BNB suffers 27% flash crash; where will Binance Coin go from here?

- Binance Coin (BNB) crashes -27% during the intraday session.

- Support found at two strong Fibonacci Retracements.

- Key levels to watch ahead.

Binance Coin (BNB) seemed well on its way to test a likely new all-time high towards the $700. Instead, BNB experienced a massive -27% drop from $496.23 to $370.14 during the Tuesday trading session. It has since recovered a significant amount of that initial drop and is presently down -15%.

So the question bulls and bears ask is this: where does BNB go from here?

BNB price has strong support was found at $368, but will it hold another test?

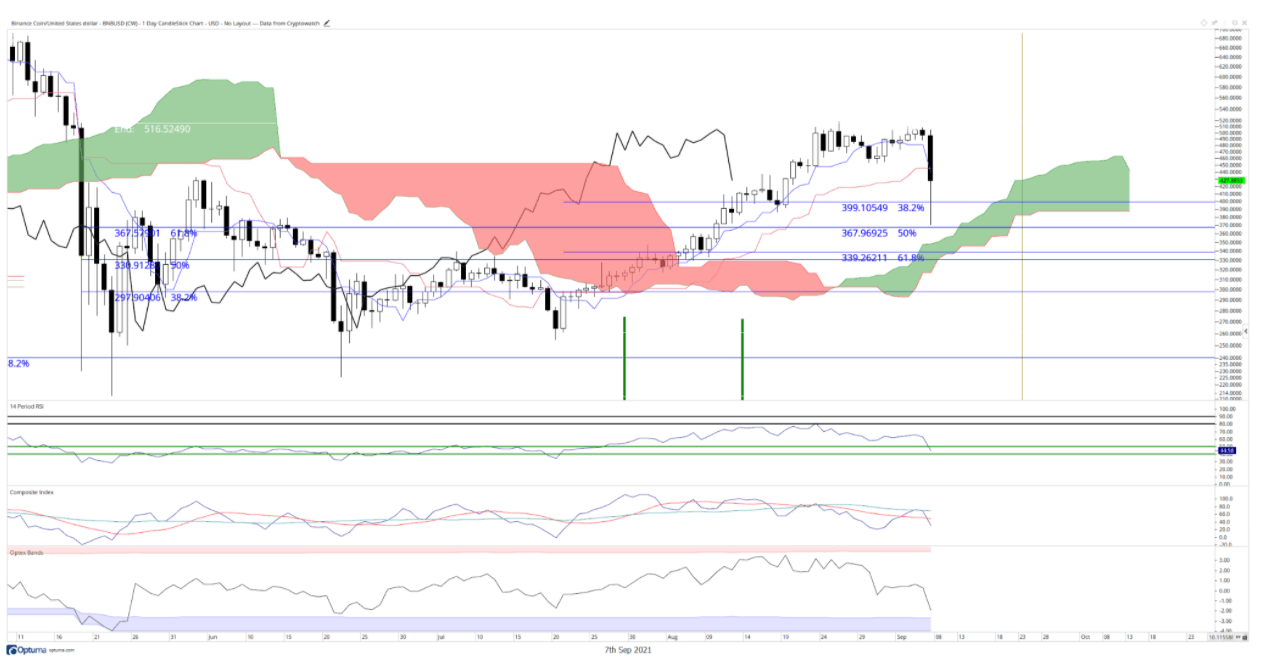

BNB price support exists at a confluence zone of two major Fibonacci Retracements at $368. The first is the 61.8% Fibonacci Retracement of the May 23rd, 2021 swing low at $212 to the top of the strong bar on May 19th, 2021, at $516.52. The second Fibonacci Retracement is the 50% range of the recent swing high of $519.14 on August 26th, 2021, to the strong bar low at $260.81. Additionally, the top of the 2021 VPOC (Volume Point-Of-Control) falls into the $368 support price level.

Binance Coin price crash could be a significant fakeout despite driving through important, prior price levels. The RSI is now between its oversold levels in a bull market (40 and 50). There is hidden bullish divergence present between the Composite Index and the candlestick chart.

Also, there has been a sharp hook south on the Optex bands with an extreme slope towards the major oversold levels, which have not been experienced since late June 2021.

Bulls may consider waiting for confirmation of support with a daily close above the Kijun-Sen or Tenkan-Sen.

BNB/USD Daily Chart

Bears will want to remain cautious.

Even though BNB price has generated a significant downside move, confirmation needs to be established. The key indicator to determine that downside move will be the Chikou Span closing below $383, putting BNB price near the 50% and 61.8% Fibonacci confluence zones.

If the RSI fails to hold 40 as support, then a continuation move south is likely. The next primary BNB price support level is the 2021 VPOC at $325.

Fundamentally, bulls and bears should continue to pay close and special attention to any US regulatory talk regarding decentralized exchanges such as Binance.

Author

FXStreet Team

FXStreet