Bitcoin Price Prediction: Why BTC/USD could fall to $11,400 before lifting off to $12,000 – Confluence Detector

- Bitcoin price struggle to secure support at $11,600 following rejection from $11,800.

- BTC/USD is likely to create fresh demand at lower price levels; preferably the support at $11,400.

Bitcoin price action is capped under $12,000. Moreover, increasing selling activity is putting pressure on support levels at $11,600 and $11,400. For example. The failure to hold above $11,800 on Monday has seen the price spiral below $11,700 to trade at $11,695 at the time of writing.

The longer Bitcoin takes before reclaiming the ground above $12,000, the stronger the bearish case becomes. In addition more investors are likely to start looking elsewhere (altcoins) for price action if BTC holds the within the narrow range ($11,600 - $11,800).

Buying activities are not necessary absent but at the moment, they are not enough to sustain bullish action towards and $12,000. If we take wider scope of Bitcoin technicals using simple indicators such as the RSI, we see a consolidation picture vividly illustrated. The RSI is moving in a leveling motion at 56.82 after losing ground from the overbought.

The MACD, on the other hand, is putting emphasis on the bearish influence the sellers have over the price. Besides, the downward trend, there is a minor bearish divergence from the MACD. If the trend remains unchanged, Bitcoin could potentially break down to retest support at $11,400.

BTC/USD daily chart

%20(25)-637339322664997058.png&w=1536&q=95)

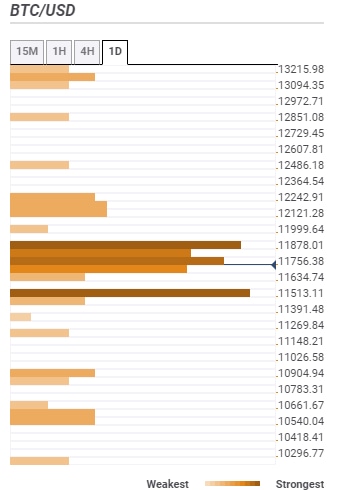

Bitcoin confluence levels

Resistance one: $11,756 – Home to the Bollinger Band 1-day middle curve, the SMA 100 4-hour, the previous high 4-hour, the Fibo 23.6% one-day and the SMA 200 1-hour upper curve.

Resistance two: $11,878 – This the strongest resistance zone. It is highlighted by the previous high one-day, the pivot point one-day resistance one and the Fibo 38.2% one-week.

Support one: $11,634 – Home to the Bollinger Band 15-minutes lower curve, the previous low one-hour, the Bollinger Band 4-hour middle and the previous low 4-hour.

Support two: $11,513 – The strongest support as highlighted by the confluence tool. It is home to the Fibo 161.8% one-day, the previous month high, the previous week low and the pivot point one-day support two.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren