Bitcoin Weekly Forecast: BTC loses directional bias, leaving holders guessing its next move

- Bitcoin price shows weakness at the retest of the weekly bearish breaker, creating doubt among investors.

- While the optimistic outlook is not yet invalidated, market participants need to be cautious.

- If bulls sustain, BTC could retest the breaker’s midpoint and range highs at $35,260 and $41,273, respectively.

Bitcoin price shows a bearish breaker setup on the weekly timeframe, suggesting that buyers need to be cautious. This signal is ambiguous since it does not accurately predict a reversal just yet. Therefore, a continuation of the ongoing 2023 BTC rally is still possible.

Read more: Is the alt season in jeopardy as Bitcoin slides below $30,000?

Bitcoin price loses directional bias

Bitcoin price seems to have formed a definitive bottom in the last quarter of 2022, which has led to an explosive rally. The year-to-date performance of BTC stands at 70%, with a local top of $30.968.

The last leg up in Bitcoin price pushed it into a weekly bearish breaker, extending from $29,247 to $41,273. As explained in detail in a previous article, a bearish breaker setup is a zone where the asset experiences high selling pressure.

The technical formation revolves around two higher highs and the down candlestick between these peaks. After the second higher high is formed and the asset starts to retrace, investors need to pay attention to how the price reacts to the last down candlestick. If the swift breakdown of the valley leads to the creation of a new lower low, it confirms the formation of a bearish breaker.

Now, market participants need to wait for the asset to pull back and retest the breaker to open short positions.

As mentioned above, Bitcoin price has already started to see immense selling pressure after venturing into the bearish breaker. In fact, BTC has undone the previous week’s gains and currently sits at $28,237.

There are two paths that Bitcoin price can take from here:

- A resumption of the bull run, which extends the rally followed by and potentially forms a local top at the breaker’s midpoint at $35,260 or the range high at $41,273.

- If Bitcoin price continues to head higher, it will encounter a confluence of a Fair Value Gap (FVG) and the bearish breaker’s midpoint. The FVG, marked in orange, extends from $34,277 to $37,406, which is a perfect place to book profits and anticipate a local top formation. In case BTC climbs higher, it will likely form a top at $41,273, which is the breaker’s upper limit.

The second path is a stairway to the ground floor, aka a continuation of the ongoing attempt from bears to push BTC lower. In this case, Bitcoin price will target the weekly FVG, extending from $26,591 to $22,591. Interestingly, this area of inefficiency contains two critical support floors at $26,591 and $22,591, where long-term holders are likely to start their accumulation.

The seemingly pessimistic outlook described in the second point is not really bearish, especially for long-term holders. For a detailed macro analysis of Bitcoin’s technicals, check out the article attached below.

Assessing the local top for Bitcoin price from a macro perspective

BTC/USDT 1-week chart

Despite the ongoing bearish outlook, on-chain metrics could paint a less ambiguous picture and indicate a direction for Bitcoin price’s next move.

