Can popular altcoins keep rising faster than Bitcoin (BTC)?

The market has recovered after a slight correction; however, some coins are trading in the red zone. Mainly, XRP and Bitcoin Cash (BCH) are still under bearish influence.

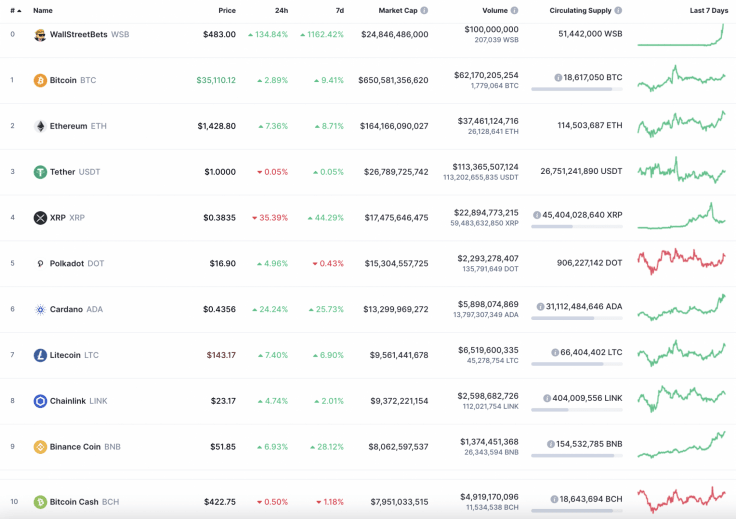

Top 10 coins by CoinMarketCap

BTC/USD

The Bitcoin (BTC) price rebounded above the resistance of $34,000 yesterday. In the afternoon, sellers tried to push through the two-hour EMA55, but by the end of the day the pair managed to hold above the average price level.

BTC/USD chart by TradingView

If today the moving average EMA55 keeps the price from falling towards the POC line ($32,600), then the recovery will continue to the resistance of $36,000.

Bitcoin is trading at $34,860 at press time.

EOS/USD

EOS is the only loser from the list today as the rate of the coin has fallen by 4.14% over the past 24 hours.

EOS/USD chart by TradingView

On the daily chart, EOS is bullish despite today's decline as the coin keeps trading above the vital level of $3. In addition, there is a high concentration of liquidity, which means that buyers are getting ready for the growth. In this case, one may expect the altcoin near the resistance of $3.45 shortly.

EOS is trading at $3.02 at press time.

ADA/USD

Cardano (ADA) is the top gainer today; its price has rocketed by more than 20% since yesterday.

ADA/USD chart by TradingView

Cardano (ADA) has set the new peak in 2021, having confirmed bulls' power. However, buyers might retest the mirror level at $0.4155 in order to continue the rise. Thus, the long-term buyers' dominance is also supported by the high trading volume.

Cardano is trading at $0.44 at press time.

LINK/USD

The rate of Chainlink (LINK) has also increased over the last day. The price change has accounted for 4.24%.

LINK/USD chart by TradingView

From the technical point of view, the growth has not ended yet, and Chainlink (LINK) has the potential to reach the nearest resistance level at $25.50 within the next few days.

Chainlink is trading at $23.08 at press time.

DOT/USD

Polkadot (DOT) is not an exception to the rule as its rate has also risen by 4% since yesterday.

DOT/USD chart by TradingView

Polkadot (DOT) is trading similarly to Chainlink (LINK), aiming at the resistance of $19.39. Such a move is confirmed by the lines of the MACD indicator that are about to get out of the red zone.

Polkadot is trading at $16.66 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.