Can Bitcoin (BTC) follow the fast rise of the altcoins?

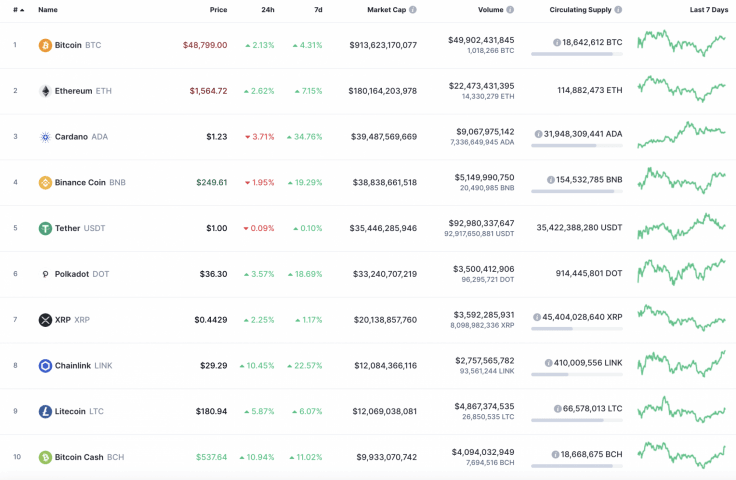

The bullish trend continues on the cryptocurrency market; however, not all coins are going up. Cardano (ADA) and Binance Coin (BNB) are the only losers from the list, falling by 3.37% and 1.89%, respectively.

Top 10 coins by CoinMarketCap

BTC/USD

Yesterday morning, the Bitcoin (BTC) price recovery continued to the resistance of $48,000. In order to break this level, the bulls formed an impulse exceeding the average buying volume. As a result, the pair has consolidated above the upper border of the wide side channel, where it has been since the middle of last week.

BTC/USD chart by TradingView

The trading volumes were below average tonight, but buyers were able to test the psychological $50,000 mark. If buyers continue to dominate, then the growth may continue to the area of $52,000.

If sellers build a strong defense at the $50,000 line, the pair will return to the average price area—to the two-hour EMA55.

Bitcoin is trading at $48,975 at press time.

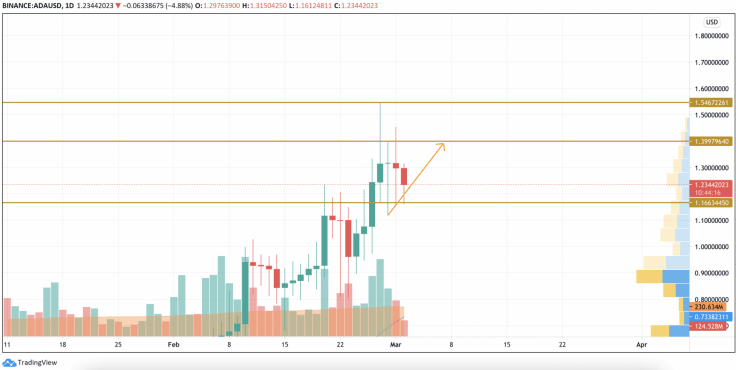

ADA/USD

Cardano (ADA) is the main loser on our list today. The rate of the third most popular crypto has decreased by 3.71%.

ADA/USD chart by TradingView

From the technical point of view, Cardano (ADA) is located in the sideways range with no bullish or bearish signals. However, the altcoin has successfully bounced off the support at $1.16, which has confirmed buyers' power. In this case, there are chances of seeing a retest of $1.39 shortly if bulls keep pressing.

Cardano is trading at $1.23 at press time.

BNB/USD

Binance Coin (BNB) also could not join the list of gainers as the rate of the native exchange token has declined by 0.59%.

BNB/USD chart by TradingView

According to the char, Binance Coin (BNB) is trading similarly to Cardano (ADA) as, despite the decline, yesterday's candle has confirmed buyers' strengths. Thus, the selling volume remains low, which makes it difficult for buyers to keep pushing the rate of the altcoin deeper. All in all, growth to $296 is likely.

Binance Coin is trading at $252 at press time.

LINK/USD

Chainlink (LINK) is the top gainer today. Its rate has rocketed by 10% since yesterday.

LINK/USD chart by TradingView

The current rise may not have ended yet as the altcoin has accumulated enough power to rise to the next resistance at around $32. Moreover, the current liquidity level is enough for such growth.

Chainlink is trading at $29.48 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.