Bitcoin Spot ETF applications see amendments, holders await January batch approval

- Bitcoin Spot ETF race has late entrants and updates from BlackRock, according to James Seyffart.

- BTC Spot ETF approval anticipation has fueled a rally in both spot and futures markets.

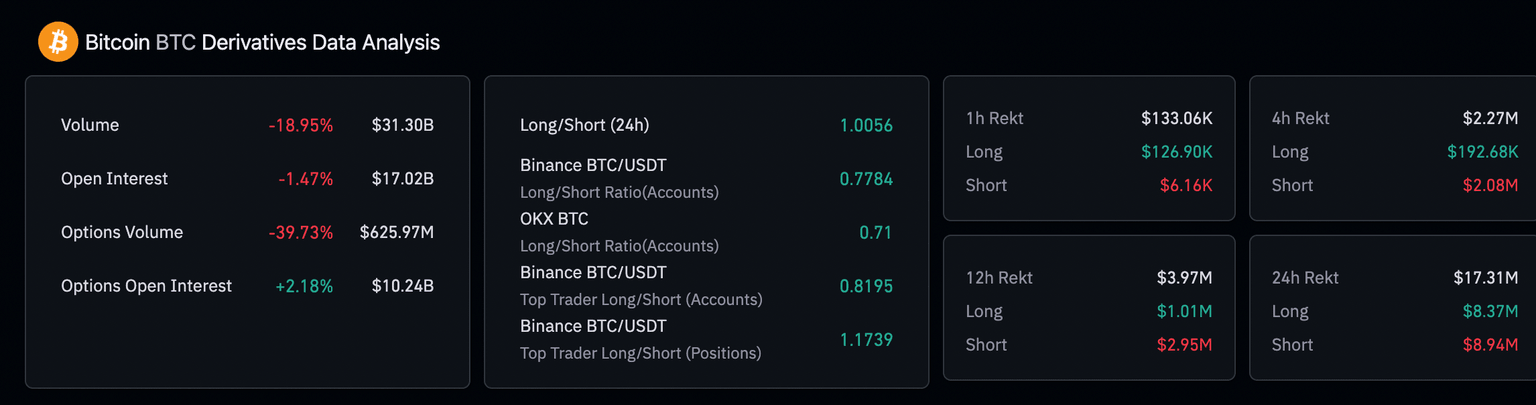

- Bitcoin price rally ushered $17.24 million in liquidations overnight.

Bitcoin Spot ETFs could see a batch approval in January. Eric Balchunas, a Bloomberg ETF analyst shared details of an updated application by asset manager BlackRock.

Bitcoin price resumed its rally, triggering $8.94 million in short liquidations.

Also read: MATIC whales on a buying spree, Polygon’s native token could extend gains

Daily Digest Market Movers: Bitcoin Spot ETF issuers race sees late entrants, BTC price extends gains

- The total number of Bitcoin Spot ETF issuers has climbed to 13, after Pando’s ETF application. European ETF giant Pando filed an S-1 for Pando Asset Spot Bitcoin Trust.

- Eric Balchunas, Bloomberg ETF analyst noted the late filing and shared details of BlackRock’s meeting with the Securities and Exchange Commission’s Trading and Markets division. The analyst informed his followers through a recent tweet, that the asset management giant presented the regulator with a revised in-kind model design based on staff’s comments at their 11/20 meeting.

Looks like BlackRock met with the SEC's Trading & Markets division again yesterday and gave presented them with a "revised" in-kind model design based on Staff's comments at their 11/20 meeting.. h/t @btcNLNico here's full doc: https://t.co/sgOpY5D1jz pic.twitter.com/863pWOX6w0

— Eric Balchunas (@EricBalchunas) November 29, 2023

- The US financial regulator has previously asked Bitcoin Spot ETF applicants to amend their filings in favor of cash creation. Applicants are likely to continue debating cash creation and in-kind delivery of the ETF with the regulator.

- The anticipation surrounding the Bitcoin Spot ETF has fueled a rally in both spot and futures markets. Seyffart shared details of ProShares BITO, a Bitcoin futures ETF that hit an all-time high recently. Grayscale Bitcoin Trust’s GBTC discount narrowed, hitting a record low in lieu of likely Spot BTC ETF approvals.

All this #Bitcoin ETF hype has driven ProShares' $BITO (Bitcoin Ffutures ETF) to a new all time high in assets. Closing in on $1.5 billion pic.twitter.com/b8advV1uGo

— James Seyffart (@JSeyff) November 29, 2023

- Bitcoin holders continue to anticipate batch approval of all Spot BTC ETFs in January 2024.

- Bitcoin price rally resulted in $8.94 million in shorts liquidations overnight, according to Coinglass data.

Bitcoin Derivatives Data Analysis

Technical Analysis: Bitcoin price eyes $40,000 target

Pseudonymous crypto analyst, Crypto Tony, evaluated the Bitcoin price chart and predicted a rally to $40,000 before a pullback in BTC price. According to Tony, BTC price could extend gains, climbing closer to $40,000 before the asset faces a correction and marks an initial drop, likely to $36,000.

BTC Liquid Index 1-day chart

Consistent demand from market participants could strengthen Bitcoin’s rally and send BTC price higher, post breakout from the $40,000 level.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.