Can altcoins keep rising faster than Bitcoin (BTC)?

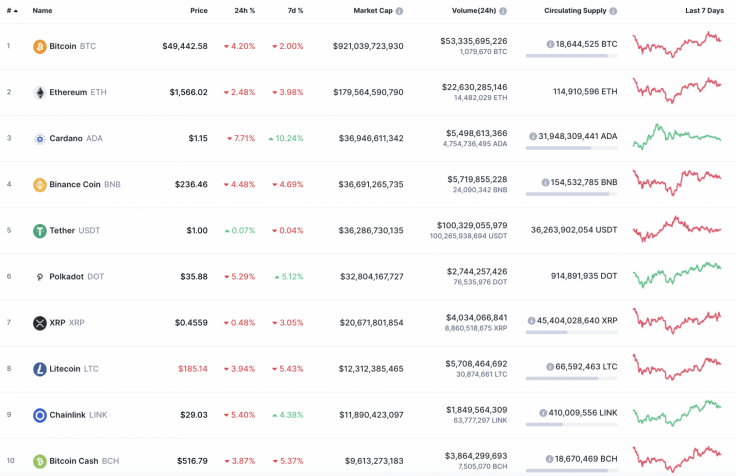

A short-term drop may have begun on the cryptocurrency market as all coins from the top 10 list are in the red zone.

Top 10 coins by CoinMarketCap

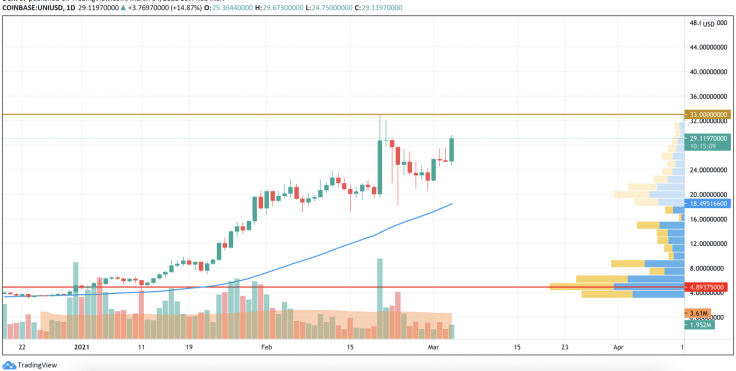

UNI/USD

Uniswap (UNI) is the only gainer today as the rate of the altcoin has risen by 7.23% since yesterday.

UNI/USD chart by TradingView

According to the daily chart, Uniswap (UNI) is about to retest the peak at $33 as bulls have accumulated enough power.

If bears do not keep that level, there are quite high chances to see a breakout, followed by a rise to $35.

UNI is trading at $28.84 at press time.

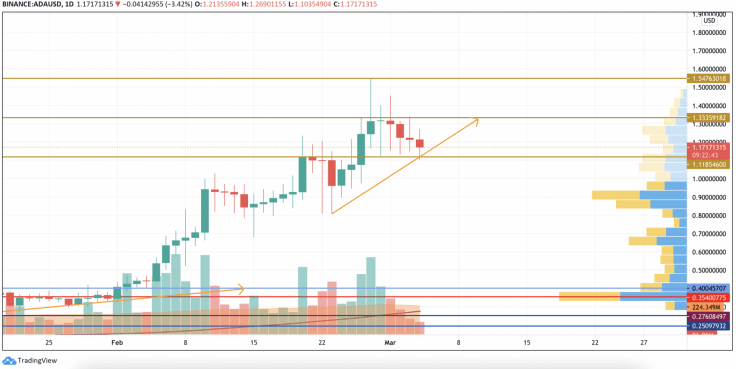

ADA/USD

Cardano (ADA) is the main loser today as the rate of the third most popular crypto has declined by almost 9%.

ADA/USD chart by TradingView

Despite the price drop, Cardano (ADA) is rather more bullish than bearish in the short-term case. The coin has made a false breakout at the level of $1.118 having confirmed the weakness of sellers. In this regard, the asset may come back to the resistance at $1.33 within the next few days.

Cardano is trading at $1.17 at press time.

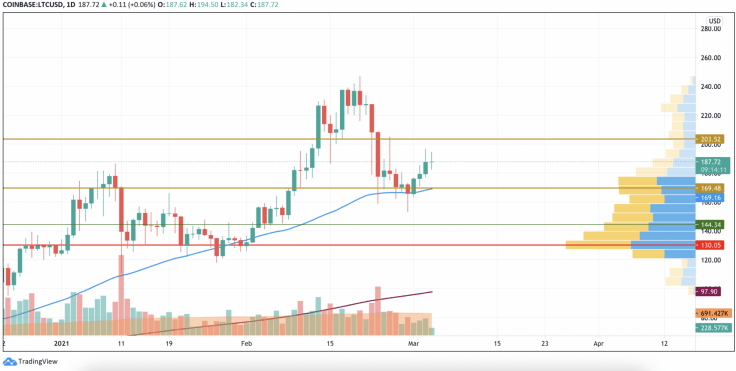

LTC/USD

Litecoin (LTC) is the second loser today as the "digital silver" could not come back to the bullish area.

LTC/USD chart by TradingView

However, bulls' long-term dominance has not been broken yet, which means that buyers still have the strength to make a retest of the closest resistance level at $203.

Litecoin is trading at $185 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.