Bitcoin price prediction: BTC/USD bulls have a lot of ground to cover to get back above $8,750

- Strong stacks of resistance on the upside are holding the price down.

- The only support level of note is at $8,445.

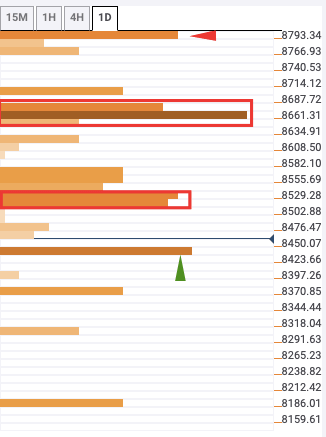

After three straight bearish days, the bulls have started to take back control of the market. As of writing, BTC/USD is priced at $8,468.25. The bulls have a busy day ahead of them if they want Bitcoin to stay above the $8,750 zone. There are strong stacks of resistance on the upside at $8,515-$8,540, $8,665-$8,680 and $8,795. On the downside, the only support level of note is at $8,445.

BTC/USD daily confluence detector

$8,515-$8,540 resistance stack has the five-day Simple Moving Average (SMA 5), SMA 50, 4-hour Previous High and one-month Fibonacci 61.8% retracement level. $8,665-$8,680 has the 4-hour Bollinger Band, one-hour Bollinger Band, SMA 100 and one-week Fibonacci 38.2% retracement level. Finally, the $8,795 resistance level has the SMA 5, SMA 200 and one-day Previous High.

On the downside, the $8,445 support level has the one-hour previous low, one-day pivot point support two, 15-min Bollinger Band, four-hour previous low and 4-hour Bollinger Band.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.