Cardano price targets $5 following smart contracts hard fork

- Cardano gears up to compete with Ethereum, replacing Tether as the third-largest cryptocurrency by market capitalization.

- Cardano differentiates itself from Ethereum by using an extended unspent transaction output model to predict transaction fees.

- Traders are bullish on Cardano, as the blockchain network can execute hundreds of simple transactions and complex scripts with Alonzo Hard Fork execution.

Smart contracts are set to go live on the Cardano mainnet within the next few hours. Analysts have a bullish outlook on the altcoin, predict a rally to a new all-time high.

Cardano ranks third in market capitalization, competes with Ether for dominance

Cardano has claimed its spot as the third-largest cryptocurrency by market capitalization, second to Ethereum. ADA market cap is less than three times away from ETH, and trader sentiment is getting increasingly bullish as smart contracts go live on Cardano mainnet.

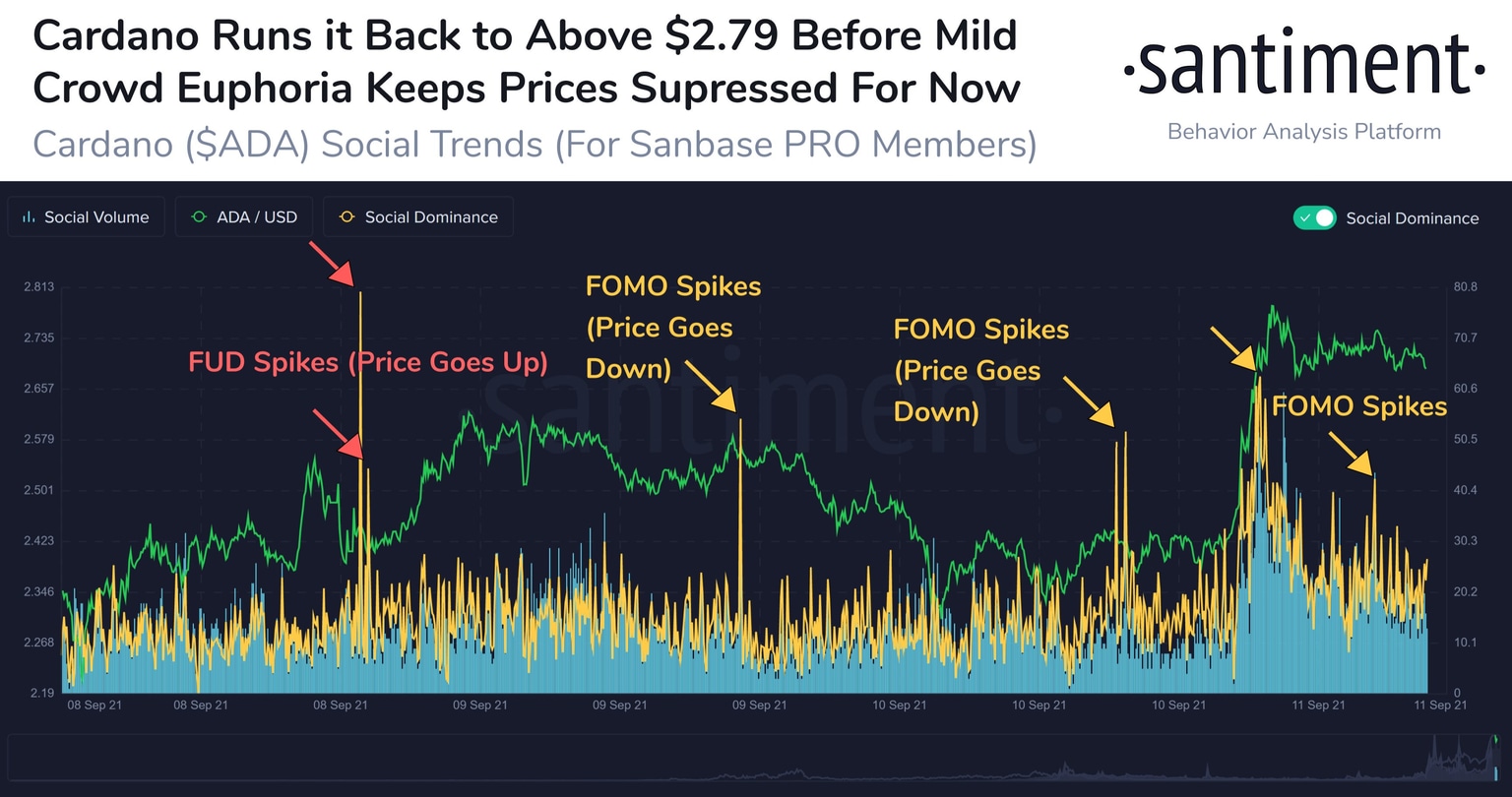

Based on data from Santiment, a crypto intelligence platform, Cardano recovered 12.5% since the flash crash of September 7. Cardano traders are likely to get over-hyped closer to launch and crowd euphoria is considered bullish for the altcoin's price in the short-term.

Crowd Euphoria in Cardano

The altcoin follows a model similar to Bitcoin, utilizing extended unspent transaction output (eUTXO). Using eUTXO Cardano offers enhanced security and predictability of transaction fees, thus approaching parallelization differently than Ethereum.

Cardano’s Alonzo Upgrade inherited Bitcoin’s UTXO model, and it uses multiple UTXOs to decentralized power applications and enforces parallelization. This results in higher scalability for smart contract applications launched on the Cardano network.

The Cardano development team expects dozens of projects that deployed smart contracts on the testnet to ramp up activity on the mainnet in the following months.

Michaël van de Poppe, cryptocurrency analyst and founder of Eight Global, has predicted that the altcoin will likely hit $5. He expects a massive bounce in the altcoin’s price.

Massive bounce on #Cardano.

— Michaël van de Poppe (@CryptoMichNL) September 11, 2021

Might be ready for $5. pic.twitter.com/czTMIIOjHW

FXStreet analysts have observed a bullish fractal that could trigger a 16% upswing in ADA price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.