Bitcoin Price Prediction: BTC needs to defend critical support level at $10,600

- Bitcoin is currently trading at $10,559, right below a crucial support level at $10,600.

- If bulls can hold this level, the outlook for Bitcoin will remain positive.

Bitcoin was trading inside an ascending triangle pattern between September 3 and September 15, which is created when the price establishes higher lows and a horizontal trendline around the swing highs. The flagship cryptocurrency had a bullish breakout of the pattern on Sept. 14 that saw it rise to $11,100. Now BTC seems to be retesting the x-axis of this technical formation.

BTC/USD 4-hour chart

The most critical support level for Bitcoin in the short-term is $10,600, which almost coincides with the 100-SMA. The flagship cryptocurrency is also seeing an overextended RSIC, which could indicate that a bounce is underway. The current 4-hour candlestick could end up being a hammer candlestick, which usually attempts to determine the bottom.

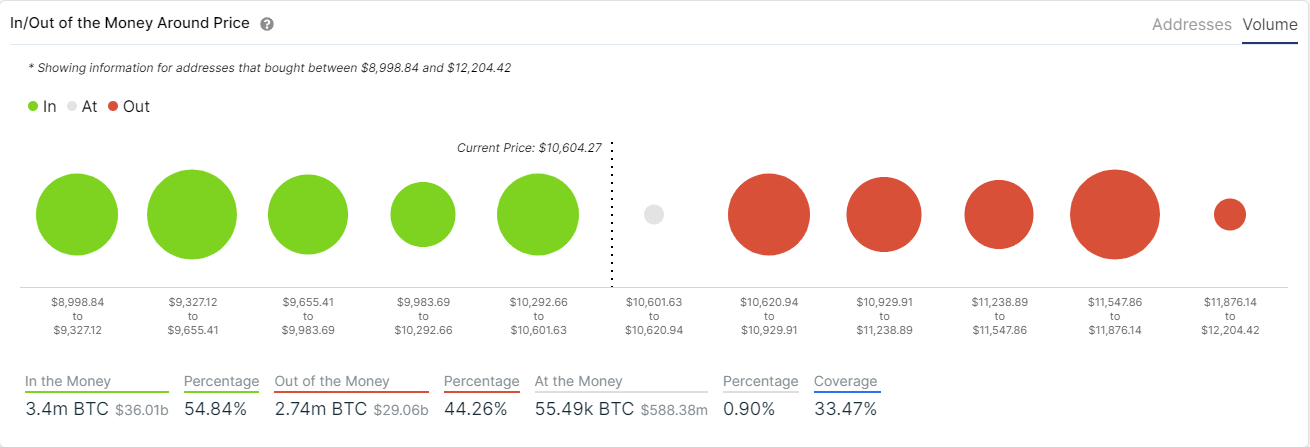

BTC IOMAP Chart

IntoTheBlock’s In/Out of the Money Around Price model (IOMAP) shows stiff resistance at a price of $10,840 as well as robust support at $10,420. A total of 965,750 addresses bought Bitcoin at an average of $10,420, with a total volume of 719,000 BTC.

On the other hand, more addresses (1,170,000) bought at a price of $10,840, but the volume (707,210 BTC) is lower.

Bitcoin Holders Distribution Chart

Source: Santiment

However, if we look at the chart with new daily active addresses, we can clearly see a decline since September 1. Additionally, the number of Bitcoin whales holding at least 1,000 coins has dropped from a peak of 2,110 holders on September 2 to a current low of 2,100, losing 10 whales.

It seems that the general outlook for Bitcoin is bearish in the short-term, and bulls need to hold the $10,600 level. A bearish breakout of this support point will most likely take Bitcoin down to $10,200. On the flip side, if BTC starts bouncing, we could see the pioneer cryptocurrency retest $11,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%20%5B16.12.29%2C%2021%20Sep%2C%202020%5D-637362946611220467.png&w=1536&q=95)