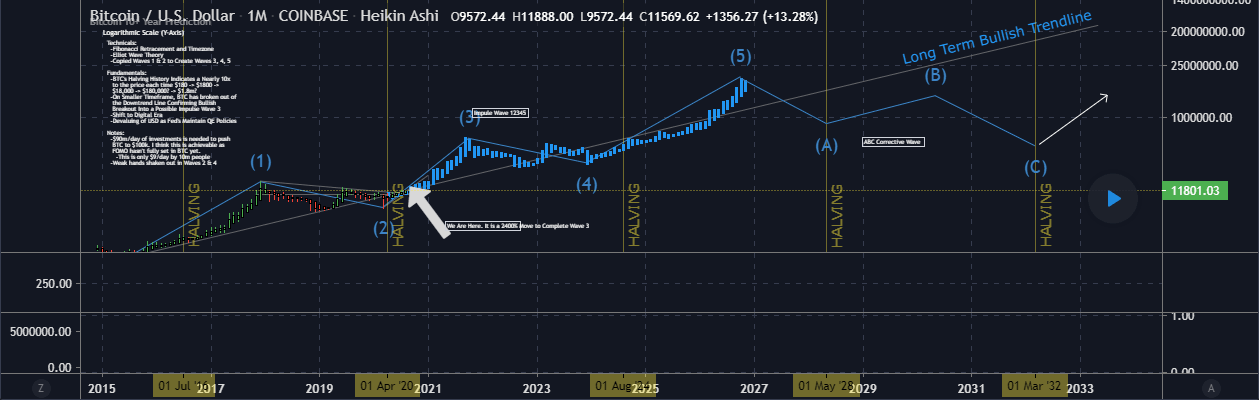

Bitcoin Price Prediction: BTC/USD $180,000 bullish case in two years – analyst

- Bitcoin bulls fail to gather volume for gains above $12,000 hitting a barrier at $11,755.

- Bitcoin needs an influx of $90 million per day to spike above $100,000 as per the analyst, Three-Bull-Insight.

Bitcoin has been gaining traction towards $12,000 in the last few days. This bullish move comes after Bitcoin was rejected from $12,200 only to find support at $10,500. The price action has not been as magical as last week’s but BTC has remained mainly in the hands of the bulls. Besides, reclaiming the ground above $11,500 the price has surged past the hurdle at $11,700 to trade an intraday high at $11,755.

A minor downward adjustment has seen the price lose ground during the Asian hours. Meanwhile, Bitcoin is trading at $11,627 after a 1.09% loss on the day. The daily chart shows Bitcoin holding well in the hands of the bulls in spite of the lower correction.

For instance, indicators such as the RSI and the MACD hint that consolidation could dominate the price action in the coming sessions. The latter is horizontal at 584.611 and features a minor bullish divergence. In addition, the RSI is clinging to the overbought at 70. In other words, there is enough power to keep Bitcoin above the initial resistance at $11,600 but still lacks the volume to sustain gains above $12,000.

BTC/USD daily chart

%20(14)-637322903125310833.png&w=1536&q=95)

Analyst predicts Bitcoin surge to $180,000 in two years

One of the most popular analysts on Tradingview, Three-Bull-Insight discussed a scenario where Bitcoin has the potential of hitting $180,000 in 24 months using mainly the Fibonacci retracement levels, the Elliot Wave Theory and other wave indicators. Highlighting the fundamentals of the largest cryptoasset, the analyst says that “BTC’s halving history indicates a nearly 10x to the price each time $180 -> $1800 ->$18,000 -> $180,000? -> $1.8m?” Building on these fundamentals, the analyst added:

“On a smaller timeframe, BTC has broken out of the downtrend line confirming bullish. Breakout into a possible impulse wave 3. Shift to the digital era and devaluing of USD as Fed's maintain QE policies”

He, however, explains that in order to achieve this massive breakout above $100,000, investors need to pump at least $90 million on a daily basis into the market. “I think this is achievable as FOMO hasn’t fully set in BTC yet, he says.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren