transactions per second for 250byte transactions. Plus, it has also been designed to prevent forks and stop attacks, such as the nothing-at-stake attacks.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.