Cardano price is ready for a rebound to new all-time highs

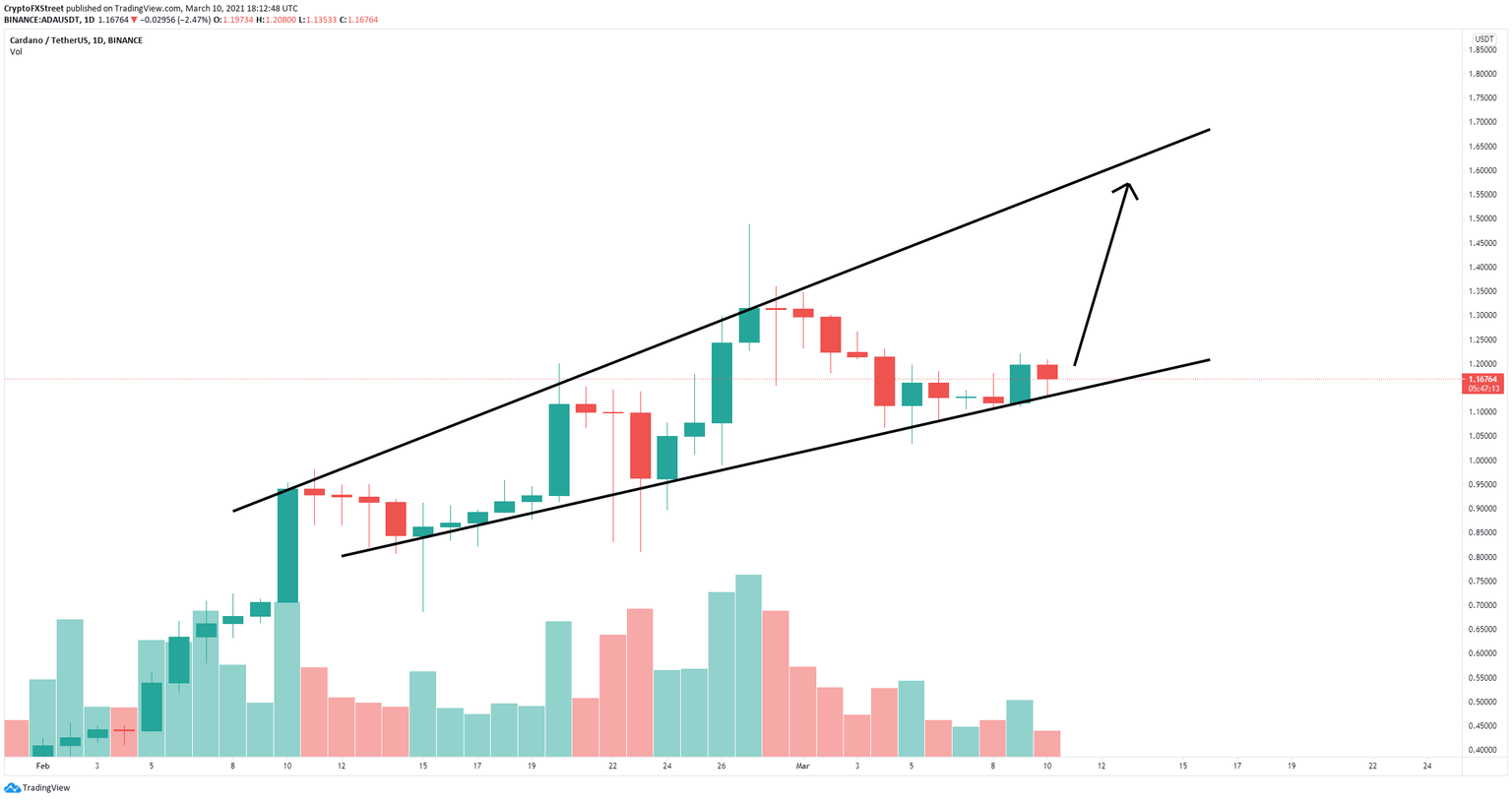

- Cardano price is contained inside a broadening wedge pattern on the daily chart.

- The digital asset has defended a key support level and aims for a significant rebound.

- ADA remains significantly bullish in the short and long-terms.

Cardano had a massive rally in 2021 and remained in a daily uptrend despite the recent sell-off. Now, after ADA bulls held a key support level, Cardano is ready for a new leg up, potentially to new all-time highs above $1.48.

Cardano price primed for a bounce to $1.6

Cardano price held the lower trendline support of the broadening wedge pattern and seems ready for a rebound towards the upper trendline. The long-term price target for the buyers will be $1.6, at the top of the pattern.

ADA/USD daily chart

The In/Out of the Money Around Price (IOMAP) chart adds a lot of credence to this theory as it shows no significant resistance levels above $1.2 and a robust support level between $1.13 and $1.16, which coincides with the lower trendline support of the wedge pattern.

ADA IOMAP chart

Losing the crucial support level of $1.13 would be a breakdown of the ascending broadening wedge pattern, which can drive Cardano price down to $0.7 in the long-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.