Bitcoin related tokens STX, RUNE, LENDS see price gains ahead of BTC halving

- Bitcoin halving anticipation is a likely catalyst for gains in Bitcoin related projects Stacks, THORChain, and Lends.

- STX, RUNE, and LENDS prices rallied on Sunday as BTC price inches closer to $70,000.

- The Bitcoin-related token narrative sees a resurgence amidst Bitcoin price rally and the upcoming halving in April 2024.

Bitcoin related tokens have seen a resurgence as Bitcoin dominance rises and the largest asset by market capitalization sustains above the $69,000 level. The narrative of BTC-related tokens is likely to stay relevant, driving gains for holders with the upcoming halving.

Also read: Crypto influencer makes controversial Bitcoin price crash prediction to $45,000

STX, RUNE, LENDS price climbs alongside Bitcoin

Bitcoin halving is scheduled for April 21, the event is 42 days away. The halving has likely catalyzed gains in Bitcoin-related tokens, Stacks (STX), THORChain (RUNE), and LENDS.

Bitcoin beta plays have emerged as a class of tokens that yield gains for holders, ahead of the Nakamoto Upgrade scheduled for April. STX price climbed nearly 13% on Sunday and yielded 7% weekly gains for holders.

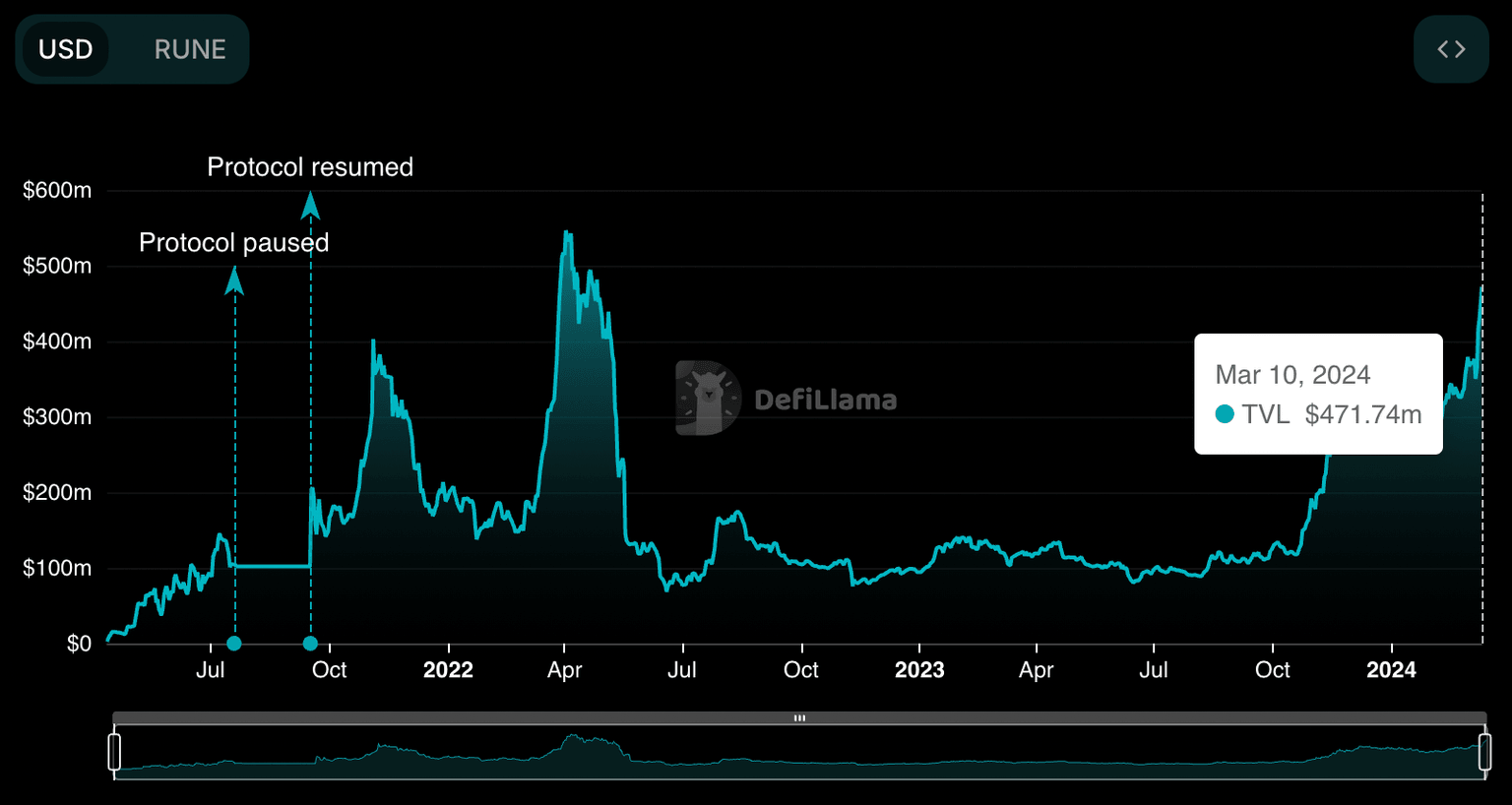

RUNE, the token of a decentralized exchange that enables cross-chain swaps hit a nearly 22-month high in the total value of assets locked (TVL).

RUNE TVL. Source: DeFiLlama

LENDS is likely a RUNE beta play since the token belongs to the THORChain ecosystem. LENDS price climbed nearly 12% today and the token yielded nearly 90% weekly gains to holders.

Bitcoin price is inching closer to $70,000, the asset sustained above the $69,000 level on Sunday. The asset has climbed 2% on the day and yielded nearly 13% weekly gains for BTC holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.