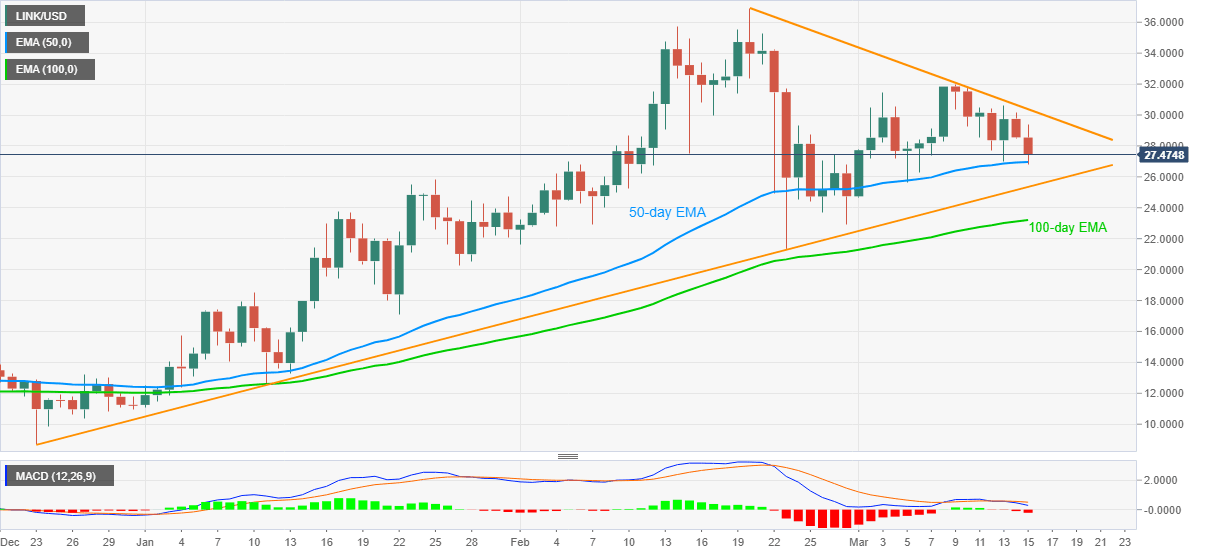

Chainlink Price Prediction: LINK bears battle intermediate support on their trip to $25.35 key level

- LINK fades bounce off 50-day EMA amid bearish MACD.

- One-month-old resistance line favors sellers, 100-day EMA adds to the downside.

-637336005550289133_XtraLarge.jpg)

LINK sellers keep the reins while fading the latest corrective pullback from $26.81 around $27.65 during early Tuesday. In doing so, the cryptocurrency pair attacks 50-day EMA amid bearish MACD.

Given the quote’s weakness since February 20, as portrayed by a descending trend line, LINK/USD is likely to break the $26.95 immediate support while eyeing the key support line from December 23, 2020, currently around $25.35.

It should, however, be noted that the 100-day EMA level of $23.20 adds to the downside filters for the quote’s drop towards the $20.00 psychological magnet.

Meanwhile, a corrective pullback from the current EMA support of $26.95 needs to cross the stated resistance line, at $30.40 now, to recall the buyers.

Following that, the monthly top of $32.00 can offer an intermediate halt during the rally to February’s peak surrounding $36.95.

Overall, LINK/USD is poised for further weakness but the key supports may test the bears eyeing heavy fall.

LINK/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.