Bitcoin Price Update: BTC bulls ready to strike back once $11,000 is cleared

- The data on the amount of BTC held on the exchanges implies that the coin is ready for a rally.

- From the technical point of view, the critical resistance comes at $11,000.

Bitcoin (BTC) attempted a recovery to the local resistance area of $10,500; however, the upside momentum proved to be unsustainable so far. At the time of writing, BTC/USD is changing hands at $10,242, down from the intraday high registered at $10,442. The first digital asset lost over 1% of its value on a day-to-day basis and since the beginning of Tuesday. The market capitalization settled at 57.4%

Bitcoin bulls are ready to strike back, or what?

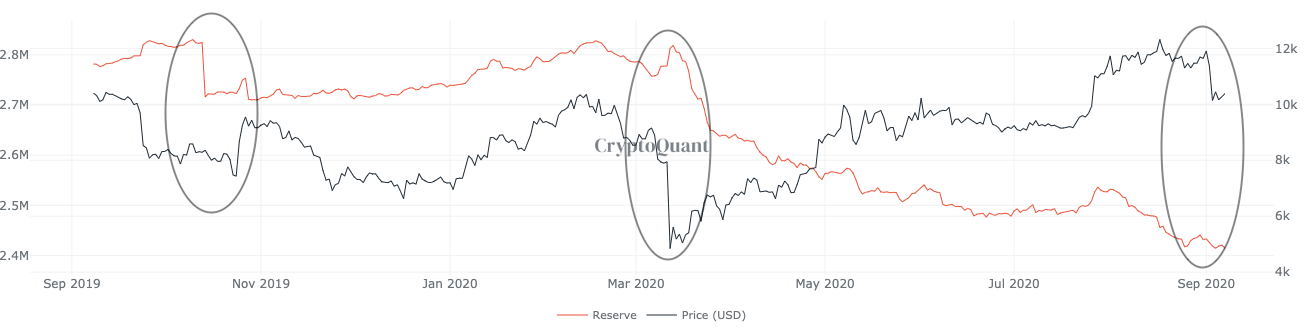

According to the statistical data provided by the analytical service CryptoQuant, BTC reserves on the top cryptocurrency exchanges have been decreasing significantly amid the growing value of stablecoins. The tilt to the stablecoins is often regarded as a bullish signal for Bitcoin, as traders usually move their stablecoins to the exchanges to purchase other cryptocurrency assets.

The chart below shows that BTC reserves have an inverse correlation with Bitcoin's price and can often be used as a leading indicator of price movements.

The amount of BTC held in all exchanges' wallets

Source: CryptoQuant

As explained by CryptoQuant's CEO Ki-Young Ju, they calculate the potential BUY and SELL pressure as a ratio between BTC and stablecoins reserves on the cryptocurrency exchanges. Currently, it implies that bulls are ready to deploy an aggressive attack and stop the alarming BTC correction.

#BTC still has intense buy pressure. Exchanges are holding more #stablecoins and fewer #BTC compared to the beginning of this year. I think we still have room for #BTC bullish trend. (Disclaimer: People can buy other coins with stablecoins tho)

BTC/USD: The technical picture

Meanwhile. from the technical point of view, BTC/USD is still locked in a tight range, limited by $10,000-$9,800 on the downside and $10,500 on the upside. A sustainable move in either direction will help to create a strong momentum. The critical support comes at $9,000, with the daily SMA200 located on the approach to that level. If the price resumes the decline after the current consolidation period, this barrier will slow down the bears and create a pre-condition for a new bullish wave.

On the other hand, a move above $10,500 will bring the broken upside trend line at $11,000 and the daily SMA50 back into focus. Once it is out of the way, BTC/USD will return to the previous consolidation range, while the bulls will get a chance to retest $12,000.

BTC/USD daily chart

The 4-hour chart's picture confirms the above-mentioned channel support and resistance levels and provides an additional upside barrier created by SMA50 at $10,800. The intraday RSI has started to revers to the downside, which means the price may retest $10,000 before the upside is resumed.

BTC/USD 4-hour chart

To conclude: The BTC exchange reserves data implies that the coin may be ready for a strong bullish rally; however, in the short run, it is still vulnerable to further losses towards the lower boundary of the current channel. From a technical perspective, we will need a sustainable move above $11,000 to confirm the bullish trend.

Author

Tanya Abrosimova

Independent Analyst

-637351474875420549.png&w=1536&q=95)

-637351475071719258.png&w=1536&q=95)