Bitcoin Price Prediction: BTC/USD lift-off to $9,000 in the Q2 of 2020 imminent – Confluence Detector

- Bitcoin price renews the uptrend after stepping past the 50-day SMA.

- A break above $7,200 could pave the way for the anticipated gains targeting $9,000 amid the halving in May.

Bitcoin commenced the week’s trading in the positive territory after defending support above $7,200. Last week’s surge above $7,000 was the second after Bitcoin crashed more than 50% in March amid a widespread COVID-19 triggered selloff. At the moment, Bitcoin is trading over 85% higher from the lows trade in March. The gains last week were reminiscent of the upward correction in the United States stock market. Bitcoin has lately become more and more correlated with the stock market and other traditional asset. A situation that has had people questioning Bitcoin’s safe haven status.

According to Qiao Wang from Messari, a cryptocurrency analysis firm, said that cryptocurrency markets and the traditional stock markets are in anticipation as the Federal Reserve prepares to stimulate the economy from the shocks of the Coronavirus pandemic.

Short-term, as usual, I don’t have a strong view,” wrote Mr. Wang about the cryptocurrency. “I think it could easily swing between $5,000 and $9,000 due to a variety of forces like the demand for the USD and the hype around halving.

As reported, Bitcoin’s step above the 50-day SMA has renewed the bullish interest and a lift-off towards $9,000 seems imminent. Looking at the price performance in the last 12 months, Bitcoin soared 280% after breaking above the moving average in April 2020 and 43% after a similar move in February 2020. However, a resistance at $7,200 must be overcome in order to open the way for the lift-off. This zone was a key support in May 2019 and could act the same in the current situation following a breakout.

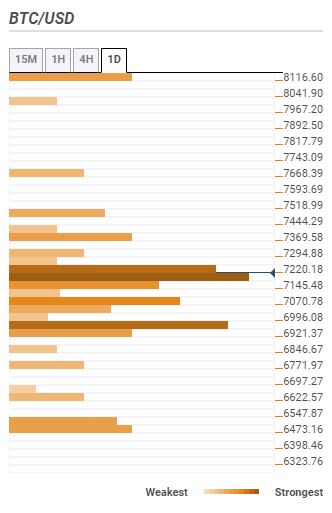

Bitcoin confluence resistance and support areas

Resistance one: $7,220 – Highlights the pivot one-day resistance one.

Resistance two: $7,369 – Highlights the pivot one-week resistance one, and the pivot point one-day resistance two.

Resistance three: 8,116 – Home to the SMA 100 one-day and the pivot point one-week resistance three.

Support one: $7,145 – Converges the Fibo 23.6% one-day, the Bollinger band 4-hour middle curve and the SMA five 4-hour.

Support two: $7,070 – Hosts the SMA 50 4-hour and the SMA 200 1-hour.

Support three: $6,996 – Highlights the Fibo 38.2% one-week, pivot point one-day support two and the BB 1-day middle curve.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren