Bitcoin Price Prediction: BTC/USD enters a new range below $9,000 – Confluence Detector

- Bitcoin is range-bound with the bearish bias on Monday.

- The local resistance is created by a psychological $9,000.

Bitcoin (BTC) is moving with a short-term bearish bias with the local support created at $8,700. This barrier attracted new buyers during the recent sell-off and helped to engineer the recovery. However, the upside momentum is nowhere to be seen as the price stays away from $9,000 that was broken on Sunday amid massive sell-off on the cryptocurrency market. At the time of writing, BTC/USD is changing hands at $8,760, down nearly 4% on a day-to-day basis and unchanged since the beginning of the day.

The short-term momentum remains bearish, with the RSI on the intraday charts flat, which means, the coin may continue the moving inside the range.

BTC/USD 1-hour chart

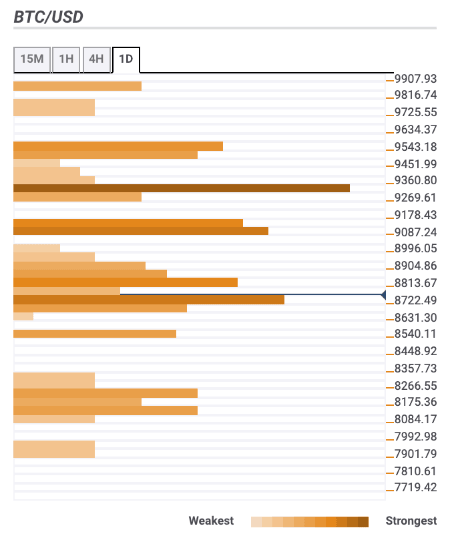

Resistance levels

$8,800 – 4-hour SMA200, 1-hour SMA10

$9,000 - 1-hour SMA50, 23.6% Fibo retracement weekly, 61.8% Fibo retracement daily

$9,300 – an middle line of the dailyBollinger Band, 4-hour SMA100

Support levels

$8,700 - 23.6% Fibo retracement monthly

$8,200 – 38.2% Fibo retracement monthly

$8,000 - Pivot Point 1-week Support 2.

Author

Tanya Abrosimova

Independent Analyst

-637260118565950046.png&w=1536&q=95)