Bitcoin rotates higher from year-close support as early-2026 structure develops

BTC/USD moves from the lower-structure ceiling into the upper-structure floor, with key pivots guiding early-year trade.

BTC/USD — MacroStructure desk observation

As of January 5, 2026

Daily timeframe | Year-block structure | Micro supply–demand mapping

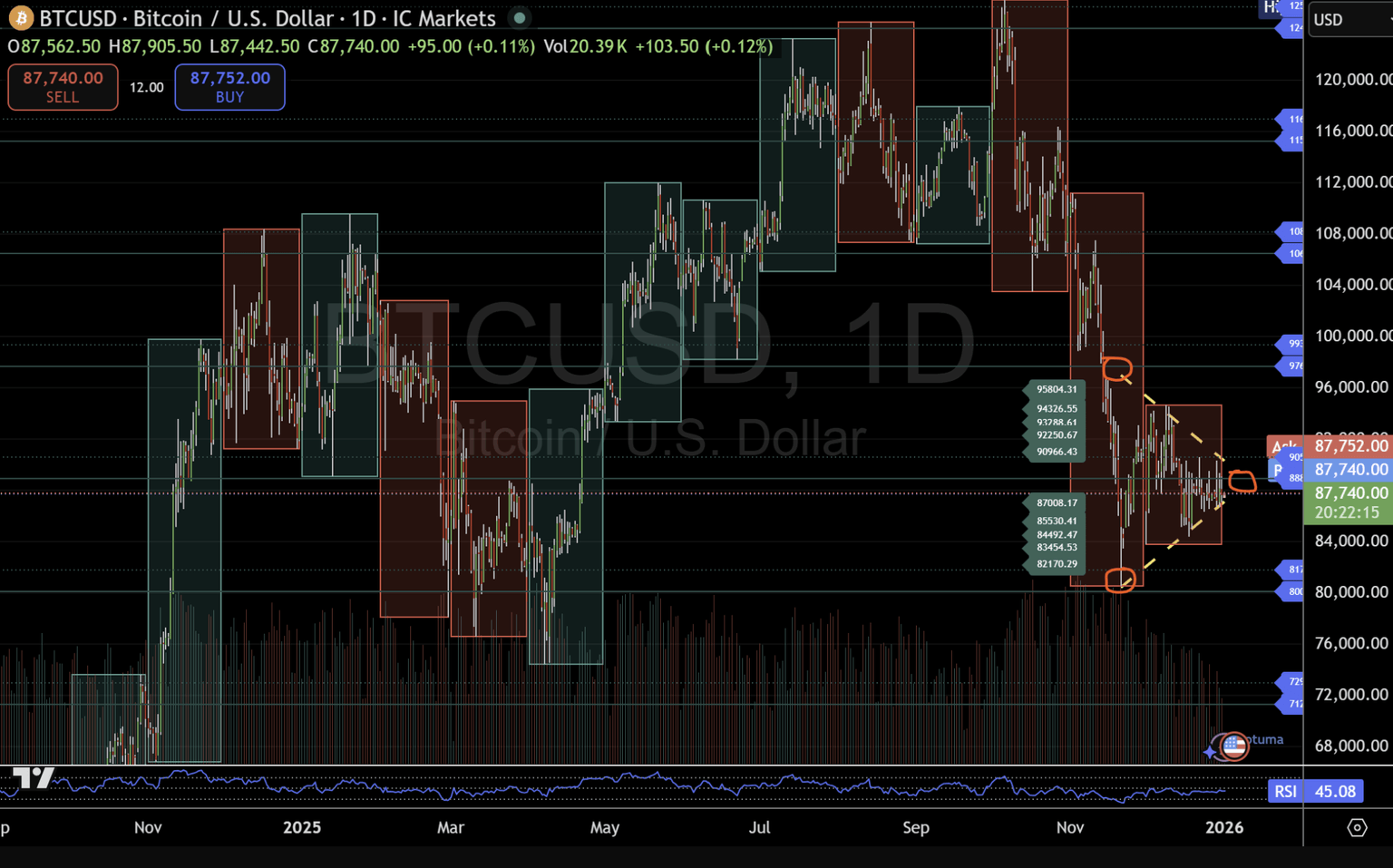

Bitcoin has opened the new year with three consecutive positive daily closes, an important early development following a compressed and unresolved end to 2025. More significant than the short-run gains is the fact that price has held above the 2025 closing line and a key demand band that previously defined the ceiling of the lower structure.

This update builds directly on the January 1 desk observation and focuses on how price is behaving around the structural transition zone, where balance may either persist or begin to resolve.

MacroStructure Phases

Balance → Expansion → Rotation → Stress Test

Early-year context: Year-close support holding

The most important structural development so far is price acceptance above the lower-structure ceiling, defined by the band between:

- Micro 5: ~87,000.

- Central pivot: 88,890.

- 2025 closing line (near this band).

This area acted as resistance into year-end and has now transitioned into active demand, allowing price to stabilise and rotate higher rather than slip back into deeper lower-structure trade.

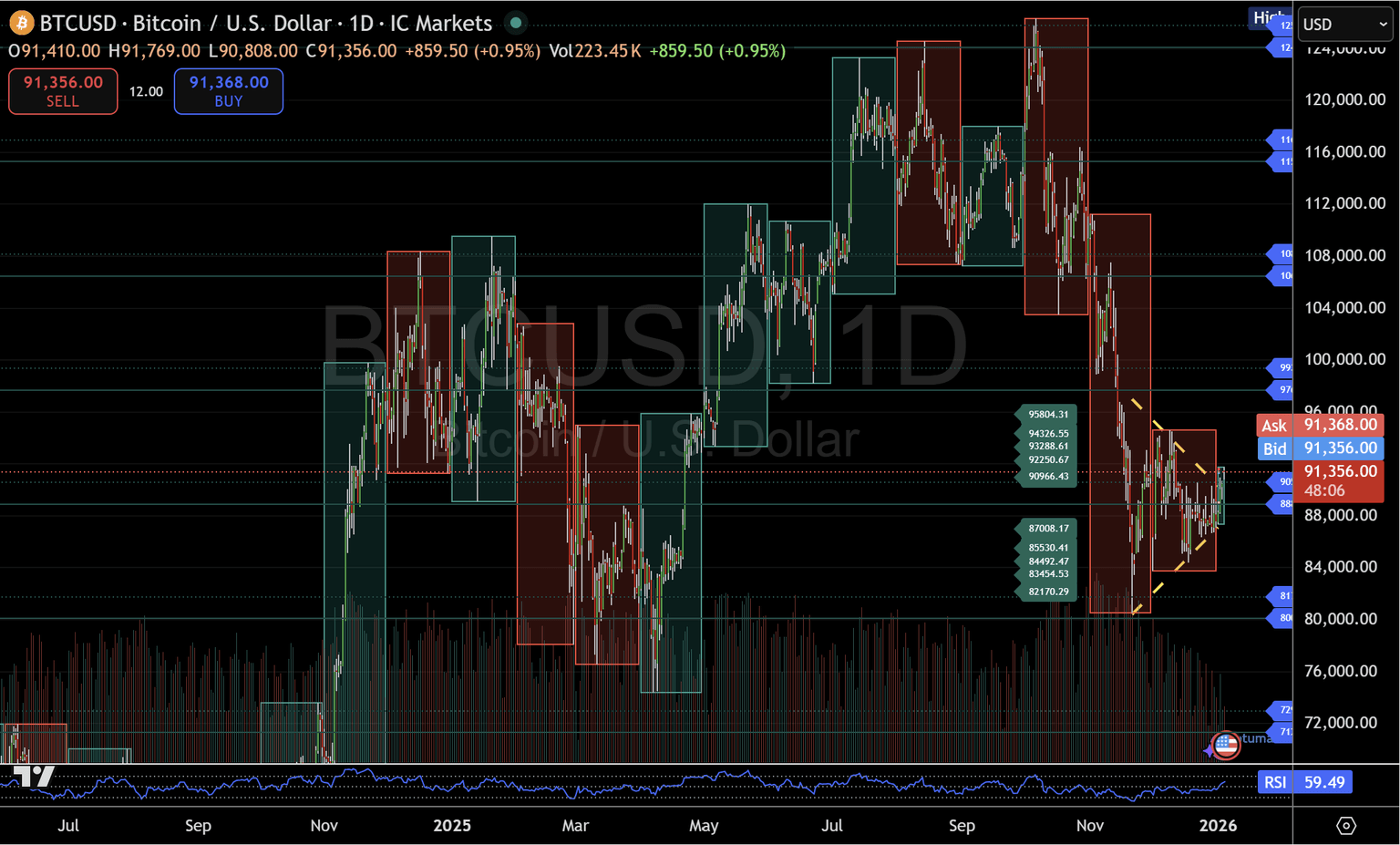

As of writing (January 5, 2026), BTC/USD trades near 91,200, maintaining acceptance above this zone. That said, price remains close enough to key references that structure is still being tested, not confirmed.

Rotation into the upper structure

With the lower band holding, price has rotated from the lower structure into the floor of the upper structure, defined by:

- Central pivot: 88,890.

- Micro 1: 90,966.

This zone represents the initial decision area separating consolidation from further structural progress. Acceptance above Micro 1 (90,966) keeps price aligned with the upper structure and allows the current rotation to continue.

The updated chart shows price probing this area, suggesting early engagement with the upper structure rather than clean expansion at this stage.

The 2025 opening line: A critical reference for 2026

Above the current rotation sits another important year-based reference:

- 2025 opening line near Micro 3: ~93,288.

This level represents the opening balance from the prior year and often acts as a structural magnet during transitions between yearly phases. Together, the 2025 closing line below and the 2025 opening line above now frame a clearly defined decision range for early 2026.

How price behaves between these two yearly references will provide early directional information, not through prediction, but through acceptance or rejection over time.

Upper micro structure: Areas to observe

Above Micro 1 (90,966) and toward the 2025 opening line, the upper-structure references remain:

- Micro 2–5: 92,250 → 95,804.

Sustained trading activity above 90,966, followed by engagement with 93,288, would keep price aligned with the upper structure and allow for further rotational expansion into this band.

These levels remain reference points, not targets.

Risk of drift back into balance

The updated chart also highlights the ongoing risk of drift back into balance.

- Failure to maintain acceptance above Micro 1 (90,966).

- Or sustained trade back below the central pivot (88,890).

could see price rotate lower, retesting the lower-structure ceiling between 87,000 and 88,890. This would signal that balance remains dominant, rather than a structural failure.

Why this update matters

This is the first structural response of the year, following a prolonged compression phase. Early-year behaviour often provides context before direction.

Periods like this frequently resolve on time as much as price, meaning further rotational trade remains possible before structure fully reveals itself. Despite elevated narrative flow around the start of the year, price behaviour around key yearly and structural reference levels remains the primary guide.

Desk takeaway

- Bitcoin has opened 2026 holding above key year-end demand.

- 87,000–88,890 remains the critical lower-structure support band.

- Price is rotating into the upper structure, but acceptance is still developing.

- 90,966 separates continuation from consolidation.

- The 2025 opening line near 93,288 is a key reference for early-2026 direction.

- A drift back below the pivot would likely return price to balance rather than signal failure.

These desk updates document a structure-first process, observing how price accepts or rejects predefined levels over time.

This observation is for informational purposes only and does not constitute financial advice.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.