Cardano hits new one-year lows as bulls abandon ADA below $1

- Cardano price continues to collapse, hitting the lowest daily close since February 19, 2021

- ADA is down more than 70% from its all-time high.

- Cardano holds the single longest stretch of monthly losses out of all major cryptocurrencies.

Cardano price action has recently achieved (and developing) some historical behaviors not seen in any of the top ten market cap cryptocurrencies – or nearly the entire altcoin space. Nevertheless, a slow bleed-off of value continues, with little sign of it abating until the very end of February 2022.

Cardano price is one of the worst-performing top ten cryptocurrencies and altcoins

Cardano price action is well on its way to achieving what none of the top 10 or top 40 cryptocurrencies by market capitalization have achieved: six consecutive months of losses. Cardano recently broke its record of four consecutive red/black monthly candlesticks in January 2022 to five consecutive red/black months – and unless something dramatic changes between now and the following Monday, it will extend the losing streak to a staggering six months.

An astonishing 65% of Cardano hodlers are now in the red. This is extremely surprising given multiple on-chain metrics and reports that confirmed ADA wallets that hold between 10,00 and 1 million ADA have more than doubled their holdings in the $1 value area.

A spectacular flash-crash could occur at any moment. From the extended 2021 Volume Profile perspective, almost nothing prevents Cardano from capitulating well below the $1. The following high volume node for Cardano price doesn’t appear until $0.35. In that scenario, ADA would extend its gap from 70% below its all-time high to nearly 90% - essentially repeating the same percentage loss from the 2018 bear market.

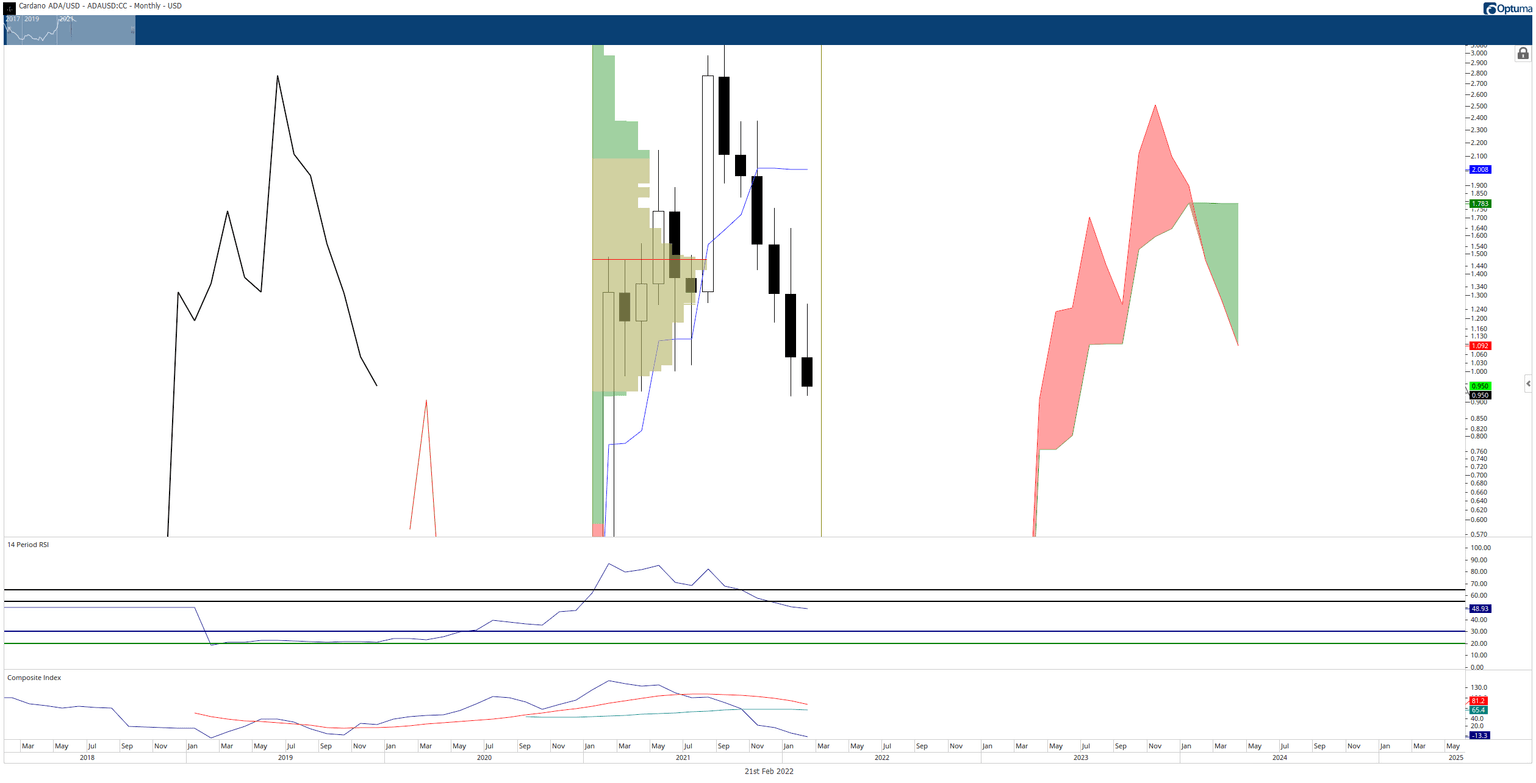

However, one of the most epic and violent bear traps in cryptocurrency history may be developing. Cardano has hit new all-time lows in the Composite Index on the monthly chart. At the same time, hidden bullish divergence developed between the candlestick chart and the Composite Index – a condition almost no cryptocurrency has created in almost four years. Finally, the monthly candlestick itself is a rare and massively influential bullish reversal candlestick known as an inverted hammer.

From an Ichimoku perspective, a violent reversal that could generate over a 110% gain is highly probable due to the enormous gaps between the bodies of the monthly candlesticks and the Tenkan-Sen.

Another consideration for Cardano’s imminent reversal is the completion of one of the most potent Gann cycles of the inner year: the 180-day cycle. 180-days from the all-time high lands precisely on March 1, 2022.

ADA/USD Monthly Ichimoku Kinko Hyo Chart

Traders should expect a mean reversion to $2.02 to occur with little to no warning. A rapid recovery of over 40% within just a few trading days is highly likely.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.