Chainlink, Mastercard team up to enable over 3 billion cardholders to purchase crypto directly on-chain

- Chainlink announces a new partnership with Mastercard, enabling payment cardholders worldwide to purchase crypto assets directly on-chain.

- The primary objective is to bridge the gap between traditional finance and decentralized finance, enabling secure fiat-to-crypto conversions.

- Chainlink’s price rose nearly 5% on Tuesday following this news.

Chainlink (LINK) price is stabilizing around $13.33 at the time of writing on Wednesday, following a 5% rally the previous day. The price rise came following LINK’s announcement of a partnership with Mastercard that will enable over 3 billion cardholders to purchase crypto directly on-chain.

Chainlink partnerships with Mastercard to bridge the gap between TradeFi and DeFi

Chainlink announced on Tuesday a partnership with card giant Mastercard to securely enable payment cardholders worldwide to easily purchase crypto assets directly on-chain through a secure fiat-to-crypto conversion.

The news boosted investors’ confidence in LINK, as its price rose nearly 5% that day. The partnership opens the door for 3 billion cardholders to access the Chainlink platform.

The primary objective of this partnership is to bridge the gap between traditional finance (TradeFi) and decentralized finance (DeFi), enabling secure fiat-to-crypto conversions. This off-chain payments world would be directly integrated with the on-chain DeFi world through a close partnership with Zerohash, Swapper Finance, Shift4 Payments, and XSwap, while leveraging the Uniswap protocol.

Earlier on Monday, Mastercard announced that it will join Paxos’ Global Dollar Network to expand stablecoin integration and adoption, enabling USDG, USDC, PYUSD, and FIUSD across its network, and launch new capabilities through Mastercard Move and the Mastercard Multi-Token Network.

This announcement follows the passage of the GENIUS Act, also known as the stablecoin bill, by the US Senate last week. The bill is now headed to the House of Representatives before it can reach the President’s desk.

As explained in the previous report, Chainlink’s CEO, Sergey Nazarov, said that the approved stablecoin regulation will kick off a wave of new stablecoins, and LINK could benefit from it.

Chainlink Price Forecast: LINK on the verge of a breakout

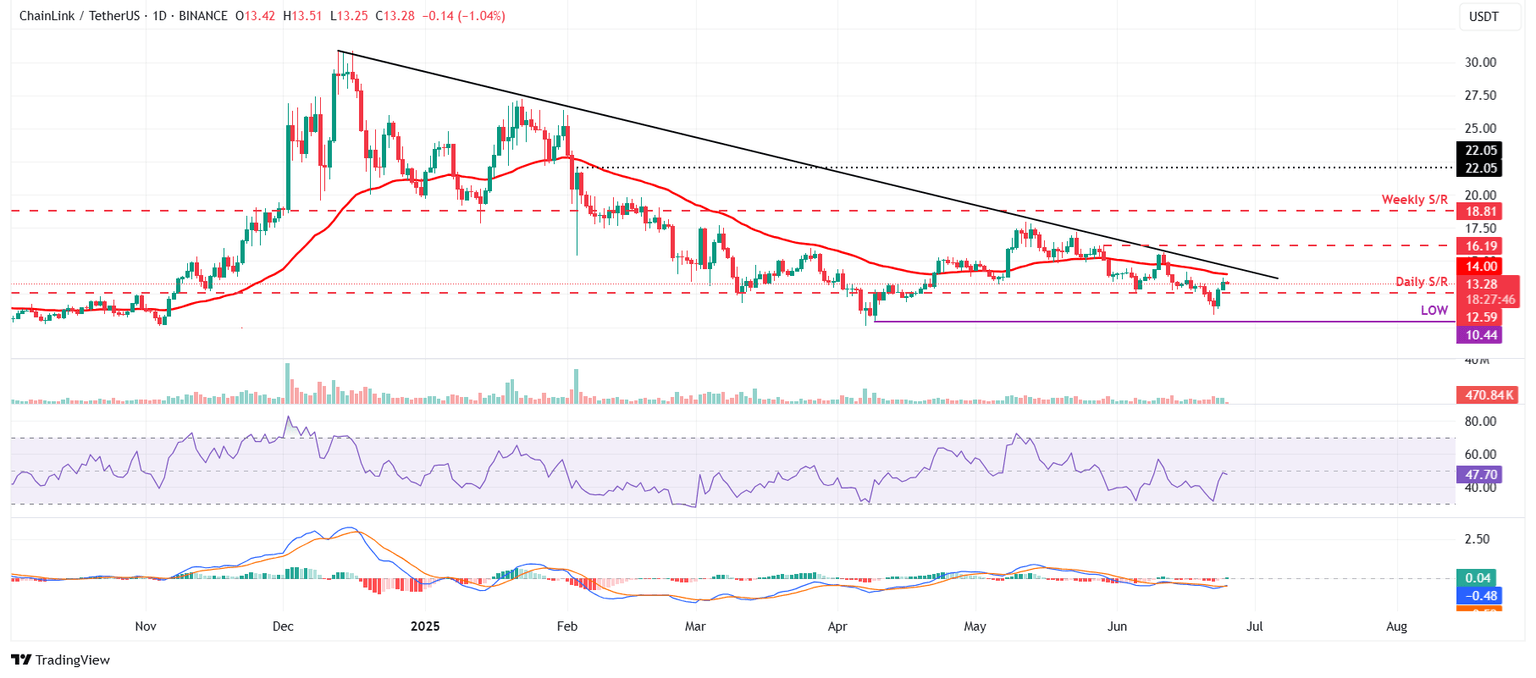

Chainlink’s price started the week on a positive note, rising nearly 18% until Tuesday. At the time of writing on Wednesday, it hovers around $13.28, just below the 50-day EMA and the descending trendline.

If LINK continues its upward trend, breaks the 50-day EMA at $14 and closes above the descending trendline, it could extend the rally toward its next resistance level at $16.19.

The Relative Strength Index (RSI) on the daily chart hovers around its neutral level of 50. For the bullish momentum to be sustained, the RSI should continue to move above its neutral level. The Moving Average Convergence Divergence (MACD) is showing a bullish crossover on Tuesday, and a daily confirmation would give a buy signal and favor the upward trend.

LINK/USDT daily chart

However, if LINK faces a correction, it could extend the decline to retest its April 9 low of $10.44.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.