Chain (XCN) ignores the wider market downtrend by rallying 100%+ over the past month

BTC, ETH and altcoins spent most of May trading in the red. So, what’s behind XCN’s near-month-long 100%+ rally?

May was an incredibly challenging month for the cryptocurrency market as the majority of tokens booked heavy losses as a bear market was confirmed, but not every project dropped back to pre-bull market lows.

Chain (XCN), a protocol designed to help organizations launch their own blockchain network or connect with other more established networks, has managed to rally more than 120% since May 19.

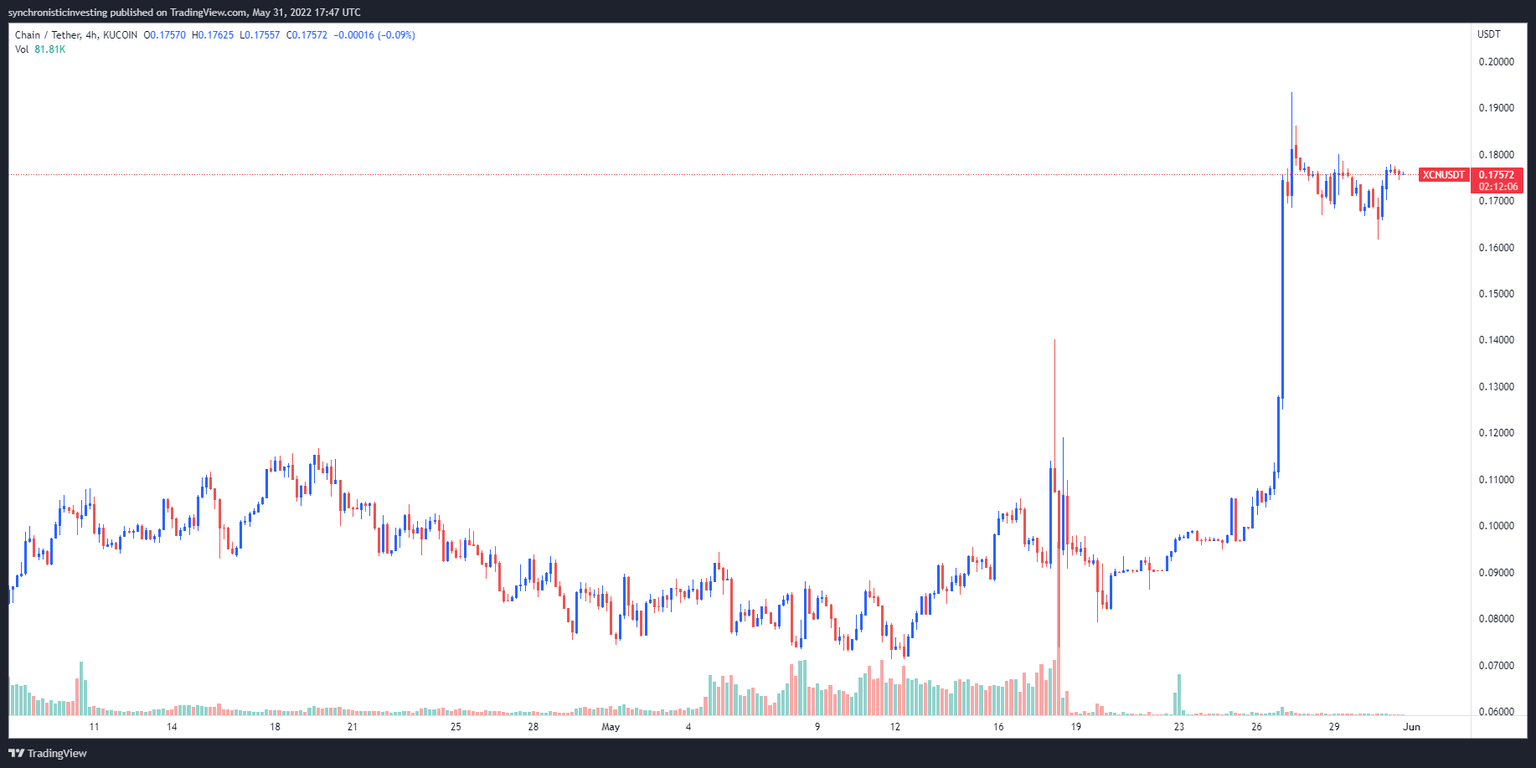

Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.0712 on May 11, XCN has reversed course to hit a record-high at $0.176 on May 31.

XCN/USDT 4-hour chart. Source: TradingView

The three reasons for the strong showing from XCN are multiple exchange listings, launching on BNB Chain and several notable partnerships, including a long-standing collaboration with the Stellar Foundation.

Exchange listings pump up the volume

In March 2022, Chain deployed a new smart contract for its token and rebranded from CHN to XCN. Following the rebrand, XCN listed on KuCoin and subsequent listings on Huobi, Gate.io, Bitrue and Hotbit were accompanied by sharp upticks in trading volume.

Several of the supporting exchanges have also launched perpetual contracts for the XCN token, including Gate.io, Huobi, Bybit and Poloniex, which has helped generate increased awareness for the project and initially led to a spike in trading volume.

XCN is also part of a cross-chain integration with BNB Chain, which enables inexpensive token transfers and trading on PancakeSwap, where holders can earn yield for providing liquidity to the exchange.

Following the integration with BNB Chain, the price of XCN rallied from $0.0712 on May 11 to $0.14 over the next week.

Notable partnerships

Since 2014, Chain has had several notable partnerships and funding rounds, including an initial fundraise of over $40 million from Khosla Ventures, Pantera Capital, Capital One, Citigroup, Fiserv, Nasdaq, Orange and Visa.

In 2018, the project was acquired and became part of the commercial arm of the Stellar Foundation known as Interstellar. Chain was reacquired in 2020 as part of a ledger-as-a-service platform called Sequence.

It’s possible the recent developments with the Stellar protocol, including its partnership with MoneyGram to create a stablecoin-based platform for money transfers, could have positive effects on the price of XCN due to their close ties.

In April 2022, Chain also announced a strategic partnership with Alameda Research, which established the private equity and quantitative cryptocurrency trading firm as Chain’s primary market maker. While none of these partnerships appears significant enough to explain XCN’s current gains, it is notable that the altcoin’s price action has diverged from the wider crypto market for nearly an entire month.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.