BTC/USD bullish reversal to test critical highs

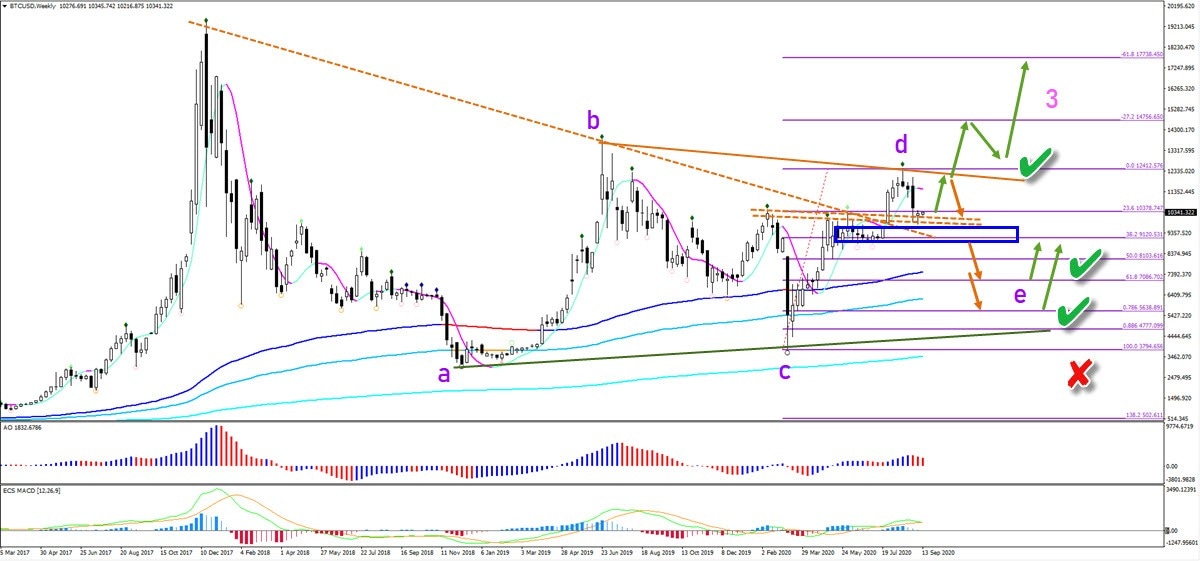

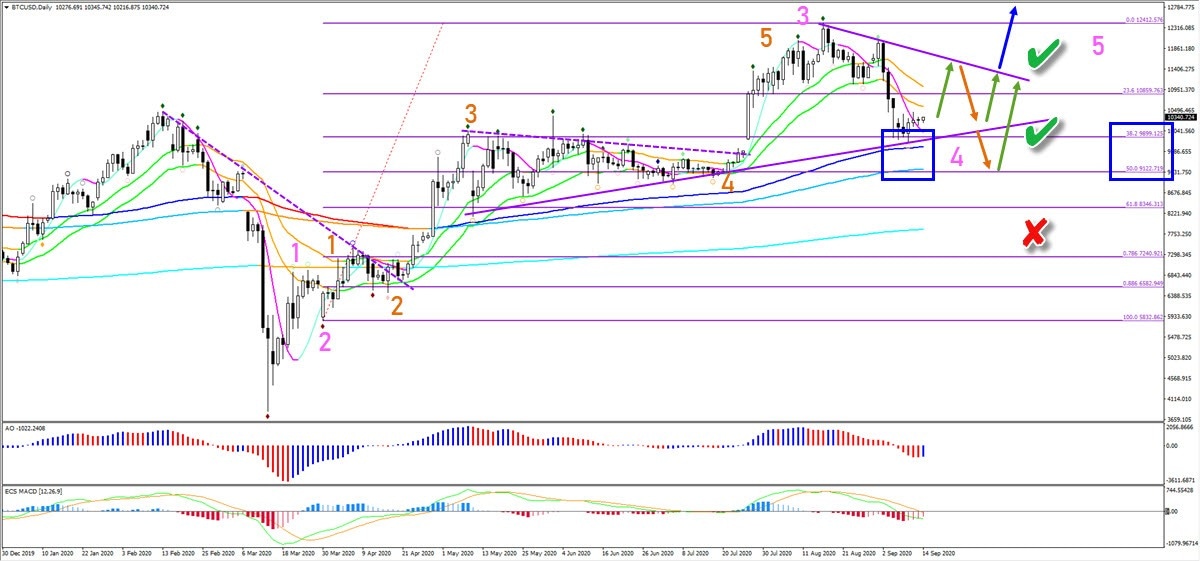

Bitcoin (BTC/USD) made a critical bullish breakout above the resistance trend line (dotted orange). But a triangle chart pattern remains a factor whether BTC/USD is really in an uptrend or not. What can we expect on the weekly and daily charts?

Price Charts and Technical Analysis

The BTC/USD is testing the broken support zone (dotted orange lines and blue box). A bullish bounce is expected to retest the previous high. A bullish break above the previous top confirms the uptrend and a wave 3 (pink) continuation. A bearish bounce indicates that an ABCDE triangle pattern is more likely to emerge. This triangle pattern only becomes invalid if price breaks below the bottom and 100% Fib.

The current retracement on the daily chart is finding support at the 38.2% Fibonacci retracement level of wave 4 (pink). The 5 wave (pink) pattern is the alternative of the triangle pattern shown on the weekly chart. But price action should stay above the 50% Fib and eventually break above the resistance. A bullish pinbar at the 144 ema is likely to create a bounce to test the resistance trend line soon.

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.