Cardano price says the bottom is in, targets $1

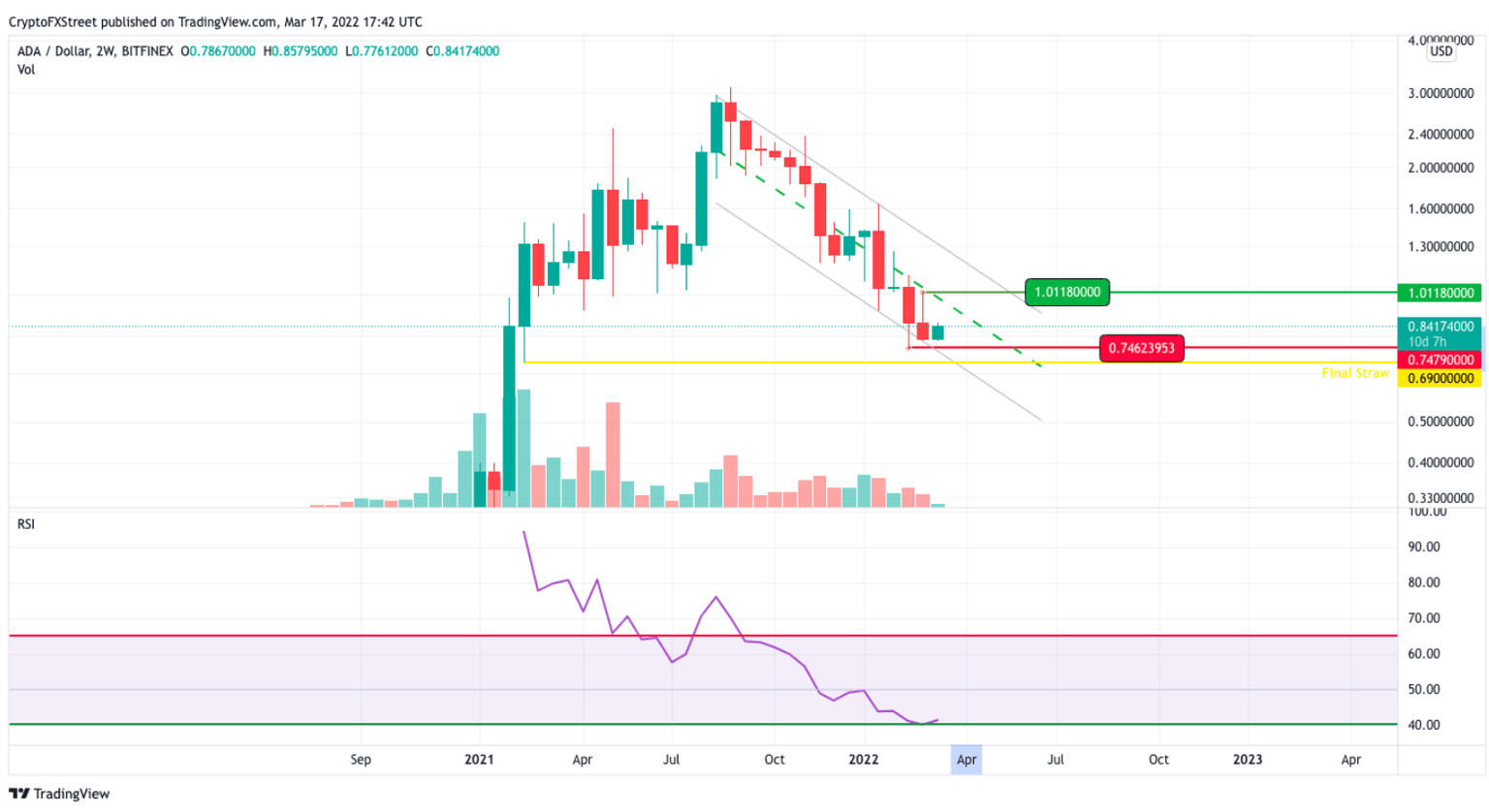

- Cardano price printed an inverted hammer on the 2-week chart.

- The relative strength index is precisely at the 40 level and turning.

- A break below $.74 will invalidate this thesis.

Cardno price appears to have bottomed out on the two-week chart. The next target for the bulls is $1.00 and $1.18

Cardano price says bulls are in control

Cardano price has had quite the bearish sentiment lately, as the bears have been aiming for the liquidity lying under $0.74. Investors should be pleased to know that the current downtrend may have ended as several indicators display bullish confluence.

Cardano price has printed a bullish inverted hammer on the two-week chart. Secondly, the Relative Strength Index has the inverted hammer printed precisely at 40, which is considered the maximum low among technical analysts. Lastly, the volume profile shows a consistent tapering off from the bears, which adds more confidence that the bearish pressure is coming to an end. Traders should consider jumping down to smaller time frames to find an entry as the bulls' next target will likely be $1.00 and maybe $1.18.

ADA/USD 2-Week Chart

This bullish thesis can only be invalidated if the bears manage to push prices lower than $0.74, currently 10% from the current price. Should this happen, the bears will likely charge for the 2021 swing low at $0.69 and attempt to print a new low in the $0.65 zone, which is currently 20% below the current price.

Author

FXStreet Team

FXStreet