Cardano price at risk of bearish play with 85% decline

- Cardano price delivers a false bullish signal with price action underpinned at $0.415.

- ADA Price sees the 55-day Simple Moving Average coming in as a trend line from the topside.

- A bearish triangle could be in play with the possible outcome to the downside, a drop to $0.075.

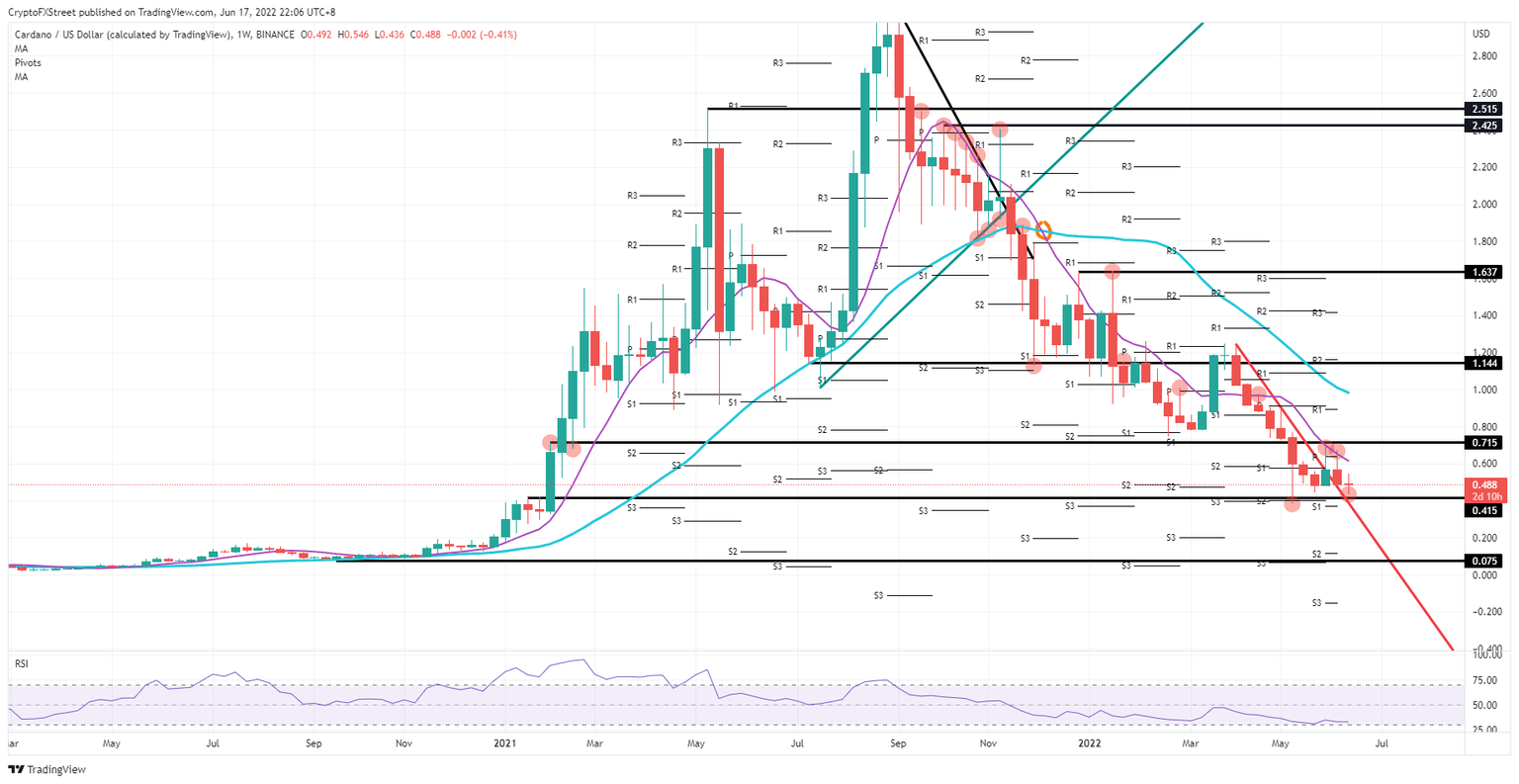

Cardano (ADA) price could be in the making of a catastrophic mistake as bulls are jumping on the false sense of safety that price action is underpinned by the pivotal historical level at $0.415. Traders could be so focused on buying the dip that they forget that the 55-day Simple Moving Average (SMA) is coming in from the top and has already capped the price action from previous weeks. This completion of this formation will result in a break to the downside below $0.415 and open up a massive area that will hold over 80% of losses in case of ADA price tanks in search of the next pivotal support that only comes in at $0.075.

ADA price to be handled with care

Cardano price is signaling a wrong message to cryptocurrency traders this week as most jump, preparing for a bullish move as ADA price action looks to be underpinned at $0.415. However, risk comes from the top side, where the 55-day SMA is dropping sharply, has already capped the topside from the previous two weeks, and is set to do that again this week. With that price pressure further building to the downside, it is just a matter of time before pressure against the bulls who bought at $0.415 and higher becomes intolerable.

ADA price could thus be set for a bearish triangle with $0.415 as the base and following the 55-day SMA as a tilted trend line that forms the descending base of the triangle. Pressure will build and inevitably break below $0.415. Below a big area opens up where losses could amount to an additional 85% of losses, and ADA Price dips below $0.1 to $0.075.

ADA/USD weekly chart

A knee-jerk reaction could be in the cards if the bulls keep their act together and withstand a squeeze against that $0.415 level. If next week the trading week can kick off with a weaker dollar, more room for the upside could be created, and bulls could get the chance to pierce through the 55-day SMA and break it down as a bearish cap. A full completion would result in a swing trade with price action in ADA rallying to $0.715.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.