Deciphering directional bias clues using on-chain metrics

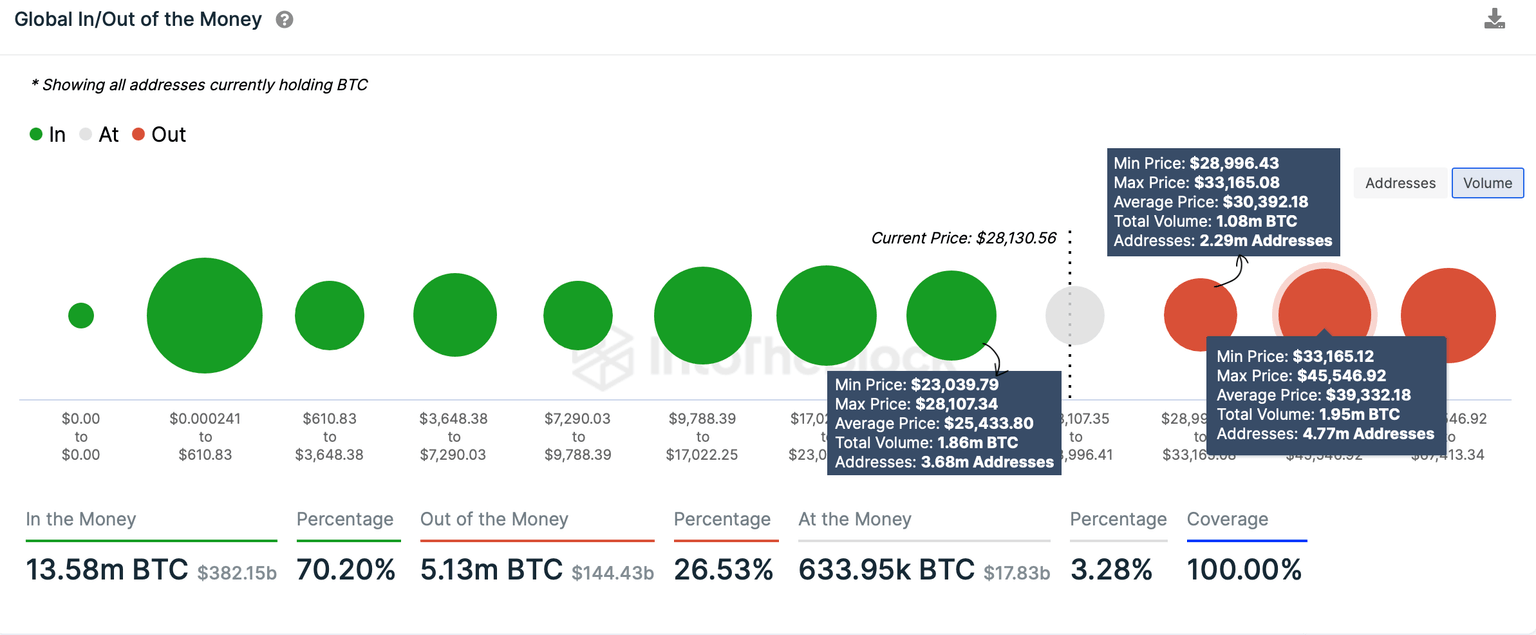

IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that the northbound move for Bitcoin price is relatively less crowded. As seen in the image below, roughly 2.3 million addresses that purchased 1.08 million BTC at an average price of $30,392 are “Out of the Money.”

Following this cluster is another one, where 4.77 million addresses that accumulated 1.95 million BTC at an average price of $39,332 are underwater. The second set of “Out of the Money” holders are likely to pose a substantial threat of selling which could result in a local top formation as opposed to the first one due to the sheer size.

Further adding credence to the long-term bullish thesis for Bitcoin price is the support cluster, extending from $23,039 to $28,107, where nearly 3.7 million addresses bought 1.86 million BTC at an average price of $25,433. These investors are likely to accumulate more BTC should the price slide lower.

BTC GIOM

While GIOM provides a detailed view of key levels, it does not provide a directional bias. So even now, Bitcoin price could go either way. Let us take a look at the Daily Active Addresses (DAA) metric. Since January 2023, the number of active participants interacting with the Bitcoin blockchain has stayed above 1 million.

After a brief dip on March 27, this metric has produced higher highs and shows no signs of weakness yet. A further investigation of this indicator will be useful in determining if investors are leaving the network, which could indicate a flight of capital and potentially signal a reversal.

BTC Daily Active Addresses

Although the DAA metric providesd a bullish bias, it should not be used as a standalone metric as it does not give users the full picture. The Whale Transaction Count is another important metric that can be used to determine what smart money investors are doing.

This indicator tracks transactions worth $100,000 or more and spikes of this index can be used to time local tops and bottoms. On April 11, this metric spotted an unusual uptick which pushed it from roughly 1,700 to 3,200 after Bitcoin price rallied from $27,900 to $30,000, which could indicate that these investors are looking to sell and book profits.

Clearly, the spike in DAA coupled with the unusually high whale transaction count, notes that a bearish outlook is persistent.

BTC whale transaction count

Lastly, we can see from the Supply Distribution chart that wallets holding between 100 and 1,000 rose from 19.97% on April 18 to 20.07% on April 21, which shows that this cohort of BTC holders accumulated.

However, the same cannot be said about the 1,000 to 10,000 BTC owners. These investors have started dumping their stash after the April 20 crash. This metric does not help in analyzing the directional bias as of now, perhaps, with the weekly close and a new week’s start, if the second category of investors start accumulating, it could signal a unified outlook from long term holders. In such a case, it could denote a bullish outlook and might help determine Bitcoin’s direction, but for now, there is not enough data to assess.

BTC supply distribution chart

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B16.03.46%2C%252021%2520Apr%2C%25202023%5D-638176753515438507.png&w=1536&q=95)

%2520%5B16.17.27%2C%252021%2520Apr%2C%25202023%5D-638176753871204300.png&w=1536&q=95)

%2520%5B16.11.13%2C%252021%2520Apr%2C%25202023%5D-638176753658095837.png&w=1536&q=95)