Coinbase steps in to offer crypto lending services after BlockFi, Genesis fall; Base L2 suffers first glitch

- Coinbase exchange has rolled out a new service, lending crypto to institutional players in the US.

- With up to $57 million raised for the program, the exchange has presented the securities offering to the US SEC.

- BlockFi and Genesis offered similar services before their financial crises in 2022, following exposure to FTX and Alameda Research.

- Coinbase Layer-2 Base chain has suffered a glitch, with the network citing a "stall in block production."

Coinbase exchange has stepped in to fill the gap BlockFi and Genesis Global left after the two lending firms faced sudden financial crises reported in 2022 as part of the bleed from exposure to crypto exchange FTX and its sister firm, Alameda Research.

Also Read: BlackRock deliberately driving down Bitcoin price in anticipation for Spot BTC ETF approval, analyst says

Coinbase offers securities to institutional players

Coinbase, the largest cryptocurrency exchange in the US by trading volume, has set up a crypto lending unit to serve institutional players, raising up to $57 million for the program thus far. It comes after crypto lenders BlockFi and Genesis Global filed for bankruptcy, leaving a void on which the exchange now capitalizes.

While there has not been any formal announcement from the exchange, this revelation came to light in a recent submission to the US Securities and Exchange Commission (SEC). An excerpt from the filing reads:

Notifying the SEC and/or each State in which this notice is filed of the offering of securities described and undertaking to furnish them, upon written request, in accordance with applicable law, the information furnished to offerees.

The product allows clients to lend to the exchange and provide more collateral than the loan's value. This over-collateralization is a strategy intended to prevent challenges in case the worst happens. An individual close to the matter to CoinDesk that, in turn, the exchange (lender) offers the capital inflow for institutional trading clients like the tier-one brokerage service banks do in the traditional finance (TradeFi) sector.

This platform will allow users to lend their capital to Coinbase, which the exchange will subsequently loan to institutional customers.

Although different, this is not the first time Coinbase is presenting itself as a lender. In 2021, the exchange advertised a "controversial Lend program" that was later canceled following a rejection by the SEC, with the regulator threatening to sue the exchange if it launched the Lend initiative. Citing Coinbase Chief Legal Officer Paul Grewal at the time:

The SEC said Lend would violate long-standing securities regulations, pointing to US Supreme Court cases including Howey and Reves.

This time around, the US-based exchange focuses its lending services specifically on institutional players, based on the assumption that large investors have the financial capacity to manage. It also puts the product up for less burdensome regulation, particularly in the US market.

Coinbase Layer-2 Base suffers temporary glitch

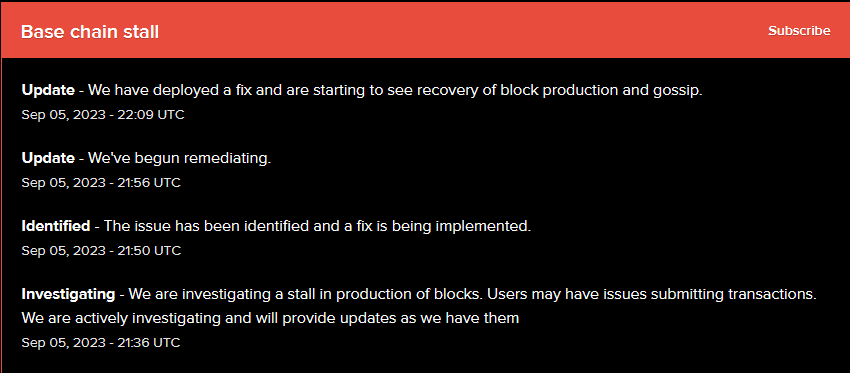

Meanwhile, a status update indicates that the exchanges Layer-2 Base program has experienced a stall in block production. The incident, which is easily the most significant technical challenge experienced by the protocol since its premiere in early August, has sparked ridicule.

Coinbase won’t acknowledge Solana for payments and now Base is down LOL@blknoiz06

— MM (@SoftServedGummy) September 5, 2023

As efforts to resolve the situation continue, “users may have issues submitting transactions. ”

Base chain stall update

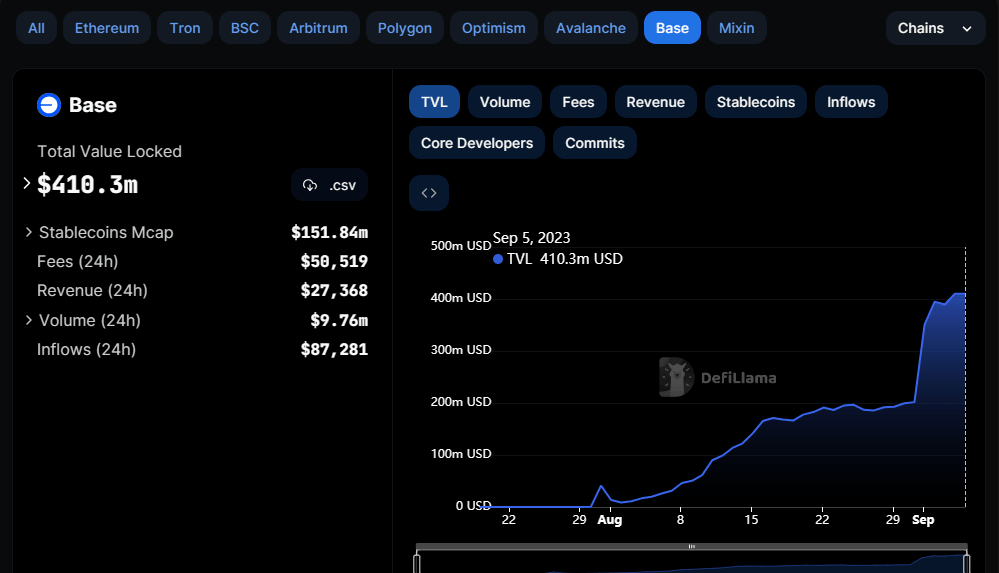

The glitch comes a day after the chain's Total Value Locked (TVL) surged by over $200 million in light of the Aerodrom decentralized exchange deployment as developers pushed for enhanced liquidity on the Base chain. Despite the temporary stall, its TVL continues to increase, recording up to $410.3 million at the time of writing.

DeFiLlama: Base TVL

This points to increasing user deposits, a sign of continued interest in the decentralized exchange. FXStreet will bring you updates concerning the block production stall as they unfold.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.