Bitcoin Price Prediction: BTC prepares for a 30% jump inside bullish chart pattern

- BTC/USD eases from intraday top after bouncing off three-week low.

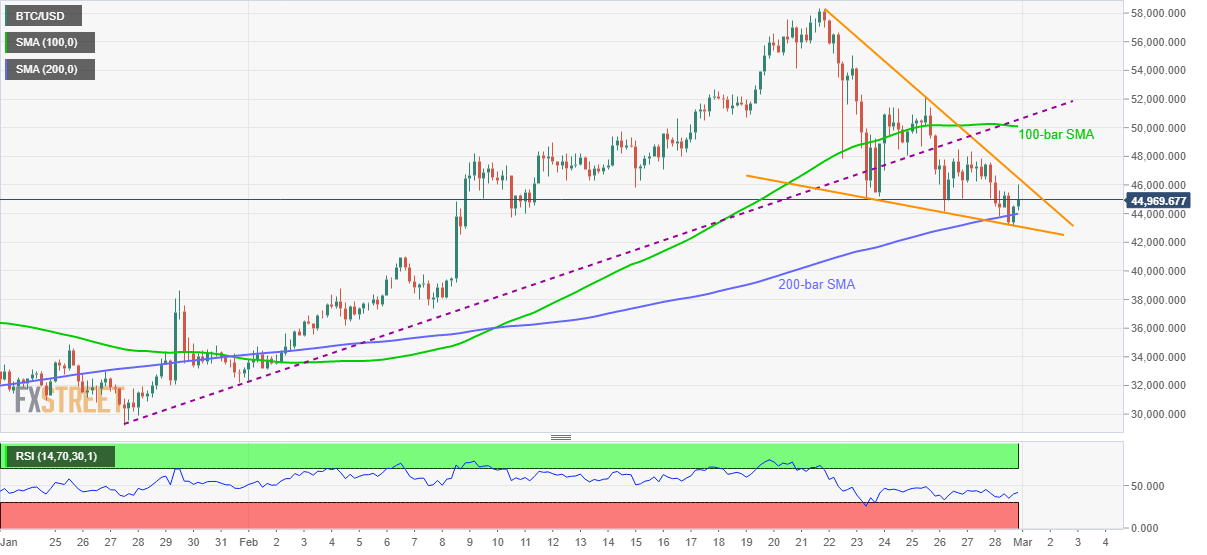

- Falling wedge, corrective pullback from 200-bar SMA favor buyers.

- Bears can eye for early February tops during further weakness.

BTC/USD drops from the intraday high near $46,000 to currently around $45,100 during early Monday. Even so, the crypto major keeps bounce off 200-bar SMA, marked during the weekend, while also staying inside a bullish chart pattern on the four-hour play.

Normal RSI conditions also back the BTC/USD towards confirming the short-term falling wedge bullish formation by clearing the $46,500 hurdle.

However, a convergence of 100-bar SMA and previous support line from January 27, near $50,100-400, should test the Bitcoin buyers ahead of directing them to $55,000 during the ultimate ride to refresh the record high of $58,355.

Meanwhile, a downside break of 200-bar SMA, currently around $44,000, needs to defy the bullish chart pattern by declining below $43,100, to extend the BTC/USD south-run towards February 06 high near $41,000.

It should be noted that $42,500 is likely an intermediate halt during the downturn whereas the $40,000 becomes an extra filter to watch.

Overall, BTC/USD bears seem tiring and a bullish chart pattern, coupled with a corrective pullback from the 200-bar SMA, suggests recovery moves.

BTC/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.