Bitcoin traders watch US Fed’s interest rate decision to plot likely return to $30,000

- Bitcoin open interest on Binance has dropped with price ahead of the US Federal Reserve’s interest rate decision and FOMC conference.

- The US Central bank is expected to raise interest rates by 25 basis points.

- Experts predict the Fed could emphasize disinflation has been slower than expected and make room for additional tightening measures.

Bitcoin traders are watching the week’s macro events closely for clues on BTC price movement. The US Federal Reserve’s interest rate decision on May 3, the FOMC conference and the Nonfarm Payrolls data release on May 5 are the key events for BTC traders keeping their eyes peeled.

If the Fed’s rate hike matches expectations or comes in lower than 25 basis points, this could elicit a positive reaction from BTC traders and push the asset’s price higher. If the rate hike is greater than 25 bps, it spells a whiplash for BTC price this week, based on historical data.

Also read: Week Ahead: Important week for Bitcoin’s 2023 rally

Bitcoin Open Interest on Binance drops ahead of Fed’s rate decision

Experts at 52kskew noted a significant decline in Bitcoin Open Interest, alongside the declining BTC price. This implies, there is a greater close in positions than opened, after traders with long positions are forced out and funding reprices lower, representing a spike in short positions in the market.

Bitcoin Open Interest on Binance

Based on data from the chart above, traders are aggressively chasing dips in BTC price. Shorts are lined up around the $28,700 and $28,600 level while long positions are underwater under $28,400.

The shift in OI ahead of the US Federal Reserve’s interest rate decision makes it a key event for BTC traders. A 25 basis point is expected by experts, if the hike comes in at or lower than expectations it could turn out to be a non-event for BTC or push the price higher.

However, a higher than 25 basis point hike in interest rates could result in a knee-jerk reaction from traders and push BTC price lower. The Fed’s rate decision is scheduled for 8:30 PM UTC on May 3.

US Central Bank’s rate hike decision

The expectation is that the central bank will raise the policy rate by 25 bps as US payrolls slow down for a third consecutive month. Experts at TD Securities expect the central bank to emphasize that “disinflation is evolving slower than expected” and leave room for additional monetary policy tightening measures in the FOMC conference.

The likelihood of additional rate hikes in 2023 could negatively impact the sentiment of risk asset traders.

Bitcoin experts predict a bounce in BTC price

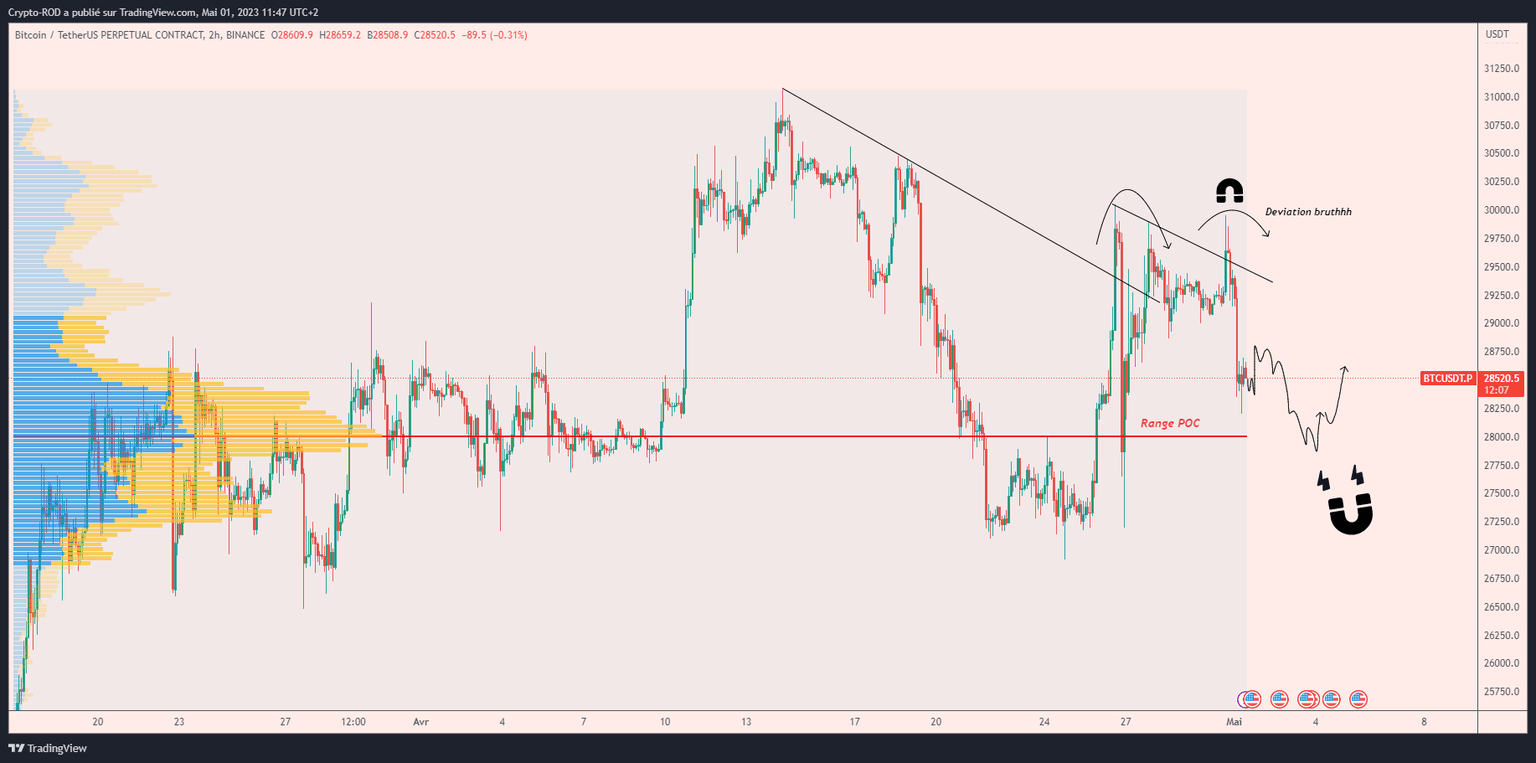

RodMartin, a crypto expert and trader believes BTC price is likely to see a bounce. Based on the expert’s analysis, BTC price could see a bounce at the range’s volume Point of Control (POC) at $28,000 and plot a return to $29,000.

BTC/USDT 2H price chart

Experts are awaiting a bounce in BTC price, however the key macro events of the week are likely to influence the asset’s price this week.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.