Bitcoin price suddenly drops by $500 in seconds to fill futures 'gap'

A bounce off $11,500 saves investors from serious pain but $12,000 remains a problematic level to flip to support.

Bitcoin (BTC) dropped several hundred dollars in seconds on Aug. 10 as $12,000 once more proved too hot to handle.

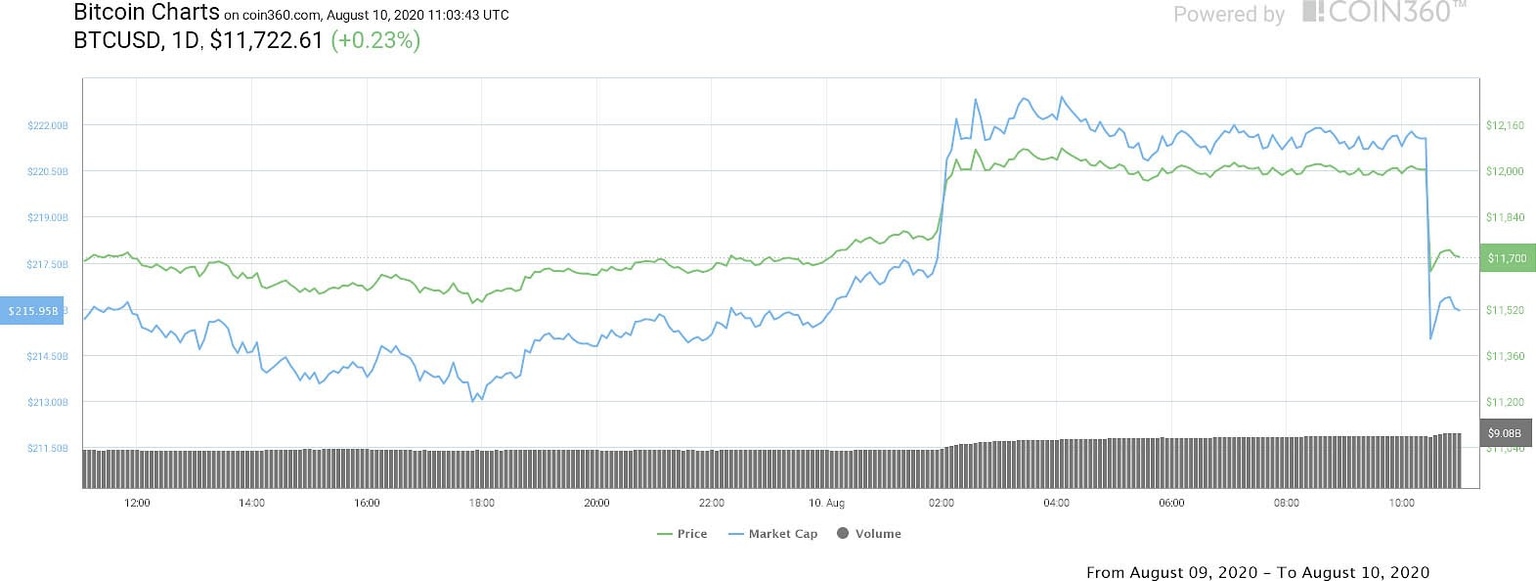

Cryptocurrency market daily snapshot Aug. 6. Source: Coin360

BTC price finds new focus at $11,700

Data from Cointelegraph Markets and Coin360 showed BTC/USD nosedive 4% during Monday trading, bouncing off $11,500 and since returning to $11,700.

In doing so, Bitcoin neatly filled the latest gap in CME Group’s Bitcoin futures markets, which lay just below $11,700.

BTC/USD 1-day price chart. Source: Coin360

A classic move, Cointelegraph predicted on the day that markets would likely attempt to go lower on short timeframes to fill the gap, in line with standard behavior.

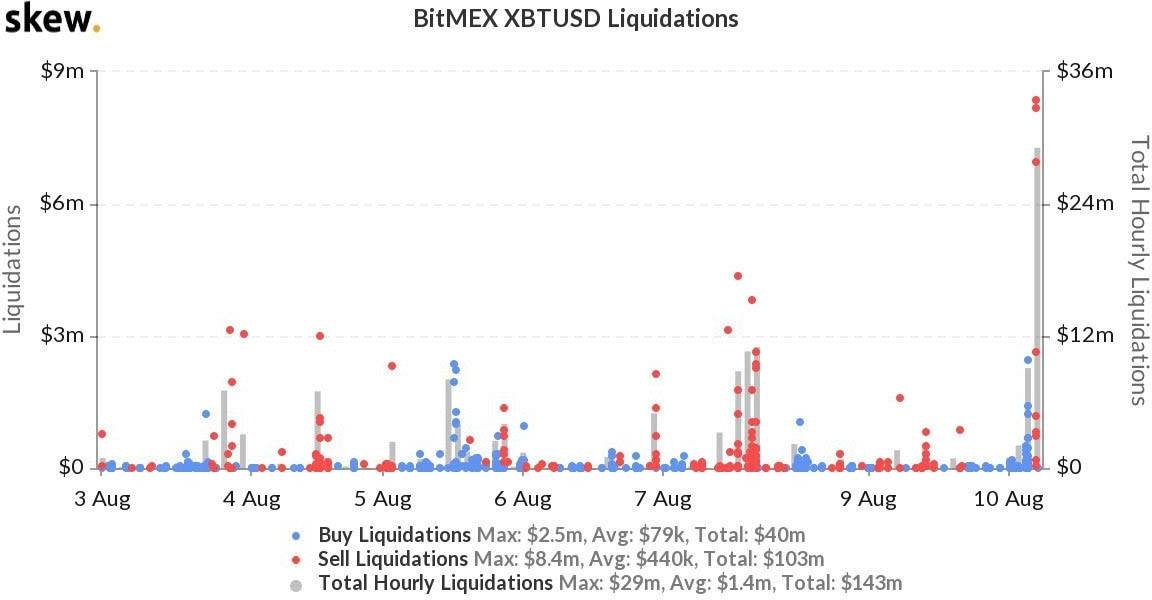

The event caused a dramatic spike in liquidations on derivatives giant BitMEX, data from monitoring resource Skew confirms.

BTC/USD liquidations on BitMEX. Source: Skew

Analyst: $13,000 will follow a $12,000 breakout

For Cointelegraph Markets analyst Michaël van de Poppe, the sudden dip suggested that Bitcoin was returning to the pattern of behavior seen in recent months.

“Smaller timeframe chart explaining what just happened. Essentially, we're back into the ranging gameplan,” he told Twitter followers.

“Ranging” within a certain price corridor has become a feature of BTC/USD in 2020, with recent gains upending a protracted period, which slowly narrowed to point — a process known as compression.

Going forward, lower levels could see a retest, with significant support just above $10,000 still apt to form the price floor, Van de Poppe thinks.

“Larger timeframe; still expecting such a scenario,” he continued.

“If we break $12K however, I assume we'll see $13k.”

Attention will thus now focus on bulls’ ability to cement $12,000 as a support zone, something which has yet to occur on any meaningful level for Bitcoin.

Nonetheless, the latest weekly close marked the highest since January 2018 and the initial fall from Bitcoin’s all-time highs of $20,000.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.