Bitcoin breaks new yearly highs; the road to $15,000 is clear

- Bitcoin breaks new yearly highs amid strong bullish momentum.

- The price may retreat to $12,800 before another bullish wave with the target at $15,000.

Bitcoin (BTC) broke above the local resistance created at $13,250 and hit a new yearly high at $13,490. The pioneer digital asset is poised for further growth as the upside momentum gains traction amid little resistance from sellers.

At the time of writing, BTC/USD is trading at $13,400, having gained nearly 3% on a day-to-day basis. Bitcoin's average daily trading volume is registered at $32.9 billion, while its market share increased to 61.9%.

Bitcoin bulls are unstoppable

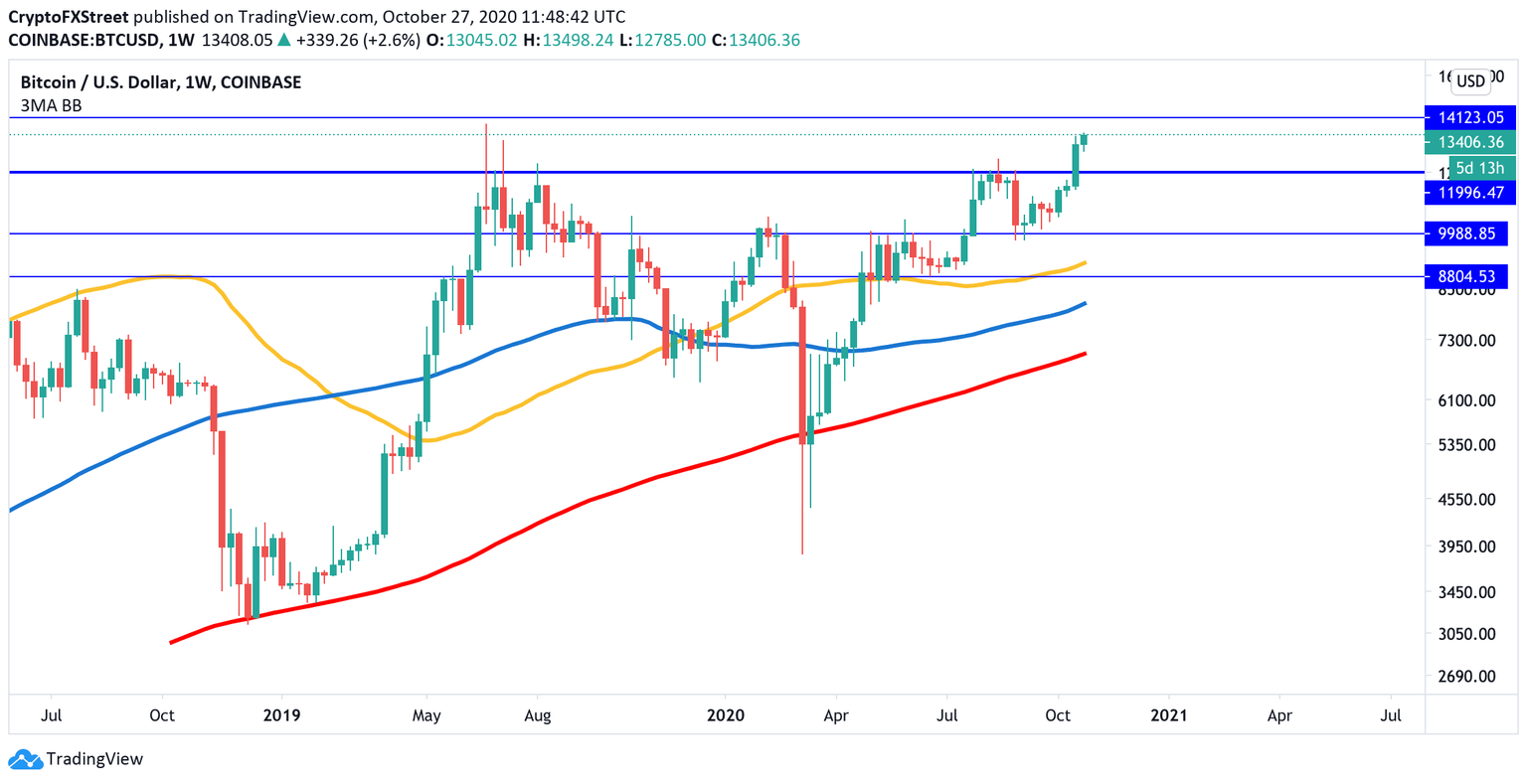

From the technical point of view, a daily candlestick close above $13,250 would signal the end of the Bitcoin consolidation phase and the beginning of a new bullish wave. If this former resistance is verified as a support, there will be little to stop BTC on the way to $15,000.

The In/Out of the Money Around Price (IOMAP) model confirms that there are no significant barriers above the current price, while the downside is clustered with substantial obstacles.

Bitcoin's IOMAP data

Source: Intotheblock

Thus, Bitcoin finds strong support between $13,000 and $12,650, as nearly 1 million addresses bought over 800,000 coins there. The next big cluster of addresses is registered below $12,000, with 1.75 accounts having bought 1 million coins.

BTC/USD 1-hour chart

On the one-hour chart, a break below $13,250 would allow for an extended correction towards $12,800 and potentially $12,600 (1-hour SMA100). This technical support area may serve as a backstop for BTC and trigger another bullish wave; however, a sustainable move lower would invalidate the immediate bullish forecast.

Meanwhile, from the longer-term perspective, BTC is well-positioned for strong growth with the next focus on $13,800, the highest level of 2019, followed by $15,000.

BTC/USD weekly chart

Key levels to watch

Considering the lack of supply walls above the current price level, BTC may quickly reach $15,000.

Nonetheless, a short-term technical correction could take BTC/USD to $12,800. Moving past this support barrier will jeopardize the bullish outlook and lead to further losses. But as of now, it seems like this hurdle is likely to keep falling prices at bay and attract new buyers to the market.

Author

Tanya Abrosimova

Independent Analyst

%20Analytics%20and%20Charts2710-637393965845049111.png&w=1536&q=95)