Bitcoin price slumps $2K on Musk’s ‘in the end’ tweets

Tesla CEO Elon Musk has brought more stress to the cryptocurrency markets by posting another series of cryptocurrency-related tweets on Thursday.

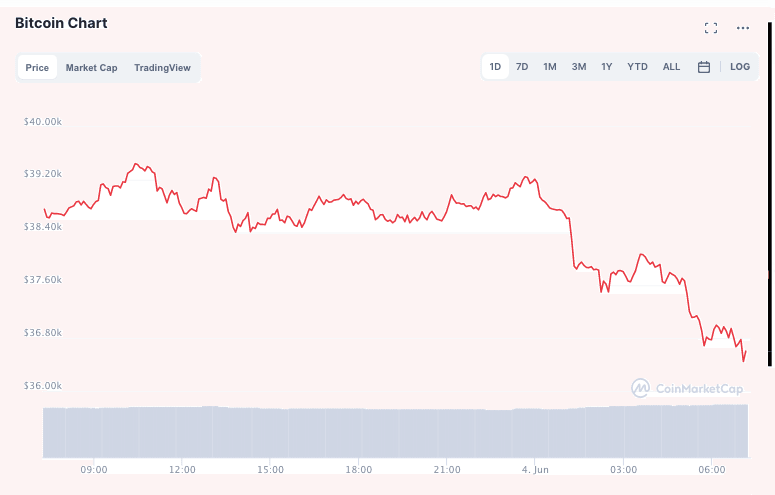

Bitcoin lost around $2,000 in a matter of hours after Musk took to Twitter to post about Bitcoin (BTC) again.

The Bitcoin price reacted immediately, dropping from around $38,700 to $37,500 in an hour. Bitcoin continued falling as Musk kept tweeting more cryptic posts in the thread including another breakup-themed tweet on falling crypto prices as well as a post on Dogecoin (DOGE).

Bitcoin subsequently dipped to as low as $36,400, dropping over 6% over the past 24 hours. At the time of writing, BTC is trading at $36,322, according to data from CoinMarketCap.

The price action comes shortly after Bitcoin attempted to retest $40,000 yesterday, with some traders suggesting that BTC could face a correction before continuing an upward trend.

Bitcoin 24-hour price chart. Source: CoinMarketCap

Musk’s new Bitcoin tweets spurred another wave of outrage in the crypto community. Some questioned the credibility of Musk’s tweets regarding Bitcoin.

Musk has been widely criticized in the community since he announced the suspension of Tesla's BTC payment option amid environmental concerns about Bitcoin mining, causing BTC to drop nearly $30,000 in mid-May.

Musk has emerged as a major Bitcoin price influencer on Twitter, previously causing major optimism on the market by announcing a $1.5 billion worth Bitcoin purchase in February. Following BTC payment suspension at Tesla, Musk hinted that the company could dump its Bitcoin holdings from its balance sheet.

Musk’s latest tweets come right before the Miami Bitcoin 2021 event that is set to kick off this morning, touted as the “largest Bitcoin event in history.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.