Can traders expect a sharp drop of Bitcoin (BTC) to $28,000 after a breakout of $30,000?

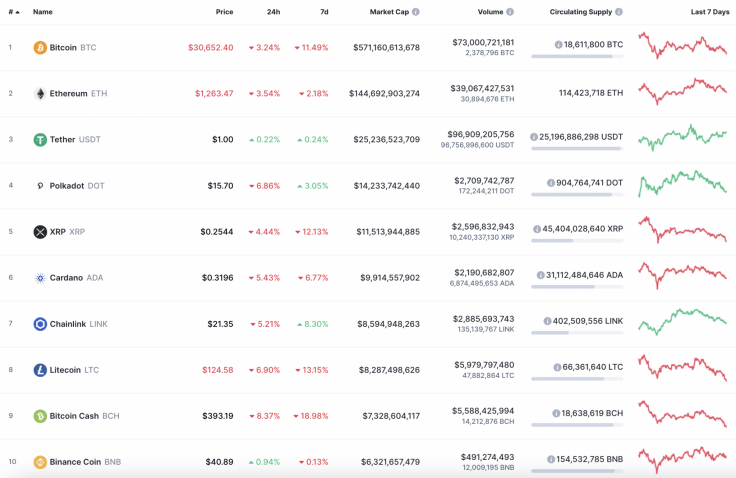

The correction has continued on the cryptocurrency market as almost all of the top 10 coins are in the red zone. Binance Coin (BNB) is the only exception to the rule, rising by almost 1%.

Top 10 coins by CoinMarketCap

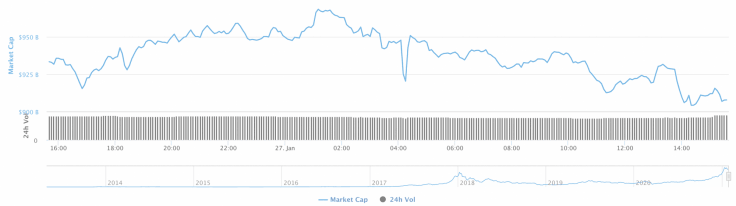

Market capitalization has gone down and is currently $907 billion.

Cryptocurrency market capitalization

The relevant data for Bitcoin today

-

Name: Bitcoin.

-

Ticker: BTC.

-

Market Cap: $570,579,838,070.

-

Price: $30,656.89.

-

Volume (24h): $73,047,765,128.

-

Change (24h): -3.44%.

The data is relevant at press time.

BTC/USD: Can bulls hold the $30,000 mark this time?

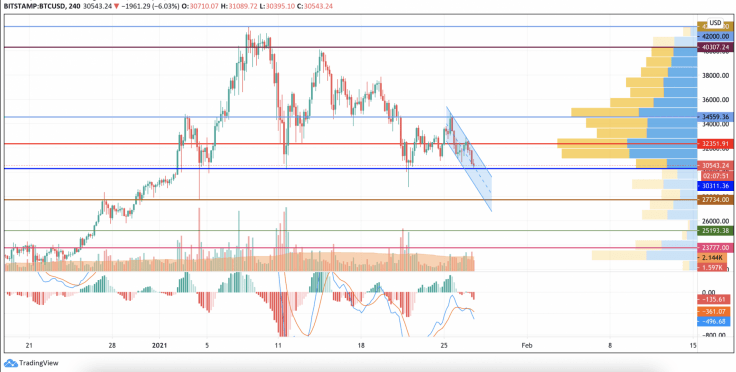

Yesterday the Bitcoin (BTC) price consolidated around the support area of $32,600. Weak attempts by buyers to restore the pair above the two-hour EMA55 were unsuccessful. The moving average in the afternoon limited the possible price recovery toward the purple downtrend line.

BTC/USD chart by TradingView

Today, buyers will continue to try to test the resistance of the trend line, but bears will be able to maintain control over the market and smoothly push the price towards the psychological support of $30,000.

BTC/USD chart by TradingView

On the 4H chart, Bitcoin (BTC) is likely to break the vital level at $30,000. Such a statement is confirmed by the high selling trading volume and the lines of the MACD indicator that have entered the red zone.

In this case, there are high chances of seeing the main crypto trading below $29,000 shortly.

BTC/USD chart by TradingView

On the bigger time frame, Bitcoin (BTC) is even more bearish as if it fixed below $30,000. It may get to the next vital support at around $24,300 within a few days. The low liquidity supports such a move.

Bitcoin is trading at $30,460 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.