Chiliz Price Forecast: Targeting a 40% upswing ahead

- Chiliz's price extends its gains on Tuesday after rallying more than 14% in the previous day.

- The technical outlook suggests a bullish move as CHZ closes above its 200-day EMA at $0.075, and open interest is rising.

- A daily candlestick close below $0.067 would invalidate the bullish thesis.

Chiliz (CHZ) price continues to trade in green on Tuesday after rallying more than 14% in the previous day. The technical outlook suggests a further gain of 40%, and CHZ’s open interest is also rising, indicating an influx of additional money.

Chiliz price is poised for a 40% gain if it closes above $0.084

Chiliz price broke and closed above the 200-day Exponential Moving Average (EMA) at $0.075, surging 14.76% on Monday. At the time of writing on Tuesday, it trades slightly above around $0.081.

If CHZ closes above the daily resistance at $0.084, it could extend the rally by 40% to retest its 61.8% Fibonacci retracement (drawn from the May 30 high of $0.165 to the August 5 low of $0.043) at $0.118.

The Relative Strength Index (RSI) indicator trades at 65 and points upwards on the daily chart, indicating the bullish momentum is gaining traction while still below overbought conditions.

CHZ/USDT daily chart

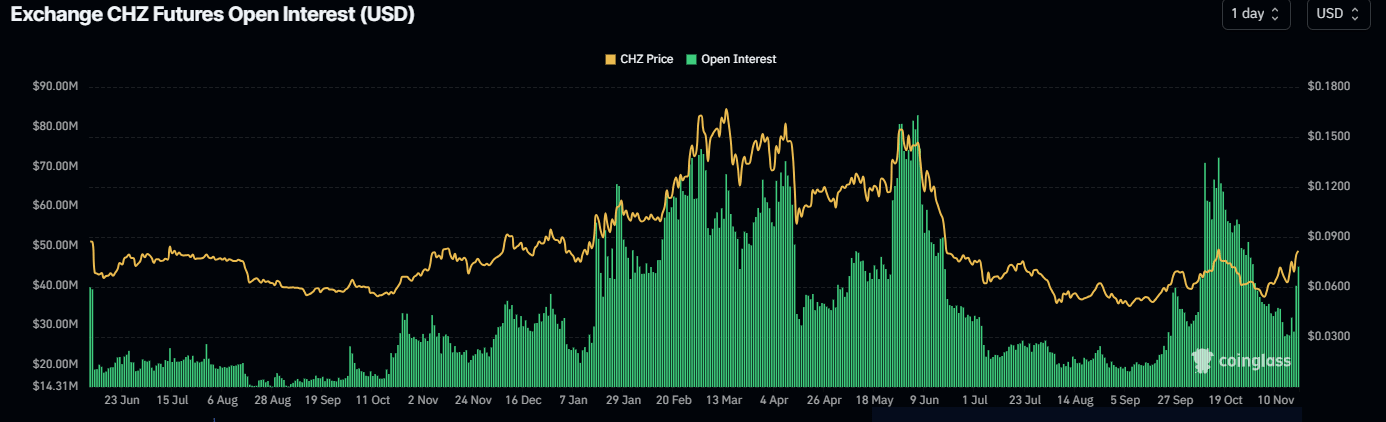

Chiliz’s Open Interest (OI) is also rising, further supporting the bullish thesis. Coinglass’s data shows that the futures’ OI in CHZ at exchanges rose from $28.67 million on Monday to $44.64 million on Tuesday, the highest level since October 31. An increasing OI represents new or additional money entering the market and new buying, which suggests a bullish trend.

CHZ Open Interest chart. Source: Coinglass

However, if CHZ fails to surpass $0.084 and declines to close below $0.067, the bullish thesis will be invalidated, and the decline will extend to the retest November 15 low of 0.061.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.