Cardano: $1 is a fever dream for ADA as Vasil hard fork fails to trigger buying pressure

- The hype behind the Cardano’s Vasil hard fork failed to materialize as the broader market fear kept ADA’s price closer to the lower lows.

- Consistently decreasing participation is resulting in declining network usage, which has brought the daily volume average down by 41% in a month.

- Fund 9 proved to be far more successful as Cardano noted a 53% increase in voting, born out of Community participation.

After Ethereum’s Merge, Cardano’s Vasil hard fork was the most anticipated event for the crypto community this year. Surprisingly, both the events, while developing the network further, acted as a disappointment for the investors and traders looking to profit off of the hype.

Cardano might need some time

The Vasil hard fork took place on September 22, and the following days were expected to be the beginning of ADA’s recovery. However, that failed to happen since ADA’s price is still consolidating below critical resistances due to the persisting fear in the crypto market.

Trading at $0.446 at the time of writing, ADA has not moved by a lot in over a month, barely even breaching the $0.5 mark. At $0.52 lies the historically tested critical resistance, which stands to prevent ADA from reclaiming the 23.6% Fibonacci retracement level of the $1.2 - $0.3 downmove.

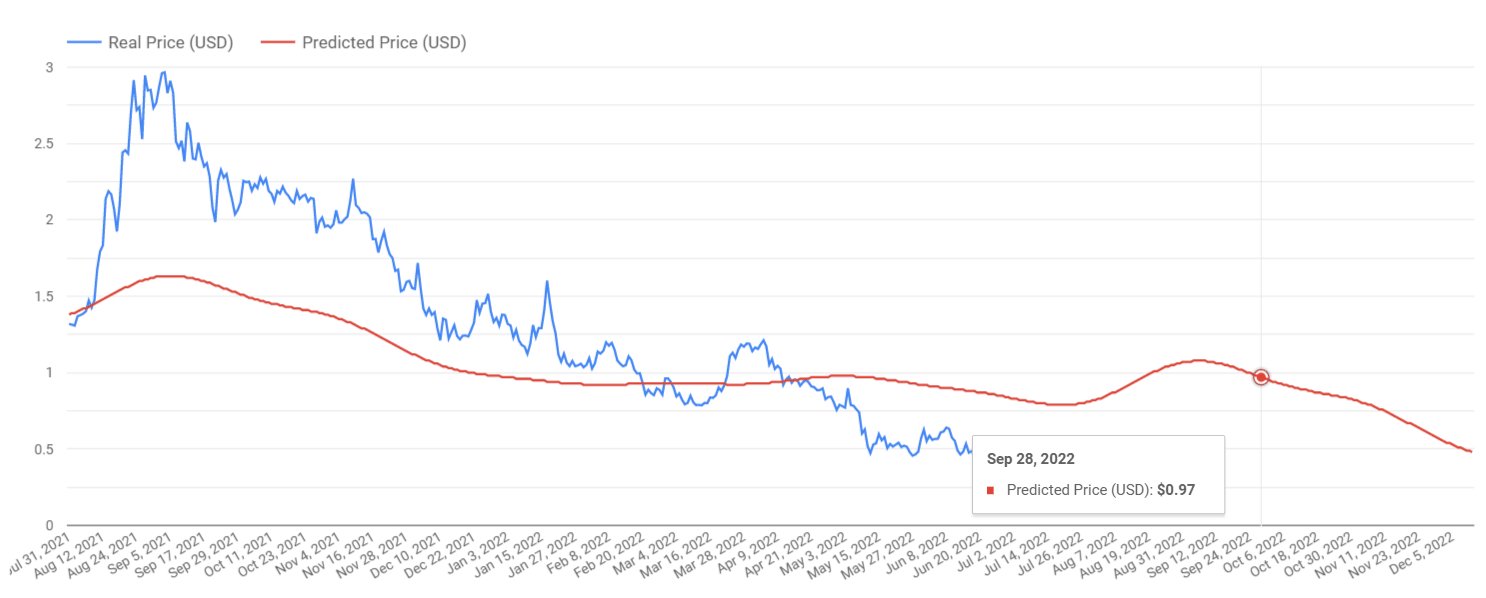

Breaching above this level would place ADA closer to $1. In such a scenario, Cardano would be closer to the predicted price for the asset, which has been set according to ADA’s price data over the last five years. According to blockchain insights, ADA’s price should have been closer to $0.97 at the moment.

Cardano real and predicted price

But the week has not been completely disappointing

According to the development report released by the Cardano Foundation this week, the Cardano community outdid itself by increasing its participation. Fund 9, a community-focused governance program allowing Cardano users to choose projects which further the chain. closed its voting this week and managed to increase the voting by 53%. The report further noted,

“The voting power has also increased, which shows more ada being used across more proposals in Project Catalyst with 11% of all circulating ada being used in Fund9. (sic)”

Thus, Cardano might still have a few tricks up its sleeve, but for now, it will not be making any stellar growth on the charts. However, Cardano still has time to flip the situation around by the beginning of the fourth quarter.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